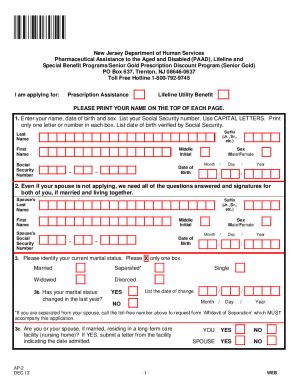

NJ AP-2 2013 free printable template

Show details

If a Part D plan is the primary payer for a drug covered on its formulary PAAD will provide coverage as secondary payer if needed for that drug and the PAAD beneficiary will pay the regular PAAD copayment for PAAD covered drugs. PAAD co-pay is 5 per PAAD covered generic drug Senior Gold co-pay for Senior Gold covered drugs is 15 50 of the remaining cost of the prescription or actual drug cost whichever is less. For More Information Visit www. njpaad.gov or www. njsrgold. gov Or Call...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ AP-2

Edit your NJ AP-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ AP-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ AP-2 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NJ AP-2. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ AP-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ AP-2

How to fill out NJ AP-2

01

Obtain the NJ AP-2 form from the New Jersey Division of Taxation website or a local tax office.

02

Begin filling out the form with your personal details at the top, including your name, address, and tax identification number.

03

Indicate the tax year for which you are filing the form.

04

Fill in the relevant income information as required in the designated sections, ensuring all figures are accurate.

05

Provide any necessary documentation to support your claims, such as receipts or tax statements.

06

Review your completed form for accuracy and completeness before signing.

07

Submit the form by the due date, either by mail or electronically, depending on your preference.

Who needs NJ AP-2?

01

Individuals and businesses operating in New Jersey that need to report income for state tax purposes.

02

Taxpayers claiming specific deductions or credits related to their income.

03

Anyone who has received a request from the NJ Division of Taxation to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

Does Social Security count as income for PAAD in NJ?

NJ PAAD's main requirement is annual adjusted gross income (which includes Social Security benefits). In 2023, the income requirements are as follows: File single - less than $42,142.

What are the asset limits for PAAD in NJ?

The PAAD program income limits are now $38,769 if single and $45,270 for a couple. The Senior Gold Prescription Discount program limits are now $48,769 if single and $55,270 if married.

What is the income limit for PAAD in NJ?

You may be eligible for PAAD if you meet the following requirements: You are a New Jersey resident; You are age 65 or older or between ages 18 and 64 and receiving Social Security Title II Disability benefits; and. Your income for 2023 is less than $42,142 if single or less than $49,209 if married.

What are the benefits of PAAD in NJ?

This program pays the monthly premium for certain standard basic Medicare Part D plans — plans must have a premium that is at or below the regional benchmark. PAAD also pays the cost of prescription medications, minus the $5 co-pay for covered generic drugs and $7 for covered brand name drugs.

What are the income limits for PAAD in NJ 2023?

You may be eligible for PAAD if you meet the following requirements: You are a New Jersey resident; You are age 65 or older or between ages 18 and 64 and receiving Social Security Title II Disability benefits; and. Your income for 2023 is less than $42,142 if single or less than $49,209 if married.

Does Social Security count as income for NJ PAAD?

PAAD will use this information to determine PAAD income eligibility. NOTE: This question does NOT ask the applicant or spouse (if applicable) to include income from Social Security Benefits, Wages, Self-Employment, Interest, or Dividends. These sources of income will be asked for in Questions 10 and 14.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NJ AP-2 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your NJ AP-2 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make changes in NJ AP-2?

The editing procedure is simple with pdfFiller. Open your NJ AP-2 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an eSignature for the NJ AP-2 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your NJ AP-2 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is NJ AP-2?

NJ AP-2 is a tax form used in New Jersey for reporting certain tax-related information, specifically relating to the adjustment of State taxes.

Who is required to file NJ AP-2?

Entities that have adjustments to their taxes, such as corporations, partnerships, and business organizations operating in New Jersey, are required to file NJ AP-2.

How to fill out NJ AP-2?

To fill out NJ AP-2, provide the necessary business identification details, report financial adjustments, and ensure all calculations are accurate. Follow the instructions provided with the form.

What is the purpose of NJ AP-2?

The purpose of NJ AP-2 is to document and report any adjustments to taxable income, credits, and deductions for New Jersey state taxes.

What information must be reported on NJ AP-2?

The NJ AP-2 must report business identification information, details of the adjustments being made, tax period information, and any financial data necessary to support the changes in tax filings.

Fill out your NJ AP-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ AP-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.