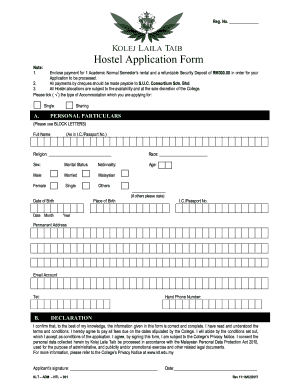

IRS 8858 2013 free printable template

Show details

Form Information Return of U.S. Persons With Respect To Foreign Disregarded Entities OMB No. 1545-1910 Information about Form 8858 and its separate instructions is at www.irs.gov/form8858. See instructions. For Paperwork Reduction Act Notice see the separate instructions. Cat. No. 21457L Form 8858 Rev. 12-2013 Page 2 Schedule C Income Statement see instructions Important Report all information in functional currency in accordance with U.S. GAAP. Information furnished for the foreign...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8858

Edit your IRS 8858 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8858 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8858 online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 8858. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8858 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8858

How to fill out IRS 8858

01

Gather necessary information about the foreign entity, including its name, address, and tax identification number.

02

Identify and report the ownership interest in the foreign entity.

03

Complete Part I of Form 8858, which includes reporting your information as the taxpayer and the entity's information.

04

Fill out Part II to provide information regarding the foreign entity's income, deductions, and tax payments.

05

Include any relevant attachments, such as financial statements of the foreign entity, if required.

06

Review the completed form for accuracy and ensure all necessary information is provided.

07

Submit the form with your federal income tax return by the tax deadline.

Who needs IRS 8858?

01

Any U.S. taxpayer who owns a foreign disregarded entity or a foreign corporation in which they have a reporting requirement based on ownership interests.

02

U.S. persons who are required to report information regarding foreign financial accounts and entities.

03

Taxpayers with specific reporting responsibilities related to their controlled foreign corporations or foreign partnerships.

Fill

form

: Try Risk Free

People Also Ask about

What is a 8858 filing requirement?

You will need to file Form 8858 if you are the owner of a foreign entity that is considered a disregarded entity for US income tax purposes. To elect to classify your business as a disregarded entity, you will want to complete Form 8832: Entity Classification Election and file this with the IRS.

What is form 8858 used for?

About Form 8858, Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs) | Internal Revenue Service.

What is the difference between a controlled foreign corporation and a disregarded entity?

Classification Overview A CFC is a separate non-US legal entity that operates in a foreign country with owners who reside in, or are citizens of, the United States. A DRE is a separate legal entity operating in a foreign jurisdiction that has made an election to be disregarded for US tax purposes.

What is the IRS form for disregarded entity?

An eligible entity uses Form 8832 to elect how it will be classified for federal tax purposes, as: A corporation. A partnership. An entity disregarded as separate from its owner.

What is the difference between form 8858 and 8865?

For companies created outside the US as multiple-owner, non-corporate companies, Form 8865 for foreign partnerships is generally required. The most common type of company created outside the US is a single-owner, non-corporate company, and this results in having to file Form 8858 for a Foreign Disregarded Entity (FDE).

How do I report a disregarded entity on 1040?

As a disregarded entity, you report your total business income, expenses, and profits on the Schedule C, which you file with your Form 1040: U.S. Individual Income Tax Return. The information from the Schedule C is added to line 12 of Schedule 1: Additional Income and Adjustments to Income.

Fill out your IRS 8858 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8858 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.