VA DoT ST-18 2012 free printable template

Show details

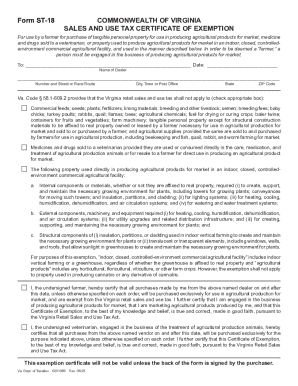

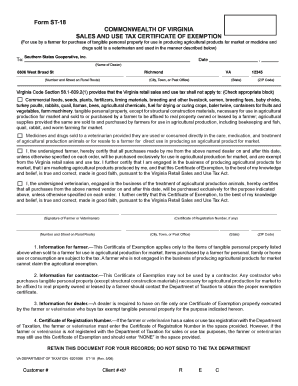

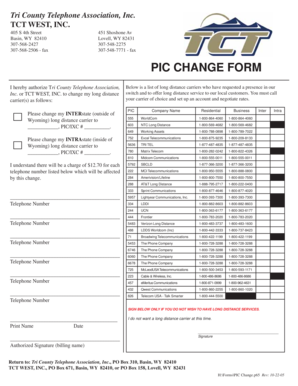

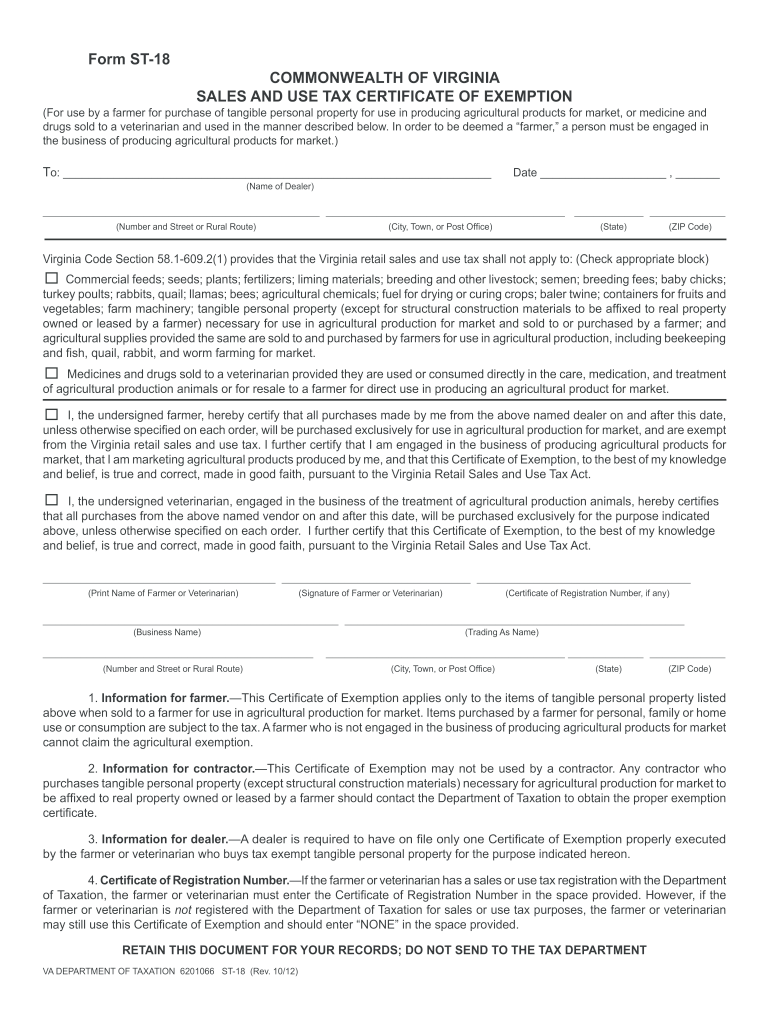

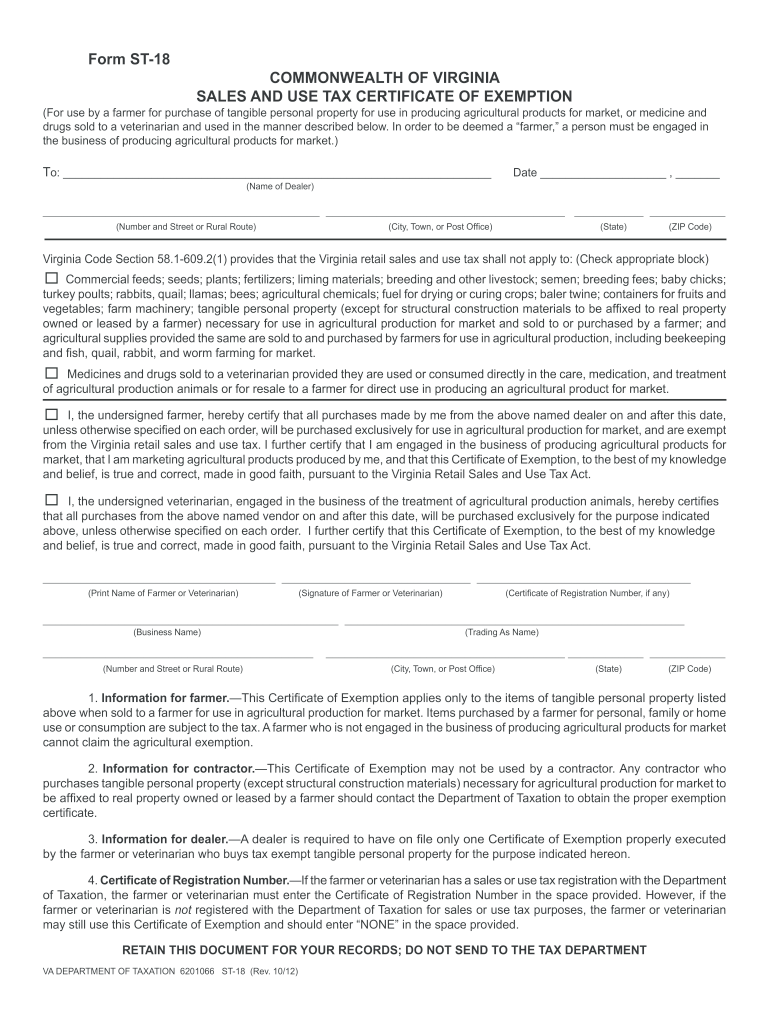

Form ST-18 COMMONWEALTH OF VIRGINIA SALES AND USE TAX CERTIFICATE OF EXEMPTION For use by a farmer for purchase of tangible personal property for use in producing agricultural products for market or medicine and drugs sold to a veterinarian and used in the manner described below. By the farmer or veterinarian who buys tax exempt tangible personal property for the purpose indicated hereon. of Taxation the farmer or veterinarian must enter the Certificate of Registration Number in the space...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA DoT ST-18

Edit your VA DoT ST-18 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA DoT ST-18 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VA DoT ST-18 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit VA DoT ST-18. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT ST-18 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA DoT ST-18

How to fill out VA DoT ST-18

01

Obtain the VA DoT ST-18 form, available online or at your local VA office.

02

Begin by entering your personal information, including your name, address, and contact details.

03

Provide the details of your service, including your service number and the dates of service.

04

Fill out the section regarding your disability status, including any related conditions.

05

Include any supporting documentation as required, such as medical records or discharge papers.

06

Review all entries for accuracy and completeness before signing.

07

Submit the completed form to the appropriate VA office or department.

Who needs VA DoT ST-18?

01

Any veterans seeking to apply for or clarify their benefits related to service-connected disabilities.

02

Family members of veterans who are completing the form on behalf of the veteran.

03

Individuals who are transitioning from military service to civilian life and need documentation for VA benefits.

Fill

form

: Try Risk Free

People Also Ask about

How do I become exempt from property taxes in Virginia?

Income and Net Worth Gross combined income in the previous year cannot exceed $77,000. Net Worth as of December 31, 2022, cannot exceed $704,421 and includes the value of all assets less liabilities of the owner(s) and the spouse of any owner, including the fair market value of the dwelling and land.

What qualifies for agricultural exemption in Virginia?

