VA DoT 760PY 2014 free printable template

Show details

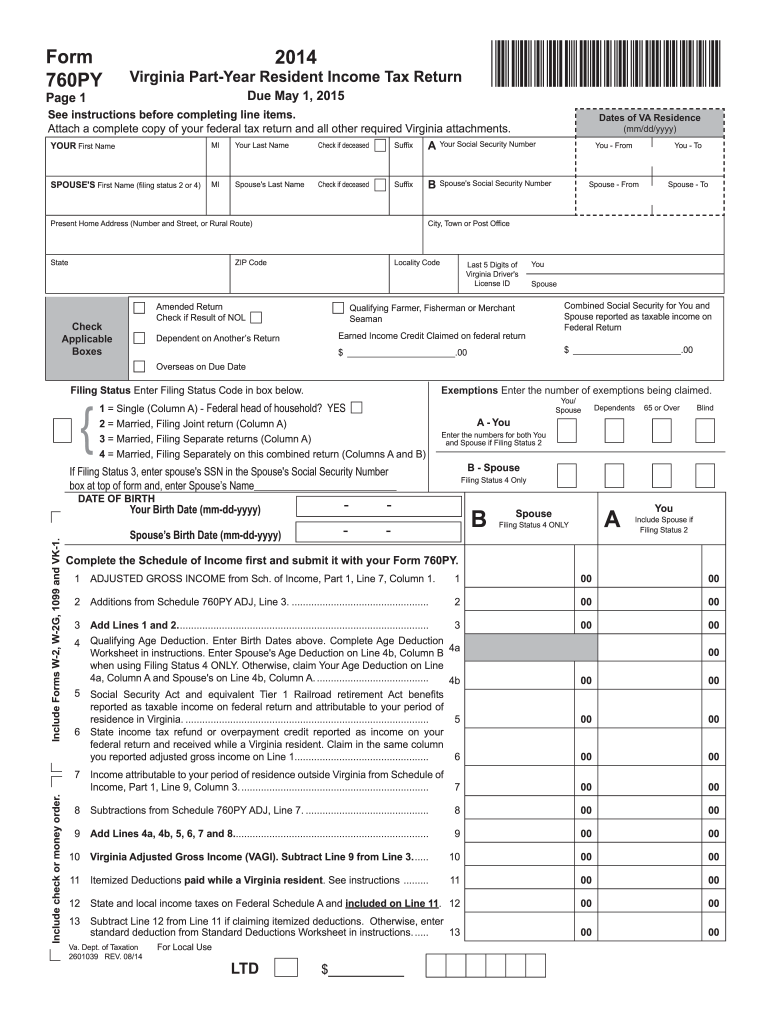

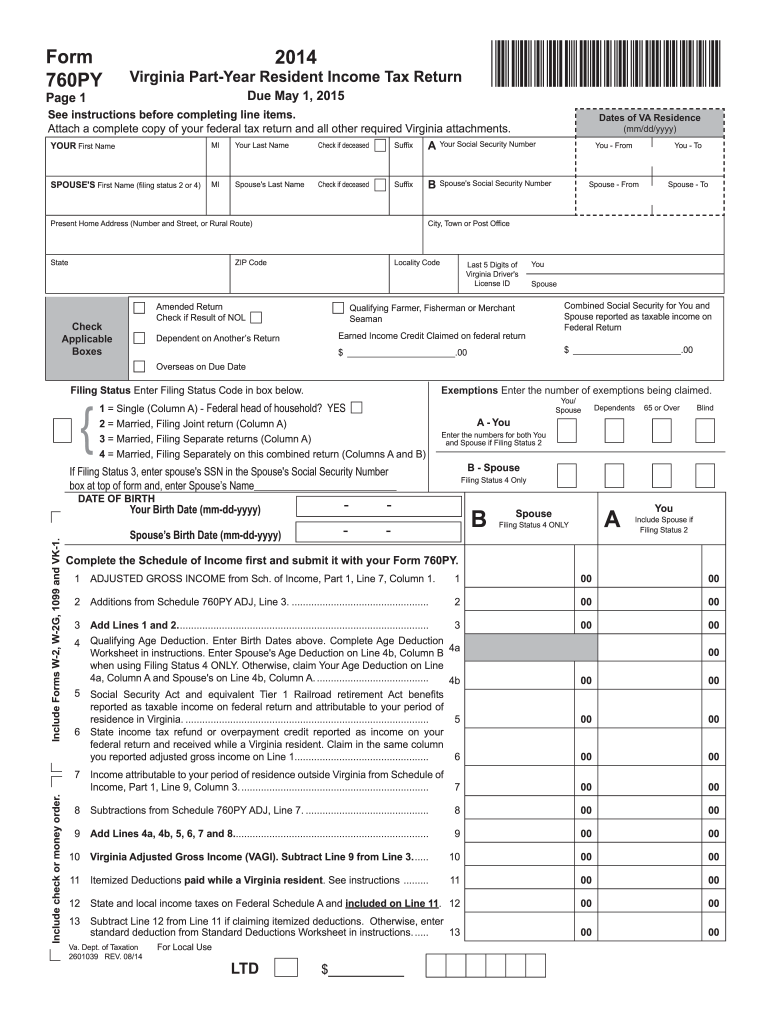

1 ADJUSTED GROSS INCOME from Sch. of Income Part 1 Line 7 Column 1. 2 Additions from Schedule 760PY ADJ Line 3. 8 Subtractions from Schedule 760PY ADJ Line 7. 9 Add Lines 4a 4b 5 6 7 and 8. Virginia Adjusted Gross Income VAGI. Deductions from Schedule 760PY ADJ Line 9. Add Lines 13 14 and 15. Virginia Taxable Income. Subtract Line 16 from Line 10. Form 760PY VA760P114888 Virginia Part-Year Resident Income Tax Return Due May 1 2015 Page 1 See instructions before completing line items....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA DoT 760PY

Edit your VA DoT 760PY form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA DoT 760PY form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VA DoT 760PY online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit VA DoT 760PY. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT 760PY Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA DoT 760PY

How to fill out VA DoT 760PY

01

Obtain the VA DoT 760PY form from the Virginia Department of Taxation website or your local tax office.

02

Begin by entering your personal information, including name, address, and Social Security number at the top of the form.

03

Indicate your filing status by checking the appropriate box (single, married filing jointly, etc.).

04

Input your income details for the year, including wages, salaries, and any other sources of income.

05

