IN SF 2837 2012 free printable template

Show details

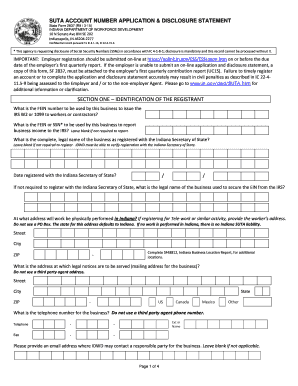

REPORT TO DETERMINE STATUS Reset Form INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT Confidential Record Pursuant To IC 4-1-6 IC 22-4-19-6 10 N. SENATE AVE. INDIANAPOLIS IN 46204-2277 SF 2837 R8/4-12 Office Use Only Original Report Transfer Amended 283701-KFI Pre-assigned IMPORTANT Any employing unit which fails to submit any report within 10 days after such request is sent shall be assessed a penalty of not less than 25. Quarter -OR- PLEASE PRINT USING UPPERCASE LETTERS IN BLACK INK. A B C 1 2...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN SF 2837

Edit your IN SF 2837 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN SF 2837 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IN SF 2837 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IN SF 2837. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN SF 2837 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN SF 2837

How to fill out IN SF 2837

01

Begin by downloading the IN SF 2837 form from the appropriate government website.

02

Fill in your personal information at the top of the form, including your full name, address, and contact details.

03

Provide the date of the request and other identifying information as needed.

04

Carefully read the instructions provided on the form to ensure compliance with any specific requirements.

05

Complete each section of the form as directed, making sure to double-check for accuracy.

06

If required, attach any necessary supporting documentation or evidence that substantiates your submission.

07

Review the entire form to verify that all information is correct and all sections are completed.

08

Sign and date the form at the designated area before submission.

09

Submit the form via the specified method, whether that be mailing it or submitting it electronically.

Who needs IN SF 2837?

01

Individuals applying for specific benefits or services that require this form.

02

Employees or applicants of government agencies who are required to provide this form.

03

Anyone who needs to formally document their request in the context dictated by the form.

Instructions and Help about IN SF 2837

Fill

form

: Try Risk Free

People Also Ask about

How to register with Indiana Department of Workforce Development?

Registration Steps: Combined registration for IN State withholding and IN State unemployment tax. Go to INBiz to complete the online registration. Click register now. Create a username and password for the Department of Workforce Development. Go to Uplink Employer Self Service Website.

What is the Indiana unemployment tax rate for 2023?

Indiana. Unemployment tax rates range from 0.50% to 7.40% in 2023 and through 2025. The wage base holds at $9,500.

How much is Indiana state unemployment tax?

Indiana updated its unemployment insurance employer handbook on Jan. 31 to include tax rates and unemployment-taxable wage base information for 2023. Tax rates for positive-rated employers range from 0.5% to 3.8% for nondelinquent employers and from 2.5% to 5.8% for delinquent employers, ing to the handbook.

Do I have to register with the Department of Workforce Development in Indiana?

If you have employees - even temporary ones - you will also need to register with the Indiana Department of Workforce Development. It oversees employee reporting, new hire reporting, unemployment insurance and wage reporting for the state of Indiana.

What is the Indiana SUTA tax rate for 2023?

SUTA tax rate and wage base 2023 Wage BaseMax (%)Hawaii$56,7006.2Idaho$49,9005.4Illinois$13,2717.625Indiana$9,5009.447 more rows • Feb 7, 2023

What is the federal unemployment tax rate in Indiana?

Indiana updated its unemployment insurance employer handbook on Jan. 31 to include tax rates and unemployment-taxable wage base information for 2023. Tax rates for positive-rated employers range from 0.5% to 3.8% for nondelinquent employers and from 2.5% to 5.8% for delinquent employers, ing to the handbook.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IN SF 2837 to be eSigned by others?

Once your IN SF 2837 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit IN SF 2837 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your IN SF 2837 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit IN SF 2837 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute IN SF 2837 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IN SF 2837?

IN SF 2837 is a form used by certain entities for specific financial reporting or compliance purposes, generally pertaining to state or local regulations.

Who is required to file IN SF 2837?

Entities that meet specific criteria set forth by the governing body or agency that oversees the use of IN SF 2837 are required to file this form.

How to fill out IN SF 2837?

To fill out IN SF 2837, follow the instructions provided on the form, ensuring all required fields are completed accurately and submitted to the appropriate office by the deadline.

What is the purpose of IN SF 2837?

The purpose of IN SF 2837 is to ensure compliance with reporting requirements and regulations, allowing the governing authority to monitor and assess the financial activities of the filing entities.

What information must be reported on IN SF 2837?

The information that must be reported on IN SF 2837 includes financial data, details about transactions, compliance with specific laws or regulations, and any other pertinent information as required by the form's instructions.

Fill out your IN SF 2837 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN SF 2837 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.