UK HMRC IHT404 2014 free printable template

Show details

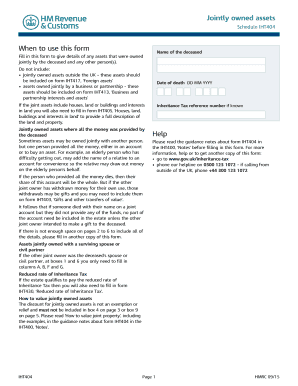

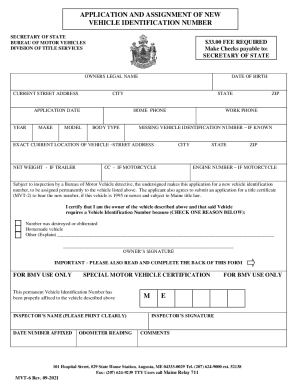

Jointly owned assets Schedule IHT404 When to use this form Fill in this form to give details of any assets that were owned jointly by the deceased and any other person s. IHT404 Page 1 09/14 This page should only contain details of jointly owned houses buildings and land shares and securities which gave the deceased control of the company. Help Please read the guidance notes about form IHT404 in the IHT400 Notes before filling in this form. For more information help or to get another copy of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC IHT404

Edit your UK HMRC IHT404 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC IHT404 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK HMRC IHT404 online

Follow the guidelines below to use a professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UK HMRC IHT404. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC IHT404 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC IHT404

How to fill out UK HMRC IHT404

01

Gather the necessary information about the deceased's estate and assets.

02

Download the HMRC IHT404 form from the HMRC website or obtain a physical copy.

03

Fill in the personal details of the deceased including their name, address, and date of death.

04

Provide details on the value of the estate including any property, cash, and investments.

05

Include information about gifts made by the deceased within seven years prior to their death.

06

Complete the sections on liabilities and outstanding debts.

07

Review the completed form for accuracy.

08

Submit the form to HMRC and keep a copy for your records.

Who needs UK HMRC IHT404?

01

Individuals who are responsible for administering an estate after someone has died.

02

Executors or administrators who need to report the value of the estate to HMRC.

03

Beneficiaries who may be affected by inheritance tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

What is the inheritance tax rate for non residents in the UK?

The standard rate for inheritance tax in the UK is 40%. Tax rates and exemptions are the same for nationals and foreign residents, as well as for non-residents with property in the UK.

How can I avoid inheritance tax?

Set up a trust to avoid inheritance tax If you put assets into a trust, provided certain conditions are met, they no longer belong to you. This means that, when you die, their value normally won't be included when the value of your estate is calculated. Instead, the cash, investments or property belong to the trust.

Do I need an IHT400?

You must complete the form IHT400, as part of the probate or confirmation process if there's Inheritance Tax to pay, or the deceased's estate does not qualify as an 'excepted estate'. You can use the notes and forms IHT401 to IHT436 to support you.

What is an IHT400?

If Inheritance Tax is due or full details are needed. You must report the value of the estate to HM Revenue and Customs ( HMRC ) by completing form IHT400. You must submit the form within 12 months of the person dying. You may have to pay a penalty if you miss the deadline.

What is IHT404 form?

Use the IHT404 with form IHT400 to give details of all UK assets the deceased owned jointly with another person.

Do I need an IHT400?

You must complete the form IHT400, as part of the probate or confirmation process if there's Inheritance Tax to pay, or the deceased's estate does not qualify as an 'excepted estate'.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit UK HMRC IHT404 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including UK HMRC IHT404, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find UK HMRC IHT404?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific UK HMRC IHT404 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in UK HMRC IHT404?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your UK HMRC IHT404 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is UK HMRC IHT404?

UK HMRC IHT404 is a form used to report certain types of gifts and transfers of value for inheritance tax purposes in the UK.

Who is required to file UK HMRC IHT404?

Those who have made potentially exempt transfers or gifts that exceed the annual allowance and are within the 7-year period prior to death may be required to file UK HMRC IHT404.

How to fill out UK HMRC IHT404?

To fill out UK HMRC IHT404, you need to provide details of the deceased, the gifts made, their values, and the dates they were given, along with the personal information of the person filling out the form.

What is the purpose of UK HMRC IHT404?

The purpose of UK HMRC IHT404 is to assess any potential inheritance tax liabilities arising from gifts made before death, ensuring compliance with tax regulations.

What information must be reported on UK HMRC IHT404?

UK HMRC IHT404 requires reporting of information including details of the deceased, gifts made, their values, dates, and any applicable exemptions or reliefs.

Fill out your UK HMRC IHT404 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC iht404 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.