Deduct any eligible expenses or credits as outlined in the instructions that accompany the form.

06

Calculate your total tax liability by following the provided calculation guidelines.

07

Review the completed form for accuracy and ensure all required signatures are included.

08

Submit the form by mailing it to the appropriate address provided in the instructions, or file electronically if available.

Who needs VA DoT 760PY?

01

Individuals who are residents of Virginia and have to report income that falls under the jurisdiction of the Virginia Department of Taxation.

02

Taxpayers who meet certain income thresholds and wish to file for state income tax.

03

Anyone who qualifies for deductions or credits available under Virginia state tax law.

Fill

form

: Try Risk Free

People Also Ask about

What are examples of tax liabilities?

Tax liability is the total amount of tax debt owed to a government by an individual, corporation, or other entity. Income taxes, sales tax, and capital gains tax are all forms of tax liabilities.

What does Form 8888 total refund per computer mean?

Form 8888 allows a Taxpayer to split one refund in up to three accounts or Savings Bonds. If you didn't file the Form 8888 with your return, the 0.00 value is correct.

What forms do I need to file with my Virginia state taxes?

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

What is a 760PY tax form?

2021 Form 760PY - Virginia Part-Year Resident Income Tax Return. Page 1. 2021. Virginia Part-Year Resident Income Tax Return. Due May 1, 2022.

