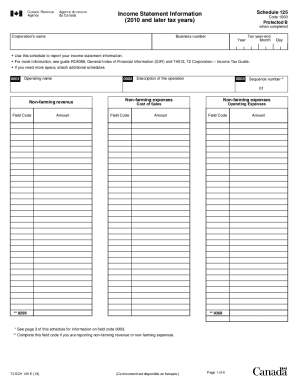

Canada T2 SCH 125 E 2014 free printable template

Get, Create, Make and Sign Canada T2 SCH 125 E

Editing Canada T2 SCH 125 E online

Uncompromising security for your PDF editing and eSignature needs

Canada T2 SCH 125 E Form Versions

How to fill out Canada T2 SCH 125 E

How to fill out Canada T2 SCH 125 E

Who needs Canada T2 SCH 125 E?

Instructions and Help about Canada T2 SCH 125 E

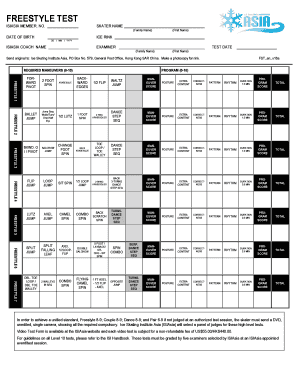

Hi my name is Alan Madden IN×39’chartereded accountant and a tax expert in the Mississauga Toronto in Oakvilleregions of Ontario Canada today×39’videos is called how to prepare the iffy also known as the tax financial statements completing the gift fee is the most important part of preparing your corporate tax return so let×39’s get started the first step in preparing sheriff is to prepare the income statementing my previous video I showed you an example of a company income statement and balance sheet that I prepared excel let's have a quick recap before restart preparing the gift fee in thiscompany'’s income statementotalal sales BS are $100,000 the expenses are broken up into various categories' depreciation car operating expenses and home office the total expenses for this company are twelve thousand eight hundred and fifty-nine dollars income taxes totals 13600 as you know income taxes can be obtained from your accountant or by using a corporate tax return preparation software the net profit is equal to the sales less the operating expenses less income taxes a din this case is seventy-three thousand five hundred and forty-one dollars now that we reviewed the income statemented×39’s go to the next step a prepared scheduled 125 the iffy version of the income statement in front of you will see Giphy Schedule 125 the general index of financial information this is the giver of the income statement these figures are obtained from the Excel based income statement you'll notice that the codes highlighted in black represent the iffy codes for various financial statement items for example total sales of goods and services has if he codes of 8:08 nine and the amounts $100,000based on the Excel income statement likewise operating expenses are twelve thousand eight hundred and fifty-nine dollars and income tax expense is thirteen thousand six hundred dollars this gives us a net income of seventy-three thousand five hundred andforty-one dollars which ties exactly tithe Excel based income statement let'stake a closer look at operating expense sand the associated iffy codes that make this up in front of you will now seethe operating expenses schedule I have taken the Excel based income statement and entered the expenses on each line item within the schedule for example advertising has a nightie code of eight five to one and an associated amount of hundred and forty-four dollars all the expenses are listed below along with the exceeded iffy code and the total operating expenses equal twelve thousand eight hundred and fifty-nine dollars which is a perfect match to the income statement based in Excel the next Stein preparing the iffy is to prepare the balance sheet in my previous video showed you how to prepare a balance sheet in Excel let×39’s quickly recap this balance sheet, so we can then learn how to prepare the iffy appropriately this balance sheet is broken up into threesectionsassets liabilities and equity under each section I have listed the...

People Also Ask about

What is Schedule 100 and 125?

How do I complete a Schedule 125?

How to complete Schedule 125?

How do I fill out a T2125 form?

What is Schedule 50 form?

How do you know if a company is associated?

What is considered a connected corporation?

What is Schedule 100?

What is a T2 schedule 125?

What is Schedule 101 on the T2 for?

What is a Schedule 100?

What is a Schedule 125?

How do I get a Schedule 50?

What is Schedule 55?

Do I have to fill out a T2125?

How do I fill out a Schedule 125?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my Canada T2 SCH 125 E in Gmail?

How do I fill out Canada T2 SCH 125 E using my mobile device?

How do I fill out Canada T2 SCH 125 E on an Android device?

What is Canada T2 SCH 125 E?

Who is required to file Canada T2 SCH 125 E?

How to fill out Canada T2 SCH 125 E?

What is the purpose of Canada T2 SCH 125 E?

What information must be reported on Canada T2 SCH 125 E?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.