CT CPC-54 2014-2025 free printable template

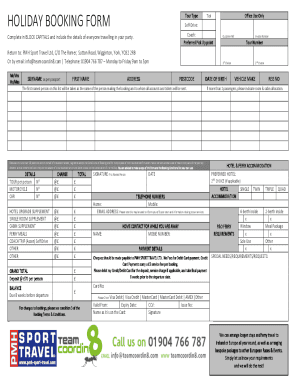

Get, Create, Make and Sign cpc 54 claim registration print form

How to edit connecticut cpc 54 registration online

Uncompromising security for your PDF editing and eSignature needs

CT CPC-54 Form Versions

How to fill out ct cpc 54 fill form

How to fill out CT CPC-54

Who needs CT CPC-54?

Video instructions and help with filling out and completing cpc 54 exemption blank

Instructions and Help about connecticut form cpc54 registration

In this video I'm going to show you how to refill all of the ink cartridges listed here first of all remove the label from the cartridge either use your fingers or a craft knife to peel back the edge to reveal the relevant fill holes unless you have a particularly thin needle attached to your syringe you'll need to widen the fill hole now I recommend using a two millimeter drill piece or a square shafted owl now fill a syringe with cyan ink and inject it slowly into the hole for the relevant chamber repeat this process for the magenta ink and finally repeat for the yellow ink we recommend injecting the amount of ink mentioned at the bottom of this video if however there are still some ink in the cartridge you may notice the ink start to overflow if this happens simply suck around one milliliter of ink from the top of the cartridge and now wipe away any excess ink from the lid of the cartridge with some tissue paper now reapply the label or cover the holes using a small piece of tape that is no bigger than the lid this tape should never overlap the sides as this may stop the cartridge being installed back into your printer with the refill complete reinstall the cartridge and perform two to three cleaning cycles using your printer or printer software if you're unsure how to do this with you for your particular model please consult your user manual it is perfectly normal for your printer to believe that the cartridge is still empty or low once your Canon printer believes the cartridge is empty it will ask for a small prompt from you before it continues printing this is usually holding down your printers stop reset or resume button for five seconds if in doubt make sure you've read all of the messages given to you in full I hope you found this video useful if however you have any further questions please let us know in the comments below thank you

People Also Ask about connecticut cpc 54 exemption edit

How to register a church in CT?

What is donor solicitation?

What is the difference between fundraising and solicitation?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify connecticut form cpc 54 exemption without leaving Google Drive?

How do I make changes in cpc 54 claim exemption from?

How do I fill out connecticut cpc54 exemption using my mobile device?

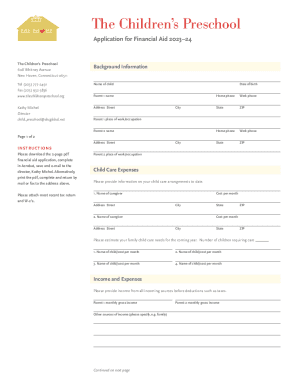

What is CT CPC-54?

Who is required to file CT CPC-54?

How to fill out CT CPC-54?

What is the purpose of CT CPC-54?

What information must be reported on CT CPC-54?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.