What is form va760cg?

Full-year residents of Virginia must include income earned in other states to compute total Adjusted Gross Income for the appropriate tax year.

How do I find my Virginia AGI?

The tax is based on the Federal Adjusted Gross Income. In most cases, your federal adjusted gross income (line 21 on form 1040A; and line 37 on form 1040) plus any Virginia additions and minus any Virginia subtractions computed on Schedule ADJ, is called Virginia Adjusted Gross Income.

What do you attach to VA 760?

REQUIRED ATTACHMENTS TO FORM 760 Forms W-2, 1099 & VK-1 showing Virginia withholding. Schedule ADJ. Schedule VAC. Schedule OSC. Schedule CR. Form 760C or Form 760F. Virginia Credit Schedules. Other Virginia Statements or Schedules.

Who Must File a Virginia partnership return?

S Corporations, Partnerships, and Limited Liability Companies. Every pass-through entity (PTE) that does business in Virginia or receives income from Virginia sources must file an annual Virginia income tax return on Form 502.

How do I file a non resident tax return in Virginia?

File Form 763, the nonresident return, to report the Virginia source income received as a nonresident. Generally, nonresidents with income from Virginia sources must file a Virginia return if their income is at or above the filing threshold.

What is VA Form 760PY?

2021 Form 760PY - Virginia Part-Year Resident Income Tax Return.

Do I have to file a Virginia non resident tax return?

Virginia law imposes individual income tax filing requirements on virtually all Virginia residents, as well as on nonresidents who receive income from Virginia sources.

Does Virginia give credit for taxes paid to another state?

To help prevent payment of taxes to multiple states on the same income, Virginia law provides a credit for taxes paid to another state. If any part of your Virginia taxable income is also taxed by another state, this credit may be available to you.

What does total tax liability TP figures per computer mean?

What does 'per computer' mean? An IRS Tax Return Transcript may include “per computer” figures for some federal income tax return data. The “per computer” figures correct mathematical errors on the federal income tax return.

Who Must File a Virginia non resident tax return?

You are liable to pay Virginia income tax as a nonresident on income you earn from any business, trade, profession, or occupation in Virginia. To report this income, file Form 763.

How do you find the total tax liability of a computer?

How to calculate tax liability from taxable income. Your taxable income minus your tax deductions equals your gross tax liability. Gross tax liability minus any tax credits you're eligible for equals your total income tax liability.

What is Virginia Form 502A?

Schedule 502A is used to show the amount of allocated income and to determine the apportionment percentage . If the pass-through entity's income is all from Virginia, then the entity does not allocate and apportion income; the Virginia apportionment percentage is 100%, and Schedule 502A is not required .

What does TP tax figures mean?

TP = Taxpayer (as opposed to Spouse) 0. 1. 2 Replies. SweetieJean.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my VA DoT 760PY directly from Gmail?

VA DoT 760PY and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify VA DoT 760PY without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like VA DoT 760PY, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit VA DoT 760PY in Chrome?

VA DoT 760PY can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is VA DoT 760PY?

VA DoT 760PY is a Virginia Department of Taxation form used for filing personal income taxes for part-year residents.

Who is required to file VA DoT 760PY?

Individuals who were residents of Virginia for part of the year and have income that is subject to Virginia taxation must file VA DoT 760PY.

How to fill out VA DoT 760PY?

To fill out VA DoT 760PY, gather all income documents, accurately report income earned during your residency, complete the appropriate sections for deductions and credits, and ensure you sign and date the form before submission.

What is the purpose of VA DoT 760PY?

The purpose of VA DoT 760PY is to calculate the amount of Virginia state income tax owed by part-year residents based on the income earned while residing in the state.

What information must be reported on VA DoT 760PY?

VA DoT 760PY requires reporting of personal identification information, income earned in Virginia, deductions, credits, and any tax payments made during the year.

Fill out your VA DoT 760PY online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA DoT 760py is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.