HI DoT BB-1 2014 free printable template

Show details

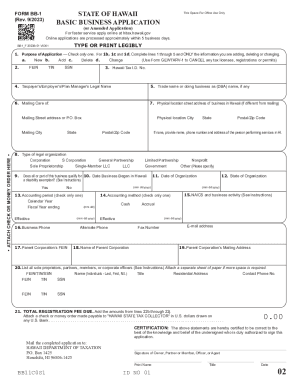

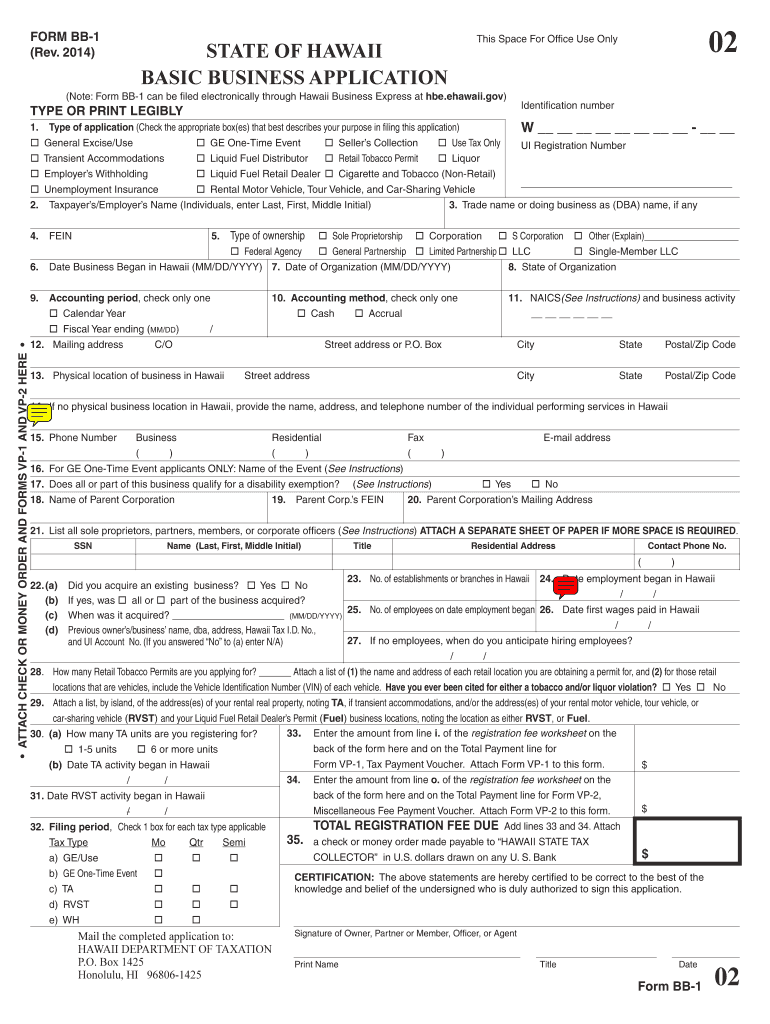

Clear Form FORM BB-1 Rev. 2014 STATE OF HAWAII BASIC BUSINESS APPLICATION Note Form BB-1 can be filed electronically through Hawaii Business Express at hbe. SUBMITTAL OF FORM If you are submitting the application in person a Hawaii tax identification number may be immediately assigned. please submit the original copy both pages and retain a copy for your records. Period or year in the space provided. If you are filing a Form BB-1 or BB-1X check...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT BB-1

Edit your HI DoT BB-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT BB-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing HI DoT BB-1 online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit HI DoT BB-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT BB-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT BB-1

How to fill out HI DoT BB-1

01

Obtain a blank HI DoT BB-1 form from the relevant authority or website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Specify the type of application you are submitting (e.g., new application or renewal).

04

Provide detailed information regarding the items or services covered in the application.

05

If applicable, include any supporting documentation as required.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form by mail or in person to the designated office.

Who needs HI DoT BB-1?

01

Individuals or businesses that require authorization for a controlled activity regulated by the HI DoT.

02

Applicants seeking a license or permit related to transportation or marine services in Hawaii.

03

Those who are renewing an existing HI DoT license or permit.

Fill

form

: Try Risk Free

People Also Ask about

Why do I need a tax ID number?

You need it to pay federal taxes, hire employees, open a bank account, and apply for business licenses and permits.

What is Hawaii bb1 form?

Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number (BB-1), file tax returns, make payments, manage your accounts, and conduct other common transactions online with the Hawaiʻi Department of Taxation.

How do I start my own business tax return?

