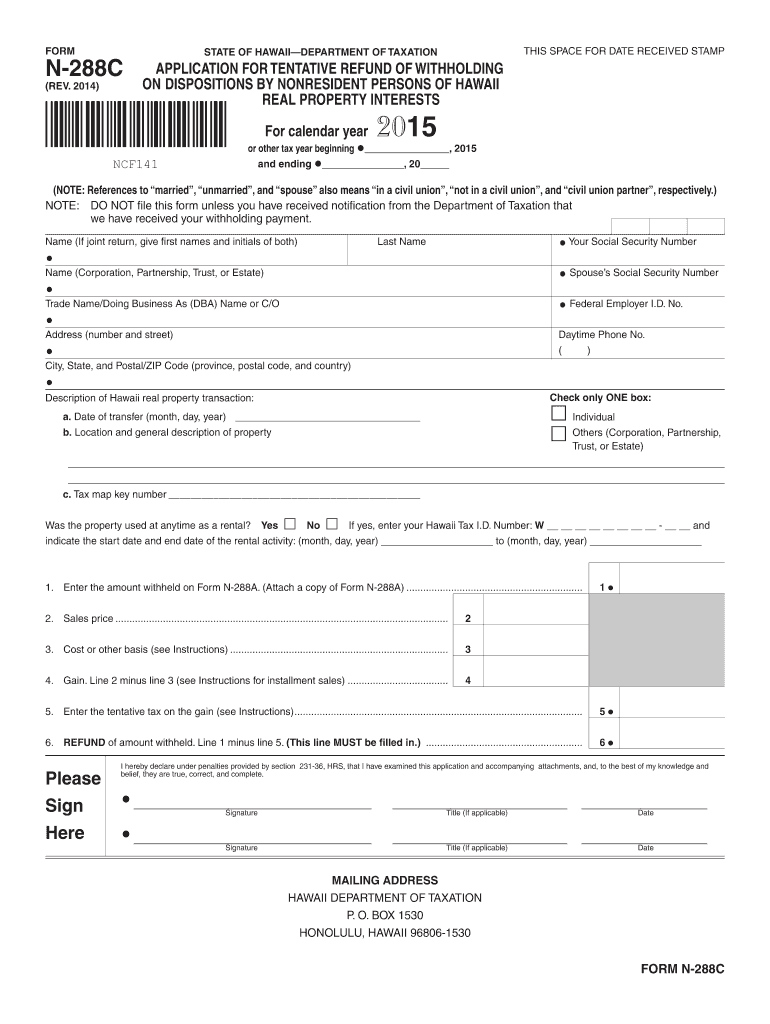

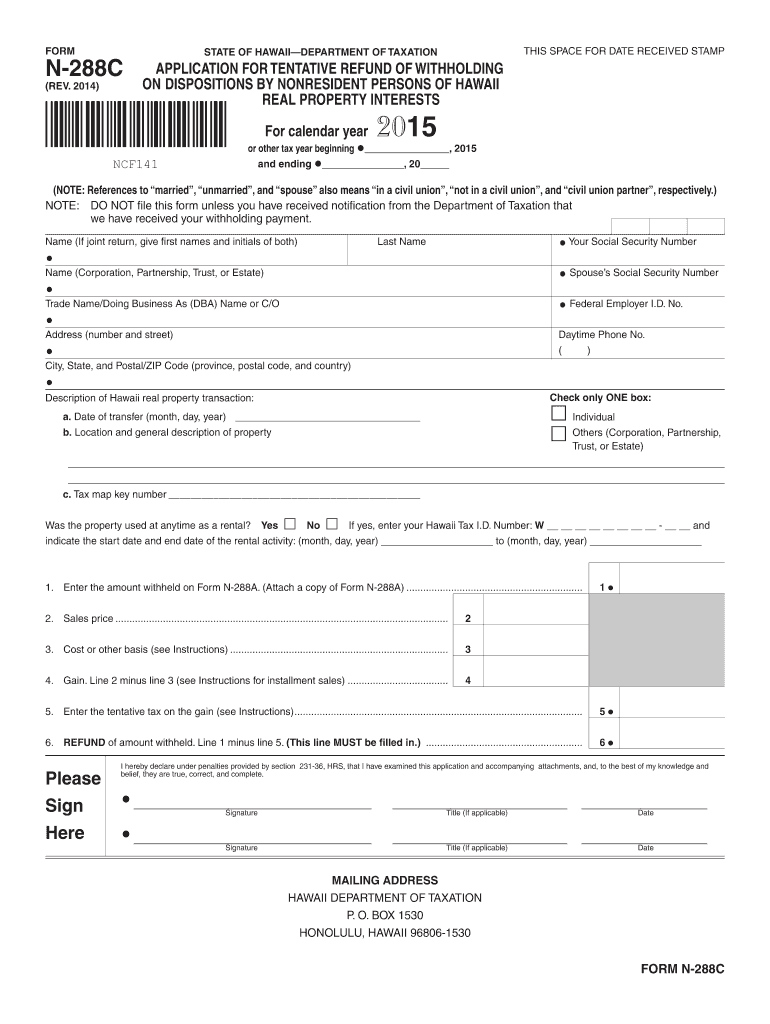

HI DoT N-288C 2015 free printable template

Show details

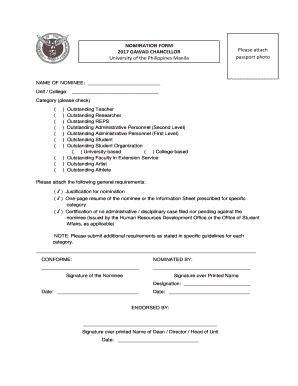

Signature Title If applicable Date MAILING ADDRESS HAWAII DEPARTMENT OF TAXATION P. O. BOX 1530 HONOLULU HAWAII 96806-1530 FORM N-288C FORM N-288C INSTRUCTIONS General Instructions return or within two years from the time the tax was paid whichever is later. Who May File an Application NOTE Under Section 235-111 Hawaii Revised Statutes any claim for credit or refund of an overpayment of taxes must be filed within three years from the due date of ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT N-288C

Edit your HI DoT N-288C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT N-288C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing HI DoT N-288C online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit HI DoT N-288C. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-288C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT N-288C

How to fill out HI DoT N-288C

01

Obtain a copy of HI DoT N-288C form from the official website or the local Department of Transportation office.

02

Carefully read the instructions provided on the form to understand the requirements and sections.

03

Begin filling out the form with your personal information, including your name, address, and contact details in the designated fields.

04

Enter the type of request you are submitting and provide any necessary details relevant to your transportation needs.

05

If applicable, attach any required documentation or evidence to support your request.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the form either in person at the designated office or by mailing it to the address specified on the form.

Who needs HI DoT N-288C?

01

Individuals or entities applying for permits or services related to transportation in Hawaii.

02

People seeking to report issues or request information from the Department of Transportation.

03

Commercial operators or businesses requiring specific transportation authorizations.

Fill

form

: Try Risk Free

People Also Ask about

What is Form N-288C?

Purpose of Form Use Form N-288C to apply for a refund of the amount withheld on dispositions by nonresident persons of Hawaii real property interests which is in excess of the transferor/ seller's tax liability for the transaction.

Does Hawaii have a separate capital gains tax?

Hawaii residents and nonresidents alike must pay Hawaii income tax on capital gains recognized on the sale of real property located in Hawaii unless the gain can be excluded under Hawaii income tax law.

How do I avoid capital gains tax in Hawaii?

