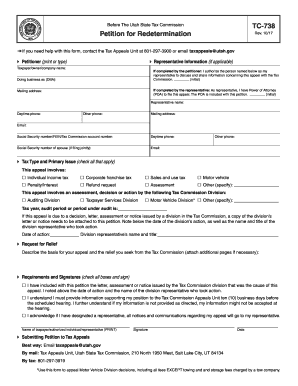

UT USTC TC-738 2015 free printable template

Show details

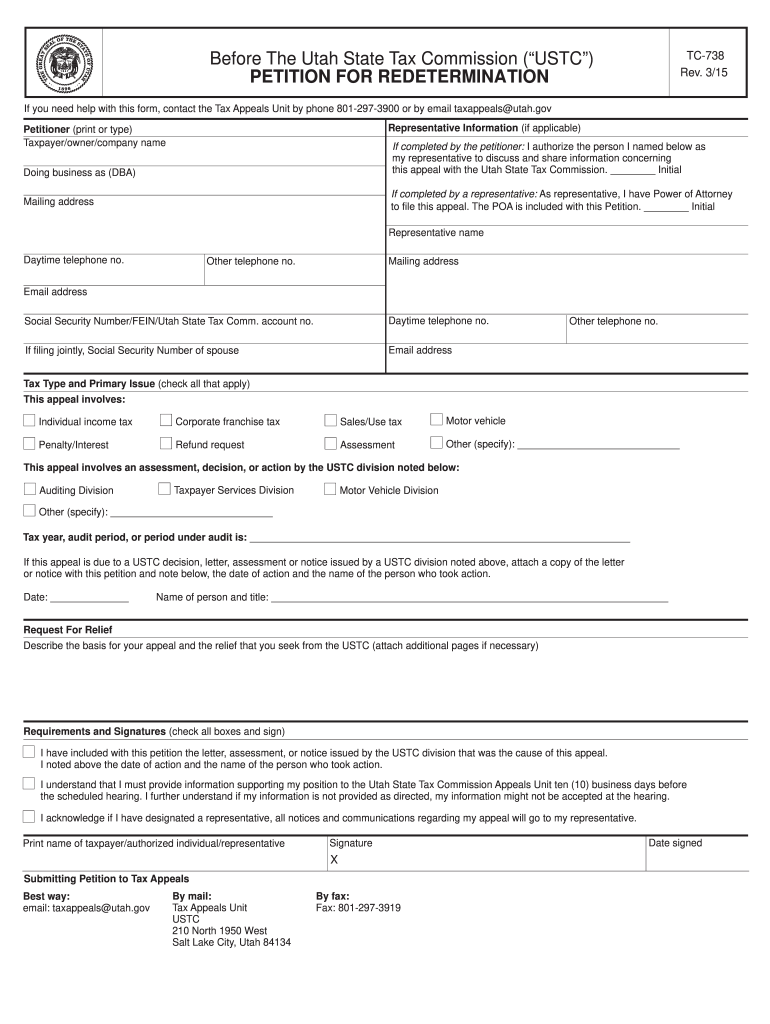

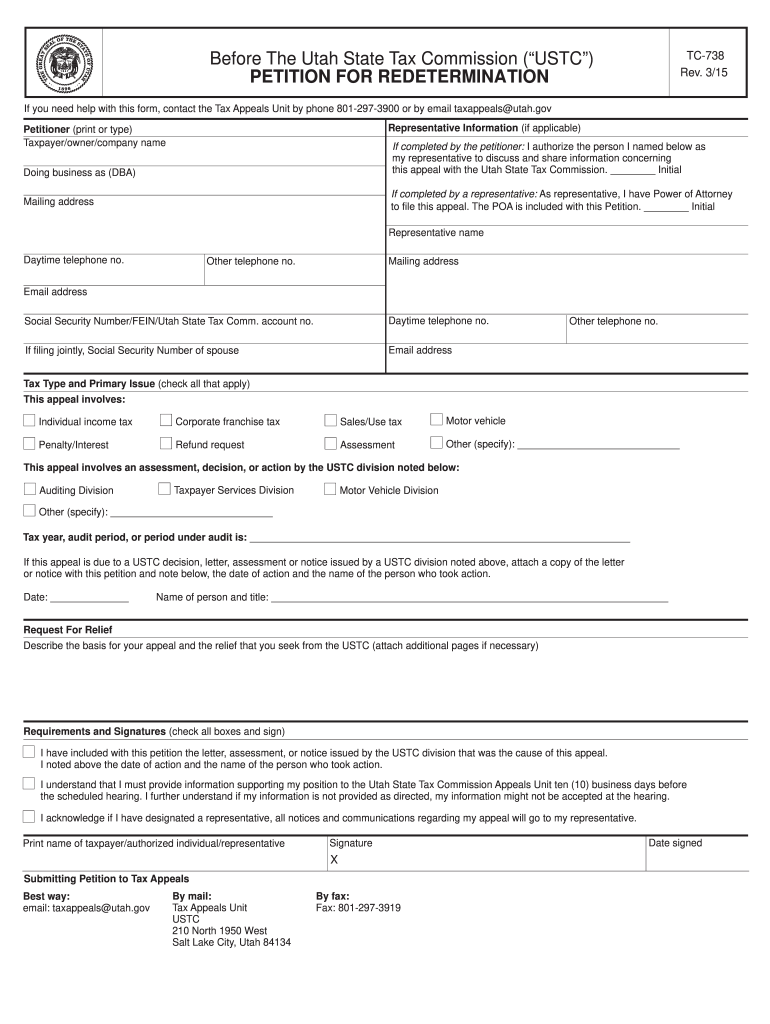

Clear form TC-738 Rev. 3/15 Before The Utah State Tax Commission (UTC) PETITION FOR REDETERMINATION If you need help with this form, contact the Tax Appeals Unit by phone 801-297-3900 or by email

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT USTC TC-738

Edit your UT USTC TC-738 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT USTC TC-738 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT USTC TC-738 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UT USTC TC-738. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT USTC TC-738 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT USTC TC-738

How to fill out UT USTC TC-738

01

Obtain the UT USTC TC-738 form from the official website or a local office.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information, including name, address, and contact details.

04

Provide any necessary identification numbers, such as social security or tax ID numbers.

05

Complete the section regarding the purpose of the form, detailing the specific reason for submission.

06

Review the form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form according to the provided guidelines, either electronically or by mail.

Who needs UT USTC TC-738?

01

Individuals applying for tax benefits or seeking verification of residency.

02

Businesses needing to report certain tax information.

03

Anyone required to complete this form for compliance with local regulations.

Instructions and Help about UT USTC TC-738

Fill

form

: Try Risk Free

People Also Ask about

How much do I have to withhold for Utah state taxes?

Multiply the annual taxable wages by 4.85 percent to determine the annual gross tax amount. Calculate the annual withholding allowance.Withholding Formula (Effective Pay Period 11, 2022) Marital Status:Amount:Single$7,774Married$15,548 Jun 7, 2022

Does Utah require a state tax form?

ing to Utah Instructions for Form TC-40, you must file a Utah income tax return if: You were a resident or part year resident of Utah that must file a federal return.

How do I send my utah state taxes?

