IRA Distribution Request Form 2013 free printable template

Show details

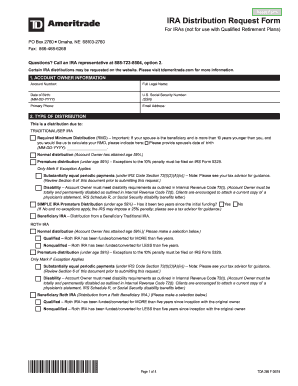

Reset Form IRA Distribution Request Form For IRAs not for use with Qualified Retirement Plans PO Box 2760 Omaha NE 68103-2760 Fax 866-468-6268 Questions Call an IRA representative at 888-723-8504 option 2. M Mark here if this request is to update your current systematic payments. Mark here if you would like to be able to request verbal IRA Distributions in the future. Please note Witholding elections indicated on this form will apply to any future verbal distribution requests. Verbal...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IRA Distribution Request Form

Edit your IRA Distribution Request Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRA Distribution Request Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRA Distribution Request Form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRA Distribution Request Form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRA Distribution Request Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRA Distribution Request Form

How to fill out IRA Distribution Request Form

01

Obtain the IRA Distribution Request Form from your financial institution's website or by visiting a local branch.

02

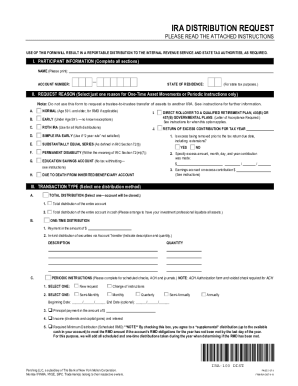

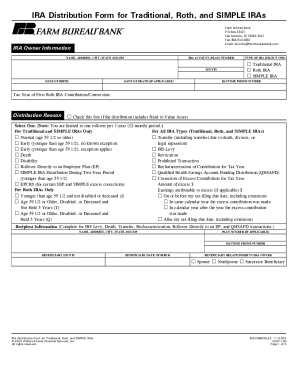

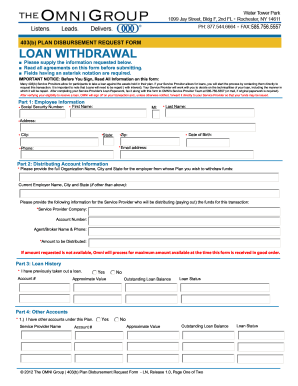

Fill out your personal information including your name, address, and Social Security number.

03

Indicate the type of distribution you are requesting (e.g., full or partial distribution, rollover, etc.).

04

Specify the amount you wish to withdraw or transfer.

05

Provide instructions on how you want to receive the funds (check, direct deposit, etc.).

06

If applicable, indicate whether any taxes should be withheld from the distribution.

07

Sign and date the form to authenticate your request.

08

Submit the completed form as directed by your financial institution, either by mail, fax, or in person.

Who needs IRA Distribution Request Form?

01

Individuals who are 59½ years or older and wish to withdraw money from their IRA.

02

People looking to roll over their IRA to another retirement account.

03

Participants who are in financial need and need to access their retirement funds early.

04

Account holders who want to take a distribution for specific financial goals, such as buying a home or paying for education.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my 1099-R form?

1099-R tax forms are mailed by the end of January each year. If you recently moved, be sure to update your mailing address. You can access and download your tax statements online by logging in to myCalPERS. To request a duplicate or replacement 1099-R tax form by mail, contact us.

What form do you get for an IRA distribution?

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs).

Can I get a copy of my 1099-R from the IRS?

However, when taxpayers are unable to find their employers or cannot otherwise secure copies, they can: Download Form 4852, Substitute for Form W-2 (Wage and tax Statement), or Form 1099-R, Distribution from Pensions, Annuities, Retirement or Profit-sharing Plans, IRAsPDF. Obtain phone assistance through 800-829-1040.

What is the form for IRA rollover distribution?

Types of Rollovers Like all retirement plans or IRA distributions, rollover distributions are reported to the taxpayer on the Form 1099-R. Depending upon the manner in which the rollover occurs it can affect whether taxes are withheld from the distribution and how the taxable amount is reported on Form 1099-R.

What is a 1099-R distribution?

Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. You should receive a copy of Form 1099-R, or some variation, if you received a distribution of $10 or more from your retirement plan.

Can I find my 1099-R online?

1099-R tax forms are mailed by the end of January each year. If you recently moved, be sure to update your mailing address. You can access and download your tax statements online by logging in to myCalPERS. To request a duplicate or replacement 1099-R tax form by mail, contact us.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRA Distribution Request Form in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your IRA Distribution Request Form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit IRA Distribution Request Form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing IRA Distribution Request Form, you need to install and log in to the app.

Can I edit IRA Distribution Request Form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like IRA Distribution Request Form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is IRA Distribution Request Form?

The IRA Distribution Request Form is a document used by individuals to request a withdrawal or distribution from their Individual Retirement Account (IRA).

Who is required to file IRA Distribution Request Form?

Individuals who wish to withdraw funds from their IRA account must file the IRA Distribution Request Form.

How to fill out IRA Distribution Request Form?

To fill out the IRA Distribution Request Form, individuals must provide their personal information, account details, the amount they wish to withdraw, and the reason for the distribution, along with any required signatures.

What is the purpose of IRA Distribution Request Form?

The purpose of the IRA Distribution Request Form is to formally request a distribution from an IRA account and to provide the necessary information to process the withdrawal.

What information must be reported on IRA Distribution Request Form?

The information that must be reported on the IRA Distribution Request Form includes the account holder's name, address, social security number, account number, the amount to be distributed, and the type of distribution (such as a regular distribution or hardship withdrawal).

Fill out your IRA Distribution Request Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRA Distribution Request Form is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.