MO DoR 768 2013 free printable template

Show details

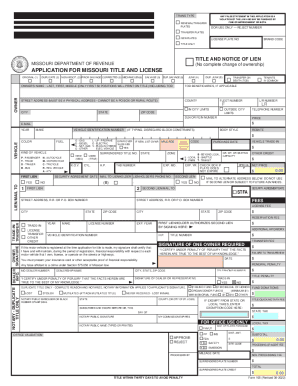

R Other Any false statement in this affidavit is a violation of law and may be punished by fine imprisonment or both. Owner Year Vehicle Identification Number Make Model Original Title Number Signature of Owner Current License Number Date MM/DD/YYYY / / Notary Information Embosser or black ink rubber stamp seal Subscribed and sworn before me this day of year State County or City of St. Louis My Commission Expires MM/DD/YYYY Notary Public Signature Notary Public Name Typed or Printed Form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DoR 768

Edit your MO DoR 768 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DoR 768 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO DoR 768 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MO DoR 768. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR 768 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO DoR 768

How to fill out MO DoR 768

01

Obtain the MO DoR 768 form from the official website or local office.

02

Begin by filling out your personal information in the designated fields, including your name, address, and contact details.

03

Provide any required identification numbers, such as your Social Security Number or tax identification number.

04

Follow the instructions for the specific section related to the type of submission you are making (e.g., income, deductions).

05

Carefully enter any financial information as instructed, ensuring accuracy in numbers.

06

Review the completed form for any errors or missing information before submission.

07

Sign and date the form as required.

08

Submit the form by the designated method, whether electronically or via mail, ensuring it is sent to the correct address.

Who needs MO DoR 768?

01

Individuals or businesses required to report their income or deductions to the Missouri Department of Revenue.

02

Tax professionals assisting clients with state tax filings in Missouri.

03

Anyone seeking to apply for specific tax credits or benefits outlined in the form.

Fill

form

: Try Risk Free

People Also Ask about

Do you pay taxes on a gifted car in Missouri?

Missouri does not require you to pay tax on a gifted car, but you should report the transaction to the IRS if the car's value is more than $15,000.

Do you have to have a safety inspection in Missouri?

Missouri law requires all motor vehicles to pass a vehicle safety inspection performed by an authorized Missouri inspection station, unless exempt as detailed below. The renewal notice you receive from the Department of Revenue will assist you in determining if your vehicle needs to have a safety inspection.

What is required to pass a vehicle inspection in Missouri?

The safety inspection insures that vehicles on Missouri roads meet a minimum safety standard of safety. Items checked include lighting, mirrors, glass, brakes, windshield wipers, suspension, and steering components. The state mandated maximum fee for a safety inspection is $12.

What is a form 768 in Missouri?

General Affidavit Form (DOR-768) Non-Use (notary required): Must be completed when applicant asks to license a vehicle that has not been operated on the highways, and applicant wishes to have registration fee prorated. Submitting an affidavit of non-use does NOT exempt the applicant from applicable renewal penalties.

What is a 551 form for Missouri?

This examination form (Form 551) expires six months from date of inspection, and must be completed in the following situations: 1. When converting a salvage title into an original title; (branded) 2. When obtaining a new vehicle identification number on a motor vehicle; 3.

What forms are needed to gift a car in Missouri?

Gifting Your Vehicle General Affidavit (Form 768) Document or a written statement indicating the vehicle was given as a gift. NOTE: The General Affidavit or statement does not have to be notarized. Lien Release (Form 4809), notarized, if applicable.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MO DoR 768 for eSignature?

When you're ready to share your MO DoR 768, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete MO DoR 768 online?

pdfFiller has made it simple to fill out and eSign MO DoR 768. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the MO DoR 768 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your MO DoR 768 in minutes.

What is MO DoR 768?

MO DoR 768 is a form used for reporting specific tax information to the Missouri Department of Revenue.

Who is required to file MO DoR 768?

Entities or individuals engaging in certain transactions or activities that require tax reporting in Missouri are required to file MO DoR 768.

How to fill out MO DoR 768?

To fill out MO DoR 768, follow the instructions provided on the form, ensuring that all required fields are completed accurately with the relevant financial information.

What is the purpose of MO DoR 768?

The purpose of MO DoR 768 is to collect information on specific transactions for tax assessment and compliance purposes within the state of Missouri.

What information must be reported on MO DoR 768?

The MO DoR 768 requires detailed information about the taxpayer, the nature of the transactions, amounts, dates, and any applicable tax identification numbers.

Fill out your MO DoR 768 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DoR 768 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.