IRS Instruction 2553 2013 free printable template

Instructions and Help about IRS Instruction 2553

How to edit IRS Instruction 2553

How to fill out IRS Instruction 2553

About IRS Instruction 2 previous version

What is IRS Instruction 2553?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

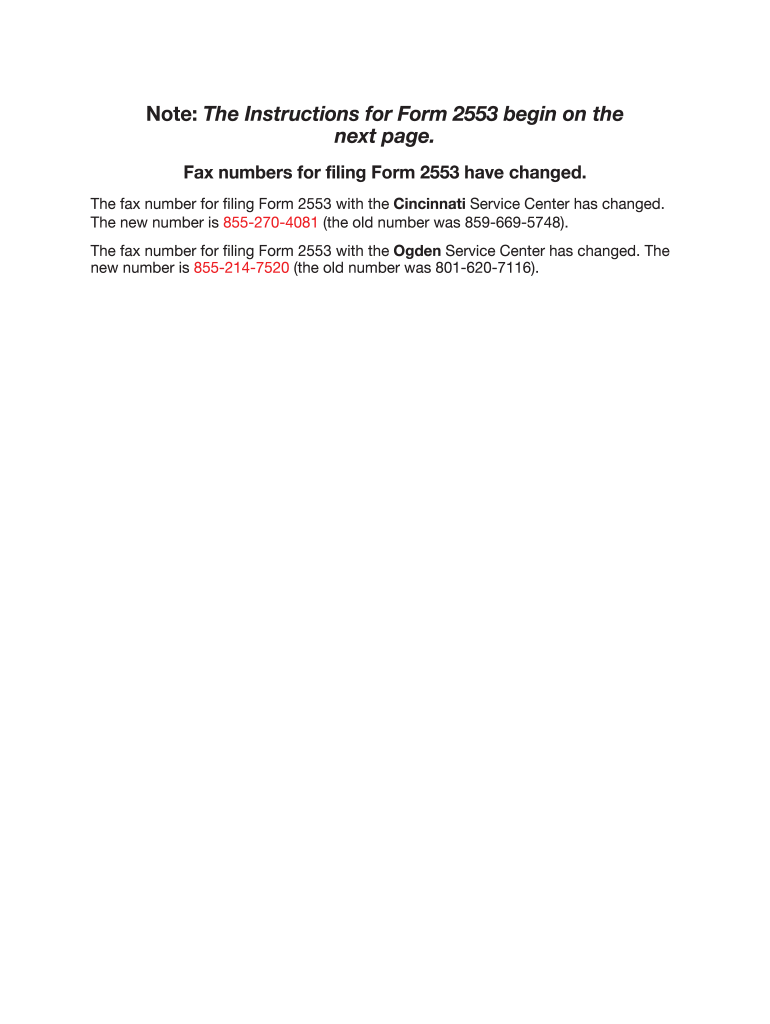

Where do I send the form?

FAQ about IRS Instruction 2553

What should I do if I realize I've made a mistake on my IRS Instruction 2553?

If you've made an error on your IRS Instruction 2553, you can submit an amended form to correct the mistake. It’s important to clearly indicate that the form is a correction and to provide the correct information. Always ensure you keep copies of both the original and amended submissions for your records.

How can I track the status of my IRS Instruction 2553 submission?

To track your IRS Instruction 2553 submission, you can use the IRS online tools designed for status checking. This will allow you to see if your form has been received and is being processed. Make sure to note any common rejection codes you may encounter and take appropriate actions to resolve them.

Is it acceptable to use an e-signature on my IRS Instruction 2553?

Yes, you can use an e-signature on your IRS Instruction 2553, provided that it complies with IRS requirements. This includes ensuring your e-signature is secure and verifiable to meet ongoing compliance and privacy standards.

What should I do if I receive an audit notice related to my IRS Instruction 2553?

If you receive an audit notice regarding your IRS Instruction 2553, first read the notice carefully to understand the issue. Prepare your documentation, including your form and any supporting evidence. It may also be beneficial to consult a tax professional to assist in addressing the audit effectively.

What common errors should I avoid when submitting my IRS Instruction 2553?

Common errors when submitting an IRS Instruction 2553 include incorrect identification numbers, missing signatures, or failing to provide adequate explanations for any discrepancies. To prevent these mistakes, double-check all entries and ensure that your form is fully completed before submission.