What are the Steps for Starting a Home-Based Tax Preparation Business? Obtain your PTIN. Get the Necessary Education and Training. Decide on Your Business Name. Register Your New Business in Your State. Obtain an EIN. Open a Business Bank Account. Apply for Local Business Licenses and Permits.

Does Hawaii have a business income tax?

Hawaii also has a 4.40 to 6.40 percent corporate income tax rate.

What is a BB-1 form Hawaii?

BB-1 Packet. State of Hawaii Basic Business Application, Instructions and Payment Vouchers. Contains BB-1 (Rev. 2021), VP-1 (Rev. 2021), and VP-2 (Rev.

Who must pay Hawaii general excise tax?

1. What is the general excise tax (GET)? The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person engaging in the business activity.

Who is subject to Hawaii general excise tax?

Hawaii does not have a sales tax; instead, we have the GET, which is assessed on all business activities. The tax rate is 0.15% for Insurance Commission, 0.5% for Wholesaling, Manufacturing, Producing, Wholesale Services, and Use Tax on Imports For Resale, and 4% for all others.

Who is a resident of Hawaii for tax purposes?

ing to the Hawaii instructions: A Hawaii Resident is an individual that is domiciled in Hawaii or an individual that resides in Hawaii for other than temporary purpose. An individual domiciled outside Hawaii is considered a Hawaii resident if they spend more than 200 days in Hawaii during the tax year.

How do I file my business taxes in Hawaii?

You can register online through Hawaii Business Express or mail in Form BB-1. After you've registered, you'll be sent a GET license. Then, on a periodic basis—monthly, quarterly, semiannually—you must submit excise tax returns to the DOT. You can do this on paper (Form G-45) or online.

Do individuals have a Hawaii tax ID number?

The Hawaii Tax ID number starts with the letters 'GE' followed by 12 digits. It's different from a Social Security number (SSN) or employer identification number (EIN) and is used to identify each Hawaii tax account.

How do I get a Hawaii tax ID number?

Individuals can register online to receive their ID by filing Form BB-1 through Hawaii Business Express . To learn more about Hawaii Tax ID numbers, see items 12 - 19 of this edition of Hawaii's Tax Facts publication.

What taxes does an LLC pay in Hawaii?

Every member or manager of the Hawaii LLC earning profit from the LLC has to pay the Federal Self-Employment Tax (also called the Social Security or Medicare Tax). The Federal Self-Employment Tax applies to all the earnings of an LLC member or manager. The Federal Self-Employment Tax rate in Hawaii is 15.3%.

How much is an EIN number Hawaii?

Plus, getting an EIN is free and takes just 10 minutes online.

Who needs Hawaii tax ID number?

Federal tax ID numbers aren't required of all businesses nationwide, but it's extremely likely that you'll need one to operate in Hawaii. You'll definitely need a tax ID number if you're running a partnership, an LLC with more than one member, or a corporation. You'll also need one if you're hiring any employees.

Who needs a general excise tax number in Hawaii?

If you pay more than $4,000 total in Hawaii GE Tax during the year, you are required to file Form G-45 on monthly basis. If you pay less than $4,000 in GE Taxes during the year you file Form G-45 on a quarterly basis. If you pay less than $2,000 in GE Taxes during the year you file form G-45 semi-annually.

Does Hawaii have an LLC tax return?

Alternatively, an LLC may elect to be treated as a corporation. All LLCs (including disregarded entities) must obtain its own GET license, file tax returns, and pay GET on its gross business income.

Who needs Hawaii tax ID number?

All businesses must obtain a Hawaii Tax Identification Number (HI Tax ID) and all required tax licenses. licenses? Complete Form BB-1, State of Hawaii Basic Business Application, and pay a one-time $20 registration fee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify HI DoT BB-1 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your HI DoT BB-1 into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send HI DoT BB-1 for eSignature?

When your HI DoT BB-1 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit HI DoT BB-1 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share HI DoT BB-1 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is HI DoT BB-1?

HI DoT BB-1 is a form used in Hawaii to report business information related to the Department of Transportation (DoT) for specific types of businesses operating in the state.

Who is required to file HI DoT BB-1?

Businesses that operate in certain regulated industries within Hawaii are required to file the HI DoT BB-1 form.

How to fill out HI DoT BB-1?

To fill out HI DoT BB-1, businesses need to provide their identification information, details about their operations, and any other required data as specified by the Department of Transportation.

What is the purpose of HI DoT BB-1?

The purpose of HI DoT BB-1 is to gather essential information from businesses to ensure compliance with state transportation regulations and for planning and policy-making purposes.

What information must be reported on HI DoT BB-1?

Information reported on HI DoT BB-1 typically includes the business name, address, type of business, operational details, and other specific data that pertain to the transportation sector.

Fill out your HI DoT BB-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT BB-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.