OH ODT SD 101 Long 2015 free printable template

Show details

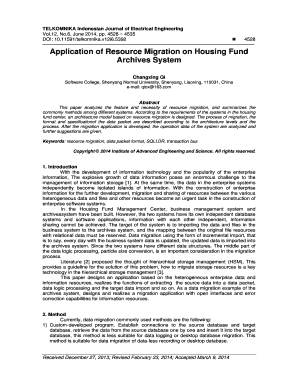

2015 SD 101 Long School District Income Tax P. O. Box 182388 Columbus OH 43218-2388 Ohio withholding acct. no. 15070100 FEIN Rev* 11/14 Employer s Payment of School District Income Tax Withheld Payment due date For the period ending Name For State Use Only M M D D Y Y Number and street City state ZIP District Name Ada EVSD Amanda-Clearcreek LSD Anna LSD Antwerp LSD Arcadia LSD Arcanum-Butler LSD Arlington LSD Athens CSD Ayersville LSD Bellevue CSD Berkshire LSD Berne-Union LSD Bethel LSD...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ohio form sd 101

Edit your ohio form sd 101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio form sd 101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ohio form sd 101 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ohio form sd 101. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH ODT SD 101 Long Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ohio form sd 101

How to fill out OH ODT SD 101 Long

01

Obtain the OH ODT SD 101 Long form from the official website or a local DMV office.

02

Read the instructions carefully before starting to fill out the form.

03

Fill in your personal information including your name, address, and date of birth in the designated fields.

04

Provide details regarding your vehicle, such as the make, model, year, and vehicle identification number (VIN).

05

Indicate the purpose for submitting the form, selecting the appropriate option from the provided choices.

06

If applicable, include information on any additional drivers or owners of the vehicle.

07

Review the form for accuracy and completeness before signing.

08

Submit the form via mail or in-person at your local DMV office, as per the instructions.

Who needs OH ODT SD 101 Long?

01

Individuals applying for vehicle registration or title transfer in Ohio.

02

Those seeking to update their vehicle information with the Ohio Department of Transportation.

03

Anyone needing to report changes related to their vehicle status.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file Ohio school district tax return?

Any individual (including retirees, students, minors, etc.) or estate that receives income while a resident of a taxing school district is subject to school district income tax. Individuals who work, but do not live, in a taxing school district are not subject to the district's income tax.

How do I withhold school district taxes in Ohio?

Until you confirm that your employer is withholding school district tax, you may chose to make an estimated payment of school district income tax using form SD 100ES. This form is available on our website at Tax Forms or by calling our toll-free forms request line at 1-800-282-1782.

Who is required to withhold school district tax in Ohio?

Ohio law requires employers to collect the school district of residence for each employee by providing the Ohio form IT 4. Employers are required to withhold school district income tax from compensation for any employee who resides in a taxing school district.

Who has to pay school district income tax in Ohio?

Any individual (including retirees, students, minors, etc.) or estate that receives income while a resident of a taxing school district is subject to school district income tax. Individuals who work, but do not live, in a taxing school district are not subject to the district's income tax.

What is the difference between workplace tax and residence tax in Ohio?

What is the difference between workplace tax and residence tax? Workplace tax refers to a tax paid to a municipality in which an employee works, regardless of where that employee lives. Residence, or courtesy withholding, is a tax paid to an employee's resident municipality for work performed outside that municipality.

Why would I get a letter from Ohio Department of Taxation?

The agency or agencies shown on the letter have reported to the Department of Taxation that you owe one or more debts. The Department is required to apply your Ohio income tax refund as partial or complete payment of the debt(s). There are two types of Ohio Income Tax Refund Offset letters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ohio form sd 101 to be eSigned by others?

When you're ready to share your ohio form sd 101, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the ohio form sd 101 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit ohio form sd 101 on an iOS device?

Create, modify, and share ohio form sd 101 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is OH ODT SD 101 Long?

OH ODT SD 101 Long is a tax form used in Ohio for reporting the Ohio Department of Taxation's Special Duties (SD) on certain types of income.

Who is required to file OH ODT SD 101 Long?

The OH ODT SD 101 Long must be filed by individuals and entities who have earned income that is subject to the Ohio Department of Taxation's special duties.

How to fill out OH ODT SD 101 Long?

To fill out OH ODT SD 101 Long, taxpayers must provide their personal information, income details, deductions, and any applicable credits as specified on the form.

What is the purpose of OH ODT SD 101 Long?

The purpose of OH ODT SD 101 Long is to assess and collect taxes on specific types of income earned by individuals and businesses in Ohio.

What information must be reported on OH ODT SD 101 Long?

The information that must be reported includes taxpayer identification details, total income earned, deductions claimed, applicable tax credits, and the final tax due.

Fill out your ohio form sd 101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ohio Form Sd 101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.