CO DoR 104PN 2014 free printable template

Show details

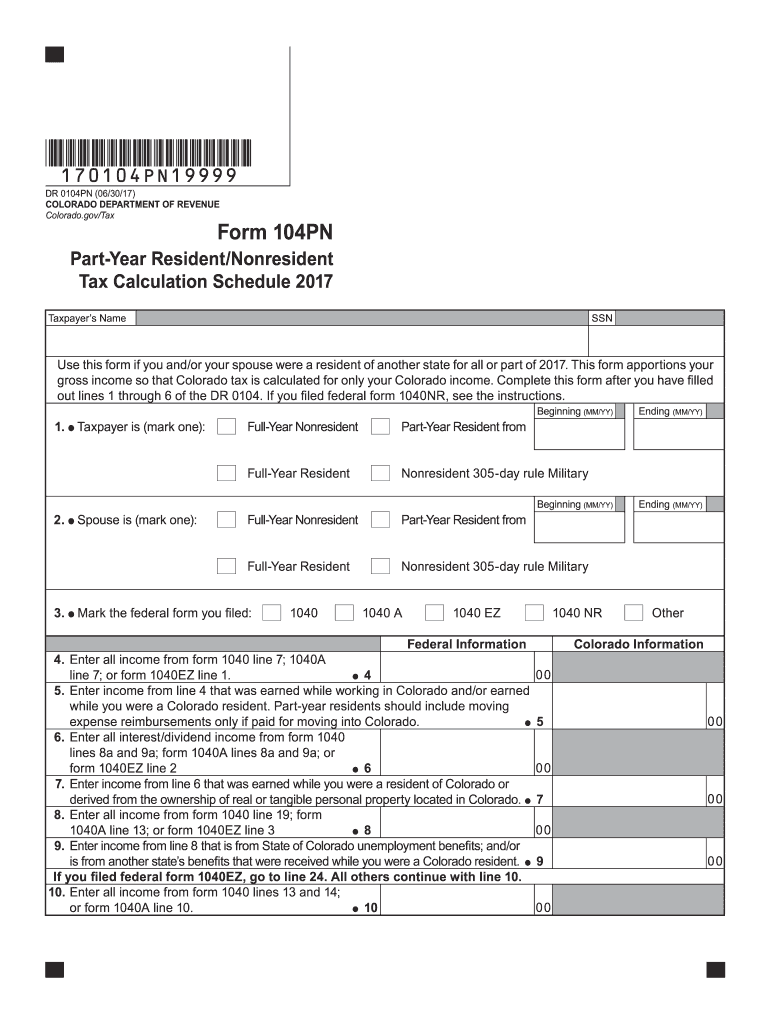

FORM 104PN 07/29/14 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0005 140104PN19999 Form 104PN Part-Year Resident/Nonresident Tax Calculation Schedule 2014 Taxpayer s Name SSN Use this form if you and/or your spouse were a resident of another state for all or part of 2014. This form apportions your gross income so that Colorado tax is calculated for only your Colorado income. Complete this form after you have filled out lines 1 through 18 of Form 104. If you filed federal form 1040NR see FYI...Income 6 and for military service persons FYI Income 21. Beginning MM/YY Taxpayer is mark one Full-Year Nonresident Full-Year Resident Nonresident 305-day rule Military Spouse is mark one Mark the federal form you filed 1040 A 1040 EZ 1040 NR Federal Information 4. Enter all income from form 1040 line 7 1040A line 7 or form 1040EZ line 1 4 5. Enter income from line 4 that was earned while working in Colorado and/or earned while you were a Colorado resident. Part-year residents should include...moving expense reimbursements only if paid for moving into Colorado 6. Enter all interest/dividend income from form 1040 lines 8a and 9a form 1040A lines 8a and 9a or form 1040EZ line 2 to Ending MM/YY Other Colorado line 3 and/or is from another state s benefits that were received while you were a Colorado resident If you filed federal form 1040EZ go to line 24. All others continue with line 10. 11b 12b and 14b 14. Enter all business and farm income from form 1040 lines 12 and 18 16. Enter all...Schedule E income from form 1040 line 17 and royalty income received or credited to your account during the part of the year you were a Colorado resident and/or partnership/S corporation/fiduciary income that is taxable to Colorado during the tax year 18. Enter all other income from form 1040 lines 10 11 and 21 List type 20. Total Income. Enter amount from form 1040 line 22 or form 1040A line 15 20 21. Total Colorado Income. Enter the total from the Colorado column lines 5 7 9 11 13 15 17 and 19...22. Enter all federal adjustments from form 1040 line 36 or form 1040A line 20 23. Enter adjustments from line 22 as follows Educator expenses IRA deduction business expenses of reservists performing artists and fee-basis government officials health savings account deduction self-employment tax self-employed health insurance deduction SEP and SIMPLE deductions are allowed in the ratio of Colorado wages and/or self-employment income to total wages and/or self-employment income. Student loan...interest deduction alimony and tuition and fees deduction are allowed in the Colorado to federal total income ratio line 21/ line 20. Domestic production activities deduction is allowed in the Colorado to Federal QPAI ratio. Penalty paid on early withdrawals made while a Colorado resident. Moving expenses if you are moving into Colorado not if you are moving out. For treatment of other adjustments reported on form 1040 line 36 see FYI Income 6. 24. Adjusted Gross Income. Enter amount from form...1040 line 37 or form 1040A line 21 or form 1040EZ line 4 24 25.

