OK Form 511 2014 free printable template

Show details

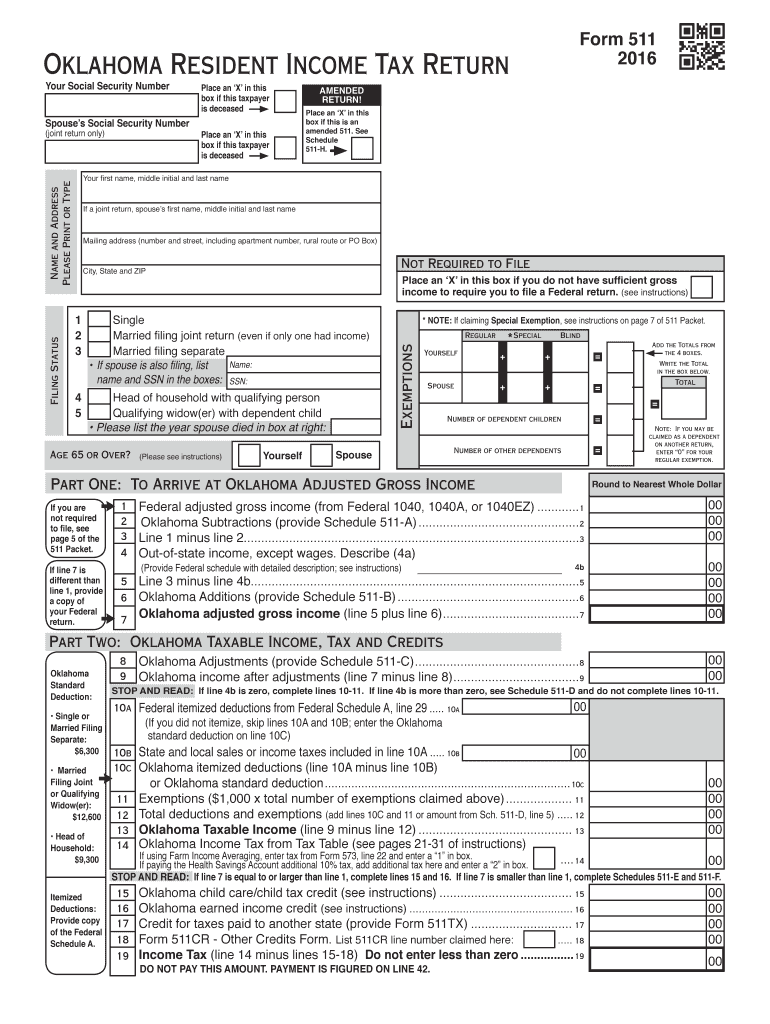

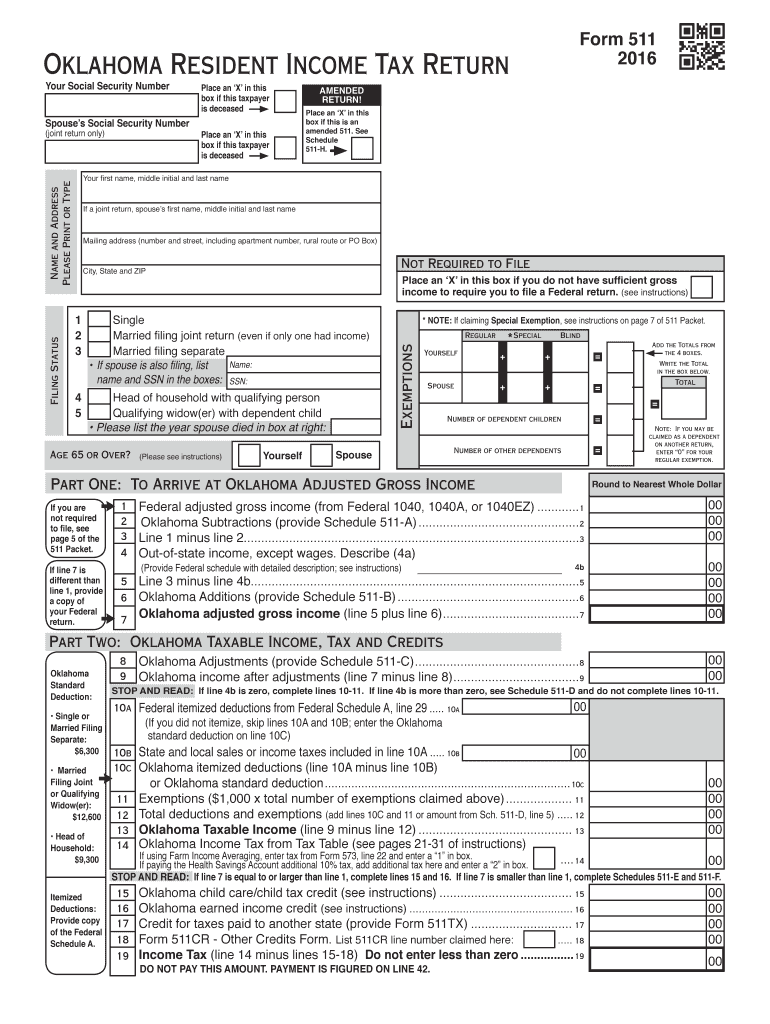

If you have withholding or made estimated payments and are filing for a refund on Form 511 you must claim the sales tax credit on your return and enclose this signed form. If you are not filing an income tax return mail this completed and signed form to Oklahoma Tax Commission Post Office Box 26800 Oklahoma City OK 73126-0800. NOTE Do NOT enclose this page with Form 511. Food Bank of Oklahoma and the Community Food Bank of Eastern Oklahoma Oklahoma Food Banks. See Schedule 511-H. Your first...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK Form 511

Edit your OK Form 511 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK Form 511 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OK Form 511 online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit OK Form 511. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Form 511 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK Form 511

How to fill out OK Form 511

01

Obtain a copy of OK Form 511 from the appropriate tax authority website or office.

02

Fill in your personal information such as name, address, and Social Security number.

03

Provide your filing status by selecting the appropriate option (single, married, etc.).

04

List your income sources, including wages, self-employment income, and any other income.

05

Deduct any exemptions or credits for which you are eligible.

06

Calculate your total tax liability using the provided tax tables or software.

07

Review the form for accuracy to ensure all information is correct.

08

Sign and date the form before submission.

09

Submit the form via mail or electronically as instructed.

Who needs OK Form 511?

01

Individuals or businesses filing state income tax in Oklahoma.

02

Residents of Oklahoma who earn income during the tax year.

03

Anyone seeking to claim tax credits or deductions allowed by the state.

Fill

form

: Try Risk Free

People Also Ask about

What is tax form 511tx?

2022 Form 511-TX Credit for Tax Paid to Another State.

What is Form 511 EIC Oklahoma?

The 2022 Oklahoma EIC is based on your earned income for either tax year 2021 or 2022. The Oklahoma EIC is refundable beginning with tax year 2022. Complete Form 511-EIC using the attached EIC Table and provide a copy of Form 511-EIC with your income tax return.

What is Oklahoma Form 561?

2022 Form 561 Oklahoma Capital Gain Deduction for Residents Filing Form 511.