You're a farmer, grower, rancher or someone else engaged in agricultural production for market. You have a soil conservation plan in place that was approved by your local soil and water conservation district.

What is agriculture tax-exempt in Virginia?

Virginia Sales and Use Tax Exemption - Farmers are generally exempt from paying this tax on items considered tangible personal property used in the production of agricultural products for market. Examples of qualifying items include feed, seed, fertilizer, chemicals, most farm machinery, etc.

Should I claim myself form VA 4?

You must file this form with your employer when your employment begins. If you do not file this form, your employer must withhold Virginia income tax as if you had no exemptions.

How do I qualify for farm tax exemption in Missouri?

How to Claim the Missouri Sales Tax Exemption for Agriculture. In order to claim the Missouri sales tax exemption for agriculture, qualifying agricultural producers must fully complete a Missouri Form 149 Sales and Use Tax Exemption Certificate and furnish this completed form to their sellers.

What qualifies for farm tax exempt in Virginia?

You're a farmer, grower, rancher or someone else engaged in agricultural production for market. You have a soil conservation plan in place that was approved by your local soil and water conservation district.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send VA DoT ST-18 to be eSigned by others?

When you're ready to share your VA DoT ST-18, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete VA DoT ST-18 online?

Easy online VA DoT ST-18 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit VA DoT ST-18 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share VA DoT ST-18 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is VA DoT ST-18?

VA DoT ST-18 is a form used in Virginia to report sales and use tax information to the Department of Taxation.

Who is required to file VA DoT ST-18?

Businesses operating in Virginia that collect sales tax are required to file VA DoT ST-18.

How to fill out VA DoT ST-18?

To fill out VA DoT ST-18, businesses need to provide detailed information about their sales, tax collected, and any exemptions. Instructions are provided on the form.

What is the purpose of VA DoT ST-18?

The purpose of VA DoT ST-18 is to ensure that businesses accurately report and pay the sales tax they have collected on their taxable sales.

What information must be reported on VA DoT ST-18?

VA DoT ST-18 requires reporting of total sales, sales tax collected, exemptions claimed, and any adjustments to sales tax amounts.

Fill out your VA DoT ST-18 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA DoT ST-18 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.