Fannie Mae 1020 2006-2025 free printable template

Get, Create, Make and Sign borrower financial form

Editing borrowers financial statement online

Uncompromising security for your PDF editing and eSignature needs

Fannie Mae 1020 Form Versions

How to fill out form 1020 statement

How to fill out Fannie Mae 1020

Who needs Fannie Mae 1020?

Video instructions and help with filling out and completing fannie mae financial statement

Instructions and Help about 1020 statement

Hi everyone Terrence Brandy here and in this video I'm going to walk you through the standard loan application form also known as the uniform residential loan application which is a standardized form created by Fannie Mae and used in every residential mortgage transaction regardless of whether it's a refinancing construction or purchase and this is an important application in that it kick-starts the entire loan process, and it's important to put accurate and detailed information on this because this is what lenders and banks are going to be using to determine your ability to secure mortgage loan based on this information so with that said we'll jump in the first section is the type of mortgage in terms of the loan and if you're applying for a loan you may not know what type of loan product you're going to be applying for or the terms of those of the loans every loan is different and so you know you may know the amount the loan amount so say if you're going to be purchasing a home for $400,000, and you're going to be putting a down payment of $100,000 the loan amount would be three hundred thousand, so you can put that in box there you may not know what the going interest rates are and really a lot of that's going to be determined by your conversations with your loan originator so if you do know this information great I'll kind of put in what today's rates for a 30-year fixed about three and a percent and number of months it's going to be the number ones for the loan and a 30-year fixed across our time is twelve months is 360 months, and it's a fixed rate product so with that we'll go down to our two section two and pretty self-explanatory this is where you're going to put the address for the property you're attempting to secure a loan against so if it's your current home, and you already have a mortgage on, and you're looking to refinance you'll just put your current address if it's a property that you are purchasing well then you'll put the address of that said property as far as the number of units if it's single-family residence it's one unit residential mortgage loans all the way up to four units so duplexes triplexes quad or four unit properties the legal description you can leave blank we'll pull that information from the title report as well as the year build the purpose alone pretty self-explanatory in this case we're going to say its purchase and this section here is fairly important this is determining how you're going to be occupying the property and if it's going to be your primary residence whether it's going to be secondary residence which is like a vacation home or if it's going to be an investment property which is also known there's non-owner occupied meaning you're not going to be occupying the property that you'll probably be leasing it out to a tenant, so this is very important to be to disclose what your intentions are with the purchases' property we're going to save right now that it's going to be our primary residence this...

People Also Ask about 1020 statement fill

What is a PFS template?

What are 3 types of financial statements?

What do you mean by financial statement?

What are 1020 forms?

What are financial statements and examples?

How do you fill out a personal financial statement?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fannie borrower financial in Gmail?

Where do I find form 1020 financial statement?

How do I complete mae 1020 financial statement on an iOS device?

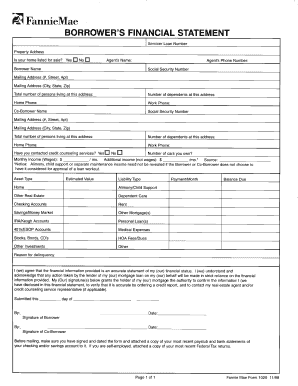

What is Fannie Mae 1020?

Who is required to file Fannie Mae 1020?

How to fill out Fannie Mae 1020?

What is the purpose of Fannie Mae 1020?

What information must be reported on Fannie Mae 1020?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.