Bankruptcy B6E 2013-2025 free printable template

Show details

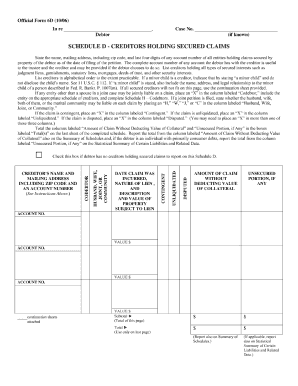

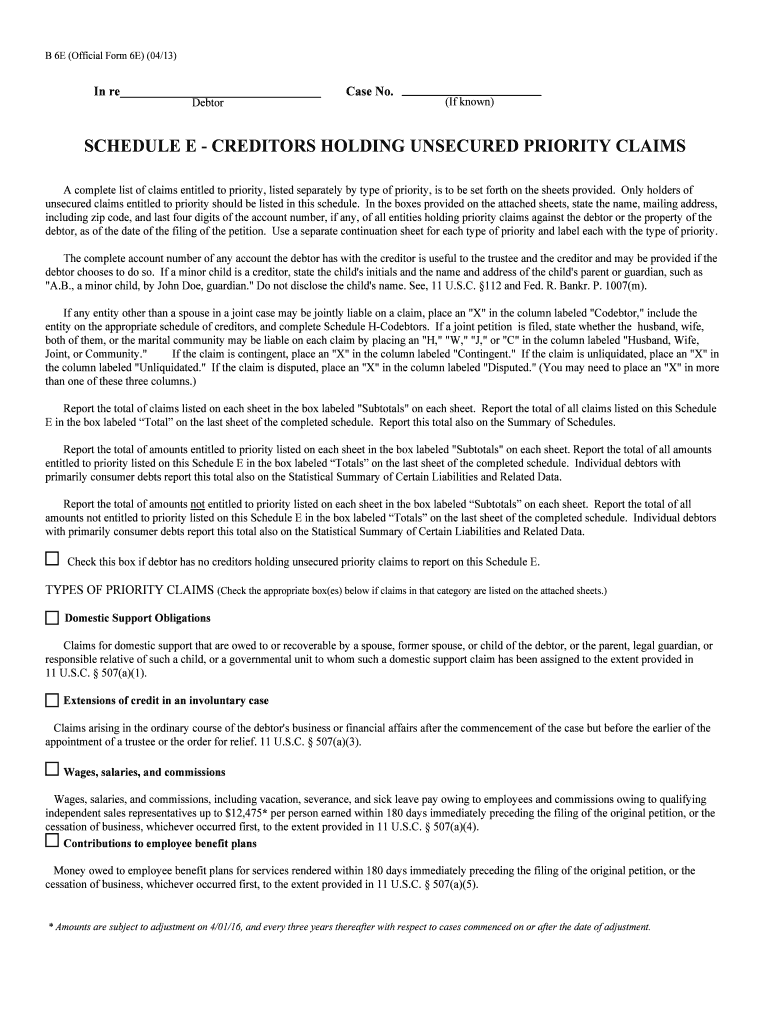

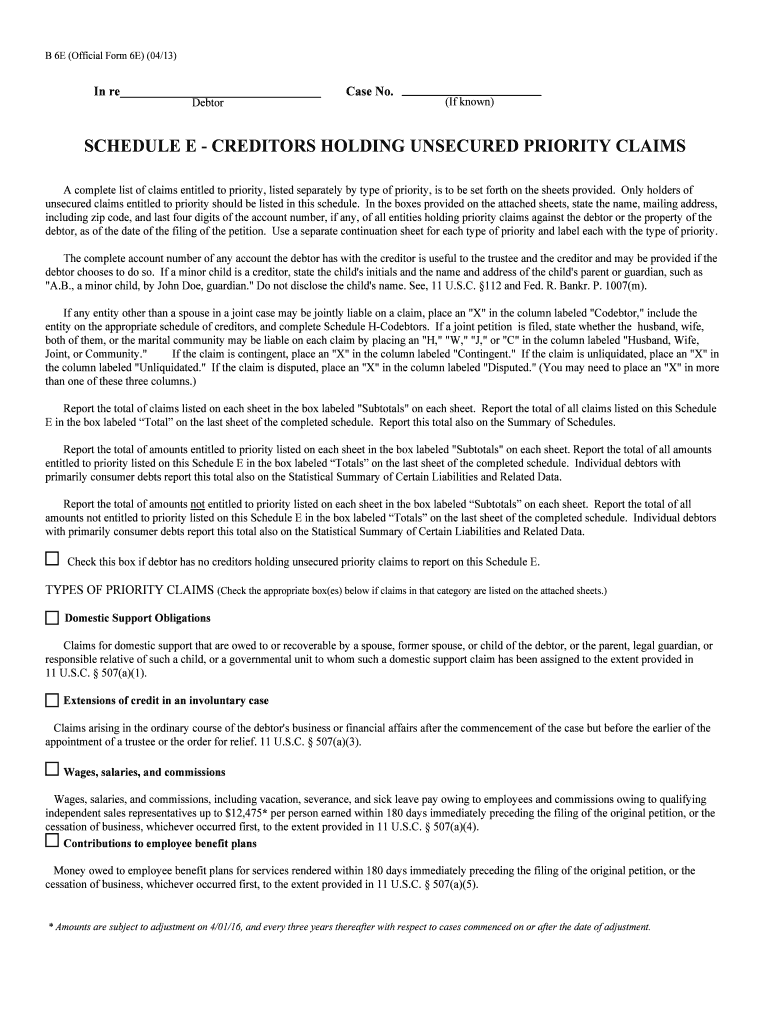

B 6E Official Form 6E 04/13 In re Debtor Case No. If known SCHEDULE E - CREDITORS HOLDING UNSECURED PRIORITY CLAIMS A complete list of claims entitled to priority listed separately by type of priority is to be set forth on the sheets provided. Only holders of unsecured claims entitled to priority should be listed in this schedule. In the boxes provided on the attached sheets state the name mailing address including zip code and last four digits of the account number if any of all entities...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form creditors

Edit your official form 6e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your creditors priority form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 6e online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit b 6 e form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Bankruptcy B6E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 6e form

How to fill out Bankruptcy B6E

01

Begin by gathering your financial documents, including income statements, expenses, debts, and assets.

02

Obtain the Bankruptcy B6E form from the official bankruptcy court website or relevant legal resources.

03

Carefully read the instructions provided with the form to ensure compliance with local bankruptcy laws.

04

Fill in your personal information at the top of the form, including your name, address, and case number if applicable.

05

List all your debts in the appropriate sections, categorizing them as unsecured, secured, priority, etc.

06

Provide detailed information about your income, including wages, rental income, and any additional financial support.

07

Document your monthly expenses accurately, including rent/mortgage, utilities, food, insurance, and other living costs.

08

Review the completed form for accuracy, ensuring all required sections are filled out properly.

09

Sign and date the form, affirming that the information provided is true and correct.

10

Submit the completed Bankruptcy B6E form along with any additional required documentation to the bankruptcy court.

Who needs Bankruptcy B6E?

01

Individuals or businesses who are filing for bankruptcy to seek protection from creditors.

02

Debtors who need to report their financial situation as part of their bankruptcy case.

03

People facing overwhelming debt and seeking to either liquidate their assets or restructure their debts under court protection.

Fill

b6 e

: Try Risk Free

People Also Ask about form 6e

Can creditors file Chapter 11?

Under Ch. 11, these Creditors are lawfully entitled to repayment, and thus have a Bankruptcy Claim against the Debtor in the case. The Bankruptcy Court, the Debtor, and the Creditors all play a part in the process to determine the outcome of the case.

What happens to unsecured creditors in Chapter 11?

