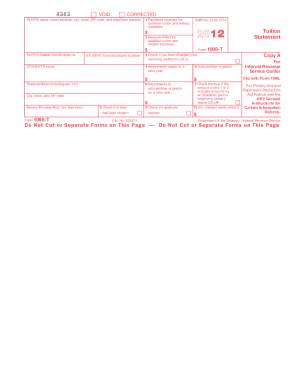

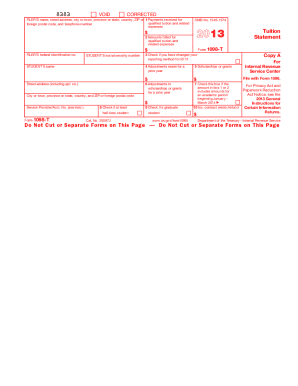

Get the free Form 1098-T - irs

Show details

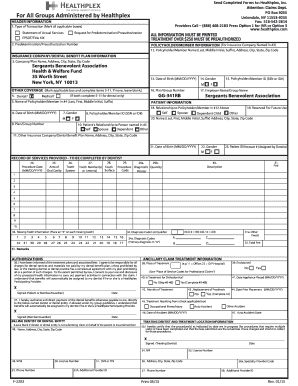

Form 1098-T is used by educational institutions to report tuition payments received and other related expenses for the IRS and students. It provides information necessary for students to claim education

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1098-t - irs

Edit your form 1098-t - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1098-t - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1098-t - irs online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 1098-t - irs. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1098-t - irs

How to fill out Form 1098-T

01

Obtain a copy of Form 1098-T from your educational institution.

02

Ensure that your personal information such as name, address, and Social Security number is correct.

03

Locate the box for qualified tuition and related expenses to fill out the amount that you paid for tuition during the tax year.

04

If applicable, fill in the scholarship or grant amounts you received in the relevant box.

05

Review the information for accuracy before submitting it along with your tax return.

Who needs Form 1098-T?

01

Students who are enrolled in an eligible educational institution and have paid qualified tuition and related expenses.

02

Parents or guardians who are claiming education tax credits for their dependent students.

03

Schools, colleges, and universities that must report their eligible students’ tuition payments to the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Can I file my taxes without my 1098-T form?

Attaching Form 1098-T to Your Tax Return You are not required to attach IRS Form 1098-T to your tax return. The IRS Form 1098-T is not like the IRS Form W-2 obtained from your employer, which is required to be attached to the tax return filed with the IRS.

How do I obtain my 1098-T form?

Your college or career school will provide your 1098-T form electronically or by postal mail if you paid any qualified tuition and related education expenses during the previous calendar year. Find information about the 1098-E form, which reports the amount of interest you paid on student loans in a calendar year.

Does a 1098-T give you money back?

The LLC allows you to claim up to $2,000 per tax return (not per student) but is not refundable. That means that it can lower your tax to $0 but you won't get anything left over back in a refund. To take advantage of these credits, you need the information from your 1098-T form.

Does filing a 1098-T increase the refund?

The main goal of Form 1098-T is to make sure you have a record of your educational expenses. These expenses might make you eligible for tax credits, like the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC). These credits can reduce your tax or potentially even increase your refund.

What happens if my school doesn't give me a 1098-T form?

If you, your spouse, or your dependent had education expenses and did not receive Form 1098-T, you may need to still report the amounts on the return. If your expenses are more than your scholarships, fellowships, and grants, you may qualify for an education credit.

Does a 1098-T mean I owe money?

The Form 1098-T is a statement that colleges and universities are required to issue to certain students. It provides the total dollar amount paid by the student for what is referred to as qualified tuition and related expenses (or “QTRE”) in a single tax year.

Do I have to file Form 1098-T on my taxes?

You, or the person who may claim you as a dependent, may be able to take either the tuition and fees deduction or claim an education credit on Form 1040 or 1040A for the qualified tuition and related expenses that were actually paid during the calendar year. There is no need to attach Form 1098-T to your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1098-T?

Form 1098-T, Tuition Statement, is a tax form used by eligible educational institutions to report information about qualified tuition and related expenses paid by students.

Who is required to file Form 1098-T?

Eligible educational institutions in the United States that receive payments of qualified tuition and related expenses must file Form 1098-T for each student enrolled and for whom a reportable transaction is made.

How to fill out Form 1098-T?

To fill out Form 1098-T, institutions must provide details such as the student's name, address, Tax Identification Number (TIN), the amount of qualified tuition and related expenses billed, adjustments made to prior year amounts, and whether the student was at least a half-time student.

What is the purpose of Form 1098-T?

The purpose of Form 1098-T is to help students and parents determine eligibility for education tax credits such as the American Opportunity Credit and the Lifetime Learning Credit.

What information must be reported on Form 1098-T?

Form 1098-T must report the student's identification information, the amount of qualified tuition and related expenses billed, any adjustments made to prior year amounts, scholarships or grants received, and whether the student was enrolled at least half-time.

Fill out your form 1098-t - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1098-T - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.