Get the free c ez 2015 form - irs

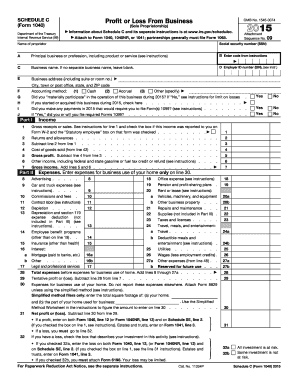

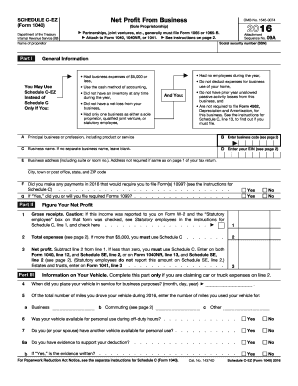

Instructions and Help about IRS 1040 - Schedule C-EZ

How to edit IRS 1040 - Schedule C-EZ

How to fill out IRS 1040 - Schedule C-EZ

About IRS 1040 - Schedule C-EZ 2015 previous version

What is IRS 1040 - Schedule C-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about c ez 2015 form

What should I do if I realize I've made an error on my submitted c ez 2015 form?

If you discover a mistake after filing the c ez 2015 form, you should submit an amended version of the form to correct the error. Ensure you clearly mark the correction and include any necessary documentation to support the changes. After submitting, monitor the status to confirm that the correction has been processed.

How can I verify if my c ez 2015 form was received and is being processed?

To verify the receipt and processing status of your c ez 2015 form, you can check with the IRS online tracking tools or contact their support. Be prepared with any identifying information linked to your submission for a smoother inquiry. Common e-file rejection codes can also help diagnose issues if your form was not processed.

What are some common errors when submitting the c ez 2015 form and how can I avoid them?

Common errors when submitting the c ez 2015 form include incorrect taxpayer identification numbers and missing signatures. To avoid these mistakes, double-check all entered information and ensure everything is complete before submission. Utilizing software that checks for common errors can also be beneficial.

Are there specific technical requirements for e-filing the c ez 2015 form?

Yes, when e-filing the c ez 2015 form, ensure that your software is compatible with IRS e-file standards. Most major tax software programs are equipped to handle this form, but always verify that your browser and device meet current technical specifications for a smooth submission process.

What steps should I take if I receive a notice regarding my c ez 2015 form submission?

If you receive a notice related to your c ez 2015 form, carefully read the correspondence to understand the issue. Prepare any required documentation and consider your options for response. Engaging a tax professional might be beneficial to navigate the situation efficiently.