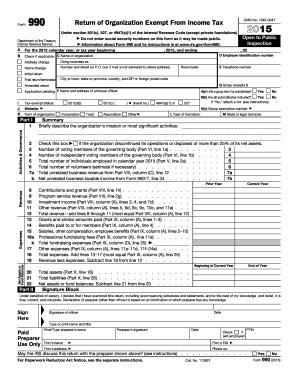

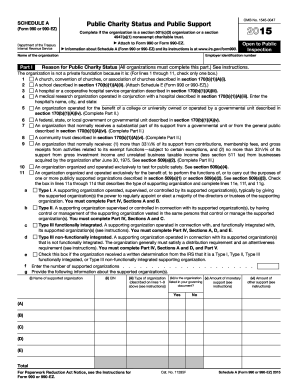

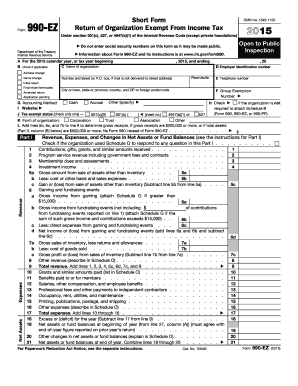

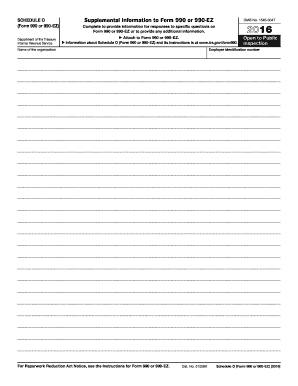

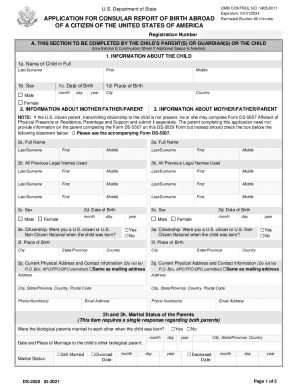

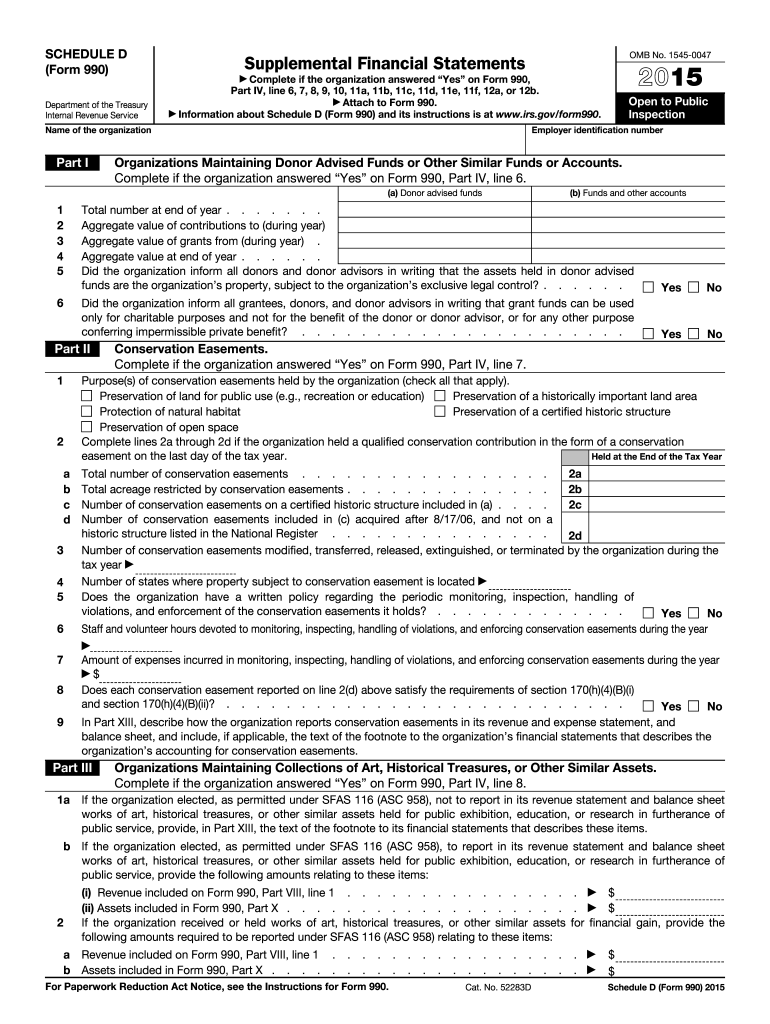

IRS 990 - Schedule D 2015 free printable template

FAQ about IRS 990 - Schedule D

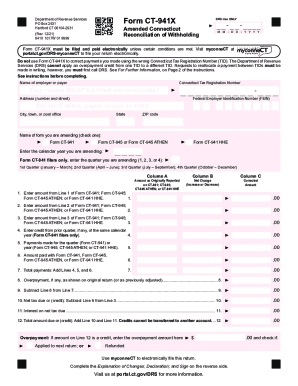

What should I do if I made a mistake on my 2015 990 schedule d after submission?

If you realize there's an error on your filed 2015 990 schedule d, you can submit an amended return to correct the mistake. Ensure you clearly indicate the reason for the correction when filing the amended form. It’s also recommended to keep documentation related to the correction for your records.

How can I verify if my 2015 990 schedule d has been received and processed?

To verify the status of your 2015 990 schedule d, you can check with the IRS online, or utilize the e-file tracking service if you submitted electronically. Keep an eye out for any correspondence from the IRS that may indicate the submission's processing status, including any rejection notifications.

What common errors should I be aware of when filing my 2015 990 schedule d?

Common errors when filing the 2015 990 schedule d include mismatched identification numbers, missing or incorrect entries in key sections, and failure to sign the form if required. To minimize errors, double-check all entries and ensure compliance with the guidelines set for the schedule d.

Are there specific technical requirements for e-filing my 2015 990 schedule d?

Yes, when e-filing your 2015 990 schedule d, ensure your software is compatible with the IRS e-filing system. You’ll need a stable internet connection and may want to check that your browser is updated to avoid compatibility issues during submission.

What steps should I take if I receive a notice from the IRS regarding my 2015 990 schedule d?

If you receive a notice from the IRS concerning your 2015 990 schedule d, first read it carefully to understand the issue. Prepare any required documentation and respond promptly, addressing the specific concerns raised. Keeping a record of this correspondence is also crucial for your future reference.