Most Chapter 11 debtors receive a moratorium on the payment of most of their general unsecured debts for the period between the filing of the case and the confirmation of a plan. This period usually lasts for six to twelve months.

What happens to unsecured creditors?

Unlike secured creditors, unsecured creditors lend you money without taking collateral. As a result, they do not have the automatic right to take specific property if you stop making payments. Instead, they must sue you and obtain a court judgment against you.

How many bankruptcies were filed in 2010?

Bankruptcies in the United States peaked in 2010, when 1.14 million Chapter 7 bankruptcies and 439,000 Chapter 13 bankruptcies were filed.

What is the priority of unsecured creditors in Chapter 11?

The “absolute priority rule” implies that if a Creditor of the highest priority (i.e. Secured Creditor), is paid in full under the Chapter 11 plan, then those of a lower priority (i.e. general Unsecured Creditor), must also be paid.

Who Cannot file Chapter 11?

An individual cannot file under chapter 11 or any other chapter if, during the preceding 180 days, a prior bankruptcy petition was dismissed due to the debtor's willful failure to appear before the court or comply with orders of the court, or was voluntarily dismissed after creditors sought relief from the bankruptcy

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form b6e directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form b6e as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send b 6e for eSignature?

To distribute your holding priority, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit form creditors 2013-2025 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing form creditors 2013-2025 right away.

What is Bankruptcy B6E?

Bankruptcy B6E is a form used in the bankruptcy process that provides a detailed statement of a debtor's current monthly income and expenses.

Who is required to file Bankruptcy B6E?

Individuals filing for bankruptcy under Chapter 7 or Chapter 13 are required to submit Bankruptcy B6E as part of their petition.

How to fill out Bankruptcy B6E?

To fill out Bankruptcy B6E, debtors must provide accurate information regarding their monthly income, expenses, and any adjustments needed to reflect their financial situation.

What is the purpose of Bankruptcy B6E?

The purpose of Bankruptcy B6E is to assess the debtor's financial situation and determine eligibility for bankruptcy relief, ensuring that the court has a clear understanding of the debtor's income and expenses.

What information must be reported on Bankruptcy B6E?

Bankruptcy B6E requires reporting of monthly income, living expenses, deductions, and any other relevant financial information to paint a complete picture of the debtor's financial health.

Fill out your form creditors 2013-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Creditors 2013-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.