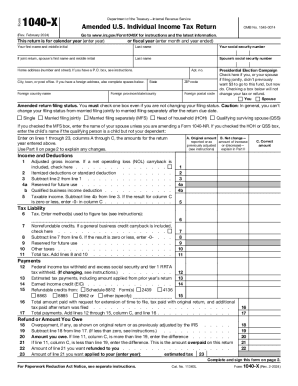

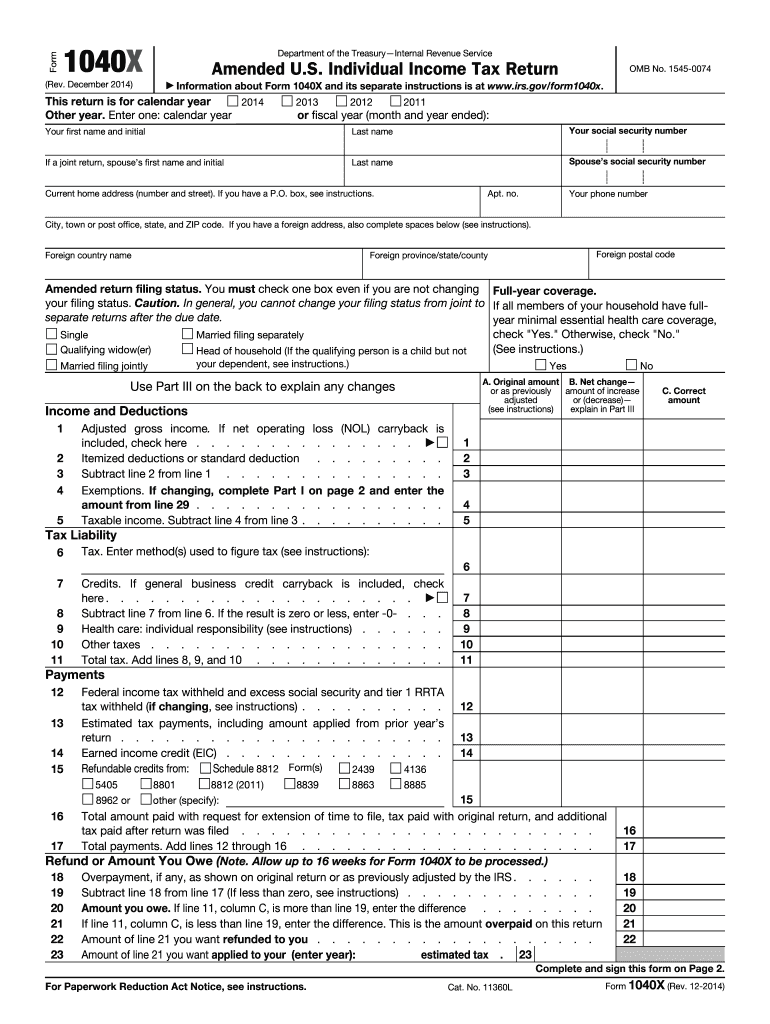

IRS 1040-X 2014 free printable template

Instructions and Help about IRS 1040-X

How to edit IRS 1040-X

How to fill out IRS 1040-X

About IRS 1040-X 2014 previous version

What is IRS 1040-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-X

What should I do if my IRS 1040-X gets rejected after e-filing?

If your IRS 1040-X is rejected, review the rejection notice for the specific code and reason outlined. Correct the identified issues in your amended return and electronically resubmit it. It's crucial to ensure all adjustments align with IRS guidelines to prevent future rejections.

How can I track the status of my IRS 1040-X after submission?

To track the status of your IRS 1040-X, visit the IRS website and use the 'Where's My Amended Return?' tool. You will need your personal information, including your Social Security number and the details of your amendment submission. Processing times can vary, so check back periodically for updates.

What happens if I need to amend my IRS 1040-X after filing?

If you discover additional errors requiring another amendment after filing your IRS 1040-X, file a new 1040-X clearly indicating changes made. Remember to provide explanations for each change and keep a record of all submissions to maintain accuracy in your tax filings.

Is electronic filing permitted for IRS 1040-X amendments?

Yes, electronic filing is allowed for IRS 1040-X amendments if you are using compatible tax software. Ensure that your software is updated to the latest version to comply with IRS requirements. However, if issues arise, you may need to file a paper version.

How long should I retain documents related to my IRS 1040-X filing?

It is recommended to retain documents related to your IRS 1040-X filing for at least three years after your amended return has been filed. This retention period allows you to reference your documents in case of inquiries or audits by the IRS.

See what our users say