What is Form 511 Oklahoma?

File as Oklahoma married filing separate. The Oklahoma resident, filing a joint federal return with a nonresident civilian spouse, may file an Oklahoma return as married filing separate. The resident will file on Form 511 using the married filing separate rates and reporting only his/her income and deductions.

What is Form 500 for Oklahoma?

A Form 500-B must be completed for each nonresident member to whom the pass-through entity has made an Oklahoma taxable distribution and paid withholding to Oklahoma. Form 500-B should not report withhold- ing paid by sources other than the pass-through entity.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OK Form 511 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including OK Form 511. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for signing my OK Form 511 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your OK Form 511 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the OK Form 511 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign OK Form 511 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is OK Form 511?

OK Form 511 is the Oklahoma Individual Income Tax Return form used by residents of Oklahoma to report their income and calculate their tax liability.

Who is required to file OK Form 511?

Individuals who are residents of Oklahoma and whose income exceeds a certain threshold are required to file OK Form 511. This includes individuals who earned income from wages, self-employment, or other sources within the state.

How to fill out OK Form 511?

To fill out OK Form 511, taxpayers need to provide personal information, report their income, claim deductions and credits, and calculate their tax owed. The form includes various sections that guide the taxpayer through the process.

What is the purpose of OK Form 511?

The purpose of OK Form 511 is to allow residents of Oklahoma to report their income and determine the amount of state income tax they owe for the tax year.

What information must be reported on OK Form 511?

OK Form 511 requires taxpayers to report information such as wages, salaries, tips, interest, dividends, capital gains, unemployment benefits, and other sources of income. Additionally, taxpayers need to provide information on deductions and credits applicable to their situation.

Fill out your OK Form 511 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK Form 511 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.