MD Comptroller MW506NRS 2015 free printable template

Show details

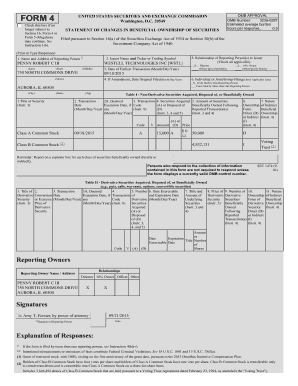

Form ATTACH CHECK OR MONEY ORDER AND FILE WITH THE CLERK OF THE CIRCUIT COURT MW506NRS Maryland Return of Income Tax Withholding for Nonresident Sale of Real Property 1. Signature COM/RAD-308 Date 15-49 Preparer s Name Preparer s Phone Number Copy A - For Comptroller of Maryland Revenue Administration Division. File with Clerk of the Circuit Court INSTRUCTIONS FOR RETURN OF INCOME TAX WITHHOLDING FOR NONRESIDENT SALE OF REAL PROPERTY FORM MW506...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2015 md return tax

Edit your 2015 md return tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2015 md return tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2015 md return tax online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2015 md return tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Comptroller MW506NRS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2015 md return tax

How to fill out MD Comptroller MW506NRS

01

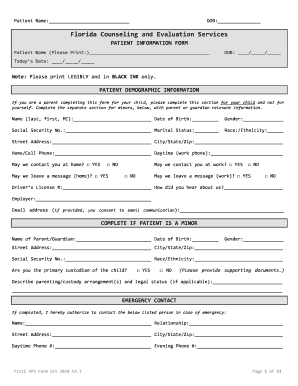

Gather all necessary payroll information, including employee names, Social Security numbers, and wages.

02

Open the MD Comptroller MW506NRS form either online or in a PDF format.

03

Start by entering your business information, including your name, address, and employer identification number (EIN).

04

Fill out the reporting period dates at the top of the form.

05

Enter each employee's information in the designated sections, including their gross wages for the reporting period.

06

Calculate and enter any deductions, such as state income taxes or other withholdings.

07

Carefully review all entered information for accuracy to prevent errors.

08

Sign and date the form where required.

09

Submit the completed form to the Maryland Comptroller's office via the provided instructions, either online or by mailing it.

Who needs MD Comptroller MW506NRS?

01

Employers who have employees working in Maryland and need to report payroll information for state tax purposes.

02

Businesses that are required to withhold and remit state income tax from their employees' wages.

03

Payroll service providers managing payroll for clients doing business in Maryland.

Fill

form

: Try Risk Free

People Also Ask about

What is Maryland form MW506NRS?

Form. MW506NRS. Maryland Return of Income Tax Withholding. for Nonresident Sale of Real Property. 2022.

What does withholding exemption certificate mean?

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

What is the employee's Maryland withholding exemption certificate?

Maryland Form MW507 is the state's Withholding Exemption Certificate and must be completed by all residents or employees in Maryland so your employer can withhold the correct amount from your wages. Form MW507 is the equivalent of the W-4 that all American workers complete for federal withholding.

How do I know if I am exempt from Maryland withholding?

The employee claims "exempt" as a result of having no tax liability for the preceding tax year, expects to incur no liability this year, and the wages are expected to exceed $200 a week (a new exemption certificate must be re-filed each year by the 15th day of February for employees whose income tax liability is

What does it mean to be subject to withholding?

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W–4.

What is the Maryland withholding tax for non residents?

The payment must be made before the deed or other instrument of transfer is recorded with the court clerk or filed with SDAT. For a nonresident individual, the payment is 8% of the total property sale payment made to the individual. A nonresident entity must make an 8.25% payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2015 md return tax from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 2015 md return tax, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make changes in 2015 md return tax?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your 2015 md return tax to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit 2015 md return tax in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing 2015 md return tax and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is MD Comptroller MW506NRS?

MD Comptroller MW506NRS is a form used in the state of Maryland for reporting and paying income tax withholding for non-resident individuals and entities.

Who is required to file MD Comptroller MW506NRS?

Employers who withhold Maryland income tax from non-resident employees or contractors are required to file the MD Comptroller MW506NRS.

How to fill out MD Comptroller MW506NRS?

To fill out MD Comptroller MW506NRS, you need to provide the employer's information, the non-resident's information, the total wages paid, the amount withheld, and any other necessary details as instructed on the form.

What is the purpose of MD Comptroller MW506NRS?

The purpose of MD Comptroller MW506NRS is to ensure proper reporting and payment of income tax withheld from non-residents by Maryland employers.

What information must be reported on MD Comptroller MW506NRS?

The information that must be reported on MD Comptroller MW506NRS includes the employer's name and identification number, employee's name and social security number, total wages, amount of Maryland tax withheld, and any applicable adjustments.

Fill out your 2015 md return tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2015 Md Return Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.