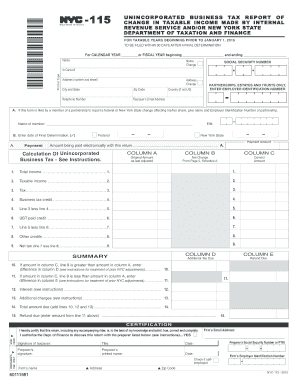

NYC DoF NYC-115 2012 free printable template

Show details

LINE 15 - CLAIM FOR REFUND Where the federal or New York State change in business income would result in a refund Form NYC-115 may be used as a claim for refund provided it is accompanied by a complete copy of the federal and/or New York State Audit Report or Statement of Adjustment. YES n Signature of taxpayer Preparer s signature l Firm s name Title Date printed name s Address Firm s Email Address l Check if selfemployed n Preparer s Social Security Number or PTIN Firm s Employer...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC DoF NYC-115

Edit your NYC DoF NYC-115 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC DoF NYC-115 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NYC DoF NYC-115 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NYC DoF NYC-115. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC DoF NYC-115 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYC DoF NYC-115

How to fill out NYC DoF NYC-115

01

Obtain the NYC-115 form from the NYC Department of Finance website or your local office.

02

Fill out the top section with your personal information such as name, address, and contact details.

03

Specify the property address associated with the request in the designated field.

04

Indicate the tax year for which you are filing the NYC-115.

05

Clearly state the reason for the filing in the appropriate section.

06

Provide any necessary attachments or supporting documents as required by the form.

07

Review all information for accuracy to avoid delays.

08

Submit the completed form via mail or in person to the NYC Department of Finance.

Who needs NYC DoF NYC-115?

01

Property owners seeking tax abatements or rebates in New York City.

02

Individuals or businesses who have gone through changes affecting their property taxes.

03

Anyone contesting their property tax assessments in NYC.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NYC DoF NYC-115 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your NYC DoF NYC-115 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find NYC DoF NYC-115?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the NYC DoF NYC-115 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete NYC DoF NYC-115 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your NYC DoF NYC-115. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is NYC DoF NYC-115?

NYC DoF NYC-115 is a form used by the New York City Department of Finance that reports property tax exemption claims and documentation for certain properties in New York City.

Who is required to file NYC DoF NYC-115?

Property owners who are claiming a property tax exemption or who have received an exemption in the previous year are required to file NYC DoF NYC-115.

How to fill out NYC DoF NYC-115?

To fill out NYC DoF NYC-115, property owners must provide details about the property, the type of exemption being claimed, and supporting documentation as required by the form's instructions.

What is the purpose of NYC DoF NYC-115?

The purpose of NYC DoF NYC-115 is to assess eligibility for property tax exemptions and to ensure compliance with NYC tax regulations.

What information must be reported on NYC DoF NYC-115?

The information that must be reported includes property identification details, the type of exemption being claimed, the applicant's information, and any relevant supporting documentation.

Fill out your NYC DoF NYC-115 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC DoF NYC-115 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.