Under IRC section 1031, if you sell investment real estate and buy more expensive investment real estate within a prescribed time frame, you can defer capital gains taxes on the property you are selling.

What is the exclusion for selling a house in Hawaii?

Will You Have to Pay Taxes When You Sell Your Home in Hawaii? Sales tax is not applied to property sales on either a federal or state level. However, if your home appreciated in value since you bought it, you may need to pay capital gains taxes on your annual tax return.

What is the maximum exclusion on sale of home?

The tax code recognizes the importance of home ownership by allowing you to exclude gain when you sell your main home. To qualify for the maximum exclusion of gain ($250,000 or $500,000 if married filing jointly), you must meet the Eligibility Test, explained later.

What is Form N 288A in Hawaii?

THIS FORM IS TO BE USED FOR TRANSFERS OR PAYMENTS MADE IN 2023 ONLY. they transferred their Hawaii real property interest. Attach Copy A of Form(s) N-288A and your check or money order to Form N-288.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my HI DoT N-288C directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your HI DoT N-288C and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I fill out the HI DoT N-288C form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign HI DoT N-288C. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit HI DoT N-288C on an Android device?

The pdfFiller app for Android allows you to edit PDF files like HI DoT N-288C. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is HI DoT N-288C?

HI DoT N-288C is a specific form used by the Hawaii Department of Transportation for reporting various transportation-related data and information.

Who is required to file HI DoT N-288C?

Entities that engage in transportation activities regulated by the state of Hawaii, such as transportation companies and service providers, are typically required to file HI DoT N-288C.

How to fill out HI DoT N-288C?

To fill out HI DoT N-288C, required fields must be completed accurately, including business information, transportation data, and signatures as necessary. There may also be instructions provided by the Hawaii Department of Transportation.

What is the purpose of HI DoT N-288C?

The purpose of HI DoT N-288C is to collect data that helps the Hawaii Department of Transportation monitor and regulate transportation operations within the state.

What information must be reported on HI DoT N-288C?

Information that must be reported on HI DoT N-288C includes business identification details, transportation service types, revenue data, operational statistics, and any other relevant information as specified by the form's guidelines.

Fill out your HI DoT N-288C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT N-288c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.