You have the following options to pay your tax: Mail in a check. You need to attach Payment Voucher (Form TC-547 ) Utah State Tax Commission. 210 N 1950 West. Salt Lake City, UT 84134-0266. Send credit card payment through online site.

Where do I send my Utah state tax return?

All offices are closed on state holidays. Ogden. 2540 Washington Blvd. 6th floor. Ogden, Utah 84401. Provo. 150 East Center #1300. Provo, Utah 84606. 801-374-7070. Salt Lake City. 210 North 1950 West. Salt Lake City, Utah 84116. 801-297-2200, option “0” Washington County – Tax Commission. 100 South 5300 West. Hurricane, Utah 84737.

Do I need a Utah income tax withholding account?

You must withhold Utah income tax (unless the employee has filed a withholding exemption certificate) if you: Pay wages to any employee for work done in Utah. Pay wages to Utah resident employees for work done outside Utah (you may reduce the Utah tax by any tax withheld by the other state)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UT USTC TC-738 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including UT USTC TC-738, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the UT USTC TC-738 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your UT USTC TC-738.

How do I complete UT USTC TC-738 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your UT USTC TC-738, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is UT USTC TC-738?

UT USTC TC-738 is a specific tax form used in the state of Utah for reporting certain types of taxable transactions.

Who is required to file UT USTC TC-738?

Individuals or businesses that are involved in taxable transactions in Utah are required to file UT USTC TC-738.

How to fill out UT USTC TC-738?

To fill out UT USTC TC-738, gather all necessary financial information related to your taxable transactions, complete the form with accurate figures, and submit it to the appropriate tax authority.

What is the purpose of UT USTC TC-738?

The purpose of UT USTC TC-738 is to ensure compliance with Utah tax laws by reporting and paying taxes on eligible transactions.

What information must be reported on UT USTC TC-738?

Information that must be reported on UT USTC TC-738 includes details of the taxable transactions, amounts, business information, and any tax due.

Fill out your UT USTC TC-738 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT USTC TC-738 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.