pdfFiller is not affiliated with any government organization

Instructions and Help about CO DoR 104PN

How to edit CO DoR 104PN

How to fill out CO DoR 104PN

Instructions and Help about CO DoR 104PN

How to edit CO DoR 104PN

To edit the CO DoR 104PN form, you can use pdfFiller's editing tools. Upload the form to your pdfFiller account, and you will be able to make changes directly on the document. Saving your edits is as simple as clicking the 'Save' button. Ensure that all alterations maintain the integrity of the tax information you intend to submit.

How to fill out CO DoR 104PN

To fill out the CO DoR 104PN form accurately, follow these steps:

01

Download the form from an official source or pdfFiller.

02

Enter your personal information, including your name, address, and identification number.

03

Detail the payments made and reasons for the report on the designated sections of the form.

04

Review your entries for accuracy.

05

Submit the completed form according to the filing requirements.

About CO DoR 104PN 2014 previous version

What is CO DoR 104PN?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CO DoR 104PN 2014 previous version

What is CO DoR 104PN?

The CO DoR 104PN form is a tax form used by certain individuals and businesses in Colorado to report specific payments made to vendors or service providers. The aim of the form is to ensure proper tax reporting of transactions, adhering to state tax laws. This previous version was relevant for tax filings during the specified period.

What is the purpose of this form?

The primary purpose of the CO DoR 104PN form is to report payments made to non-employees for services rendered. This allows the state of Colorado to accurately track income and enforce tax compliance among individuals and businesses operating within its jurisdiction.

Who needs the form?

Any individual or business that makes payments to independent contractors, freelancers, or any vendors in exchange for services may need to fill out CO DoR 104PN. It is essential for taxpayers who need to report these payments for tax purposes to avoid penalties.

When am I exempt from filling out this form?

You may be exempt from filling out the CO DoR 104PN form if the total payments to a single contractor or vendor are below the threshold set by the Colorado Department of Revenue, or if the services provided are exempted by law. It is crucial to verify eligibility criteria annually as they may change.

Components of the form

The CO DoR 104PN form consists of several sections, including but not limited to identifying information for the payer and payee, detailed payment amounts, and the purpose of payments. Each section must be completed with accurate and truthful data to ensure compliance with tax regulations.

What are the penalties for not issuing the form?

Failing to issue the CO DoR 104PN form when required can result in significant penalties. Taxpayers could face monetary fines, interest on unpaid taxes, and potential audits. It is imperative to adhere to the filing requirements to avoid these repercussions.

What information do you need when you file the form?

When filing the CO DoR 104PN form, you will need the following information:

01

Your name and identification number.

02

The recipient's name and address.

03

The total amount paid to the vendor or contractor.

04

The specific service or goods provided for clarity on reporting.

Is the form accompanied by other forms?

The CO DoR 104PN form may need to be accompanied by other forms depending on specific circumstances, such as additional schedules detailing payments or exemptions. Always consult with the latest guidelines provided by the Colorado Department of Revenue to ensure compliance.

Where do I send the form?

Completed CO DoR 104PN forms should be sent to the address specified by the Colorado Department of Revenue. Citizens can usually submit the forms electronically or via mail, depending on current submission guidelines. Make sure to verify the latest filing addresses as they may vary with updates in regulations.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It has been GREAT lots of forms to choose from and easy to fill out.

It works great, and here is all I neeed for my job. GOD BLESS YOU ALL. GOOD WOEK

See what our users say