IRS 990 - Schedule A 2015 free printable template

Show details

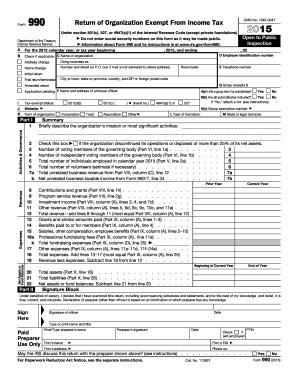

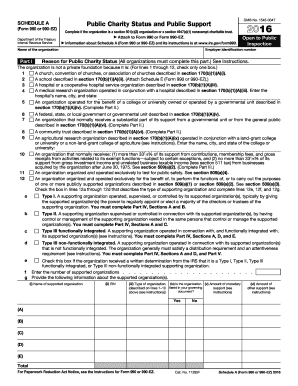

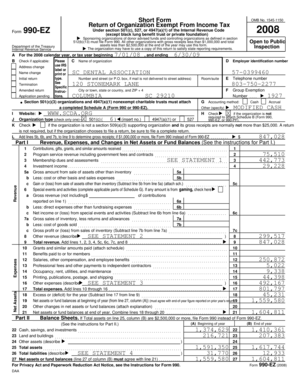

You must complete Part IV Sections A and D and Part V. Check this box if the organization received a written determination from the IRS that it is a Type I Type II Type III functionally integrated or Type III non-functionally integrated supporting organization. f Enter the number of supported organizations. g Provide the following information about the supported organization s. i Name of supported organization ii EIN iii Type of organization described on lines 1 9 above see instructions. iv Is...the organization v Amount of monetary listed in your governing support see document instructions Yes vi Amount of other support see No A B C D E Total For Paperwork Reduction Act Notice see the Instructions for Cat. No. 11285F Schedule A Form 990 or 990-EZ 2015 Page 2 Support Schedule for Organizations Described in Sections 170 b 1 A iv and 170 b 1 A vi Complete only if you checked the box on line 5 7 or 8 of Part I or if the organization failed to qualify under Part III. Iv Is the organization...v Amount of monetary listed in your governing support see document instructions Yes vi Amount of other support see No A B C D E Total For Paperwork Reduction Act Notice see the Instructions for Cat. No. 11285F Schedule A Form 990 or 990-EZ 2015 Page 2 Support Schedule for Organizations Described in Sections 170 b 1 A iv and 170 b 1 A vi Complete only if you checked the box on line 5 7 or 8 of Part I or if the organization failed to qualify under Part III. If the organization fails to qualify...under the tests listed below please complete Part III. Section A. Form 990 or 990-EZ Department of the Treasury Internal Revenue Service Complete if the organization is a section 501 c 3 organization or a section 4947 a 1 nonexempt charitable trust. Information Attach to Form 990 or Form 990-EZ. about Schedule A Form 990 or 990-EZ and its instructions is at www*irs*gov/form990. Name of the organization Part I OMB No* 1545-0047 Public Charity Status and Public Support SCHEDULE A Open to Public...Inspection Employer identification number Reason for Public Charity Status All organizations must complete this part. See instructions. The organization is not a private foundation because it is For lines 1 through 11 check only one box. A church convention of churches or association of churches described in section 170 b 1 A i. A school described in section 170 b 1 A ii. Attach Schedule E Form 990 or 990-EZ. A hospital or a cooperative hospital service organization described in section 170 b 1...A iii. A medical research organization operated in conjunction with a hospital described in section 170 b 1 A iii. Enter the hospital s name city and state An organization operated for the benefit of a college or university owned or operated by a governmental unit described in section 170 b 1 A iv. Complete Part II. A federal state or local government or governmental unit described in section 170 b 1 A v. described in section 170 b 1 A vi. Complete Part II. A community trust described in section...170 b 1 A vi.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 990 - Schedule A

How to edit IRS 990 - Schedule A

How to fill out IRS 990 - Schedule A

Instructions and Help about IRS 990 - Schedule A

How to edit IRS 990 - Schedule A

Editing IRS 990 - Schedule A involves obtaining the most recent version of the form. You can fill out the form digitally using tools that allow for easy text entry and formatting. Ensure you review any changes made before finalizing the form to maintain accuracy.

How to fill out IRS 990 - Schedule A

Filling out IRS 990 - Schedule A requires precise information concerning the organization's exempt status and financial data. Follow these steps:

01

Obtain the IRS 990 - Schedule A from the IRS website or a tax professional.

02

Fill in the organization's name and Employer Identification Number (EIN).

03

Provide information about the organization's activities for the tax year.

04

Complete the sections that apply to the organization’s status.

Review all entries for completeness and correctness before submitting to ensure compliance with IRS regulations.

About IRS 990 - Schedule A 2015 previous version

What is IRS 990 - Schedule A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 990 - Schedule A 2015 previous version

What is IRS 990 - Schedule A?

IRS 990 - Schedule A is a supplementary form used by tax-exempt organizations to provide detailed information regarding their eligibility for tax-exempt status. This form ensures transparency in how organizations operate and how they handle funds.

What is the purpose of this form?

The purpose of IRS 990 - Schedule A is to report the basis on which an organization claims its tax-exempt status. It is crucial for organizations to demonstrate that they operate within the bounds set by the IRS. This helps maintain public trust and accountability.

Who needs the form?

Organizations that qualify for tax exemption, such as charities and certain non-profits, must file IRS 990 - Schedule A. This includes organizations classified as 501(c)(3), 501(c)(4), and others as defined by the IRS. Entities not meeting these criteria do not need to file this form.

When am I exempt from filling out this form?

Exemptions from filing IRS 990 - Schedule A may apply to small organizations with gross receipts below a certain threshold. Additionally, specific types of organizations may not be required to file due to unique IRS classifications. Always consult the IRS guidelines to confirm eligibility.

Components of the form

IRS 990 - Schedule A includes multiple sections detailing an organization's qualifications for tax exemption. Key components often include sections on public support, activities, and financial disclosures. Each part must be filled out accurately to reflect the organization’s activities and revenue sources.

Due date

Organizations must file IRS 990 - Schedule A along with their annual IRS Form 990. Typically, the due date falls on the 15th day of the 5th month after the end of the organization's fiscal year. If an organization’s fiscal year ends on December 31, the form is due by May 15 of the following year.

What are the penalties for not issuing the form?

Failing to file IRS 990 - Schedule A can result in significant penalties, including fines and potential loss of tax-exempt status for organizations. The IRS may impose automatic penalties for late or incomplete submissions, affecting an organization's reputation and ability to operate.

What information do you need when you file the form?

When filing IRS 990 - Schedule A, you will need information such as the organization's name, EIN, financial data, and specific details about its operational activities. This information helps to verify compliance with IRS requirements for maintaining tax-exempt status.

Is the form accompanied by other forms?

IRS 990 - Schedule A is typically filed alongside the main IRS Form 990. Additional schedules might also be required depending on the organization’s activities and structure. It is essential to check filing requirements to ensure all necessary documents are submitted together.

Where do I send the form?

IRS 990 - Schedule A must be submitted to the IRS. The mailing address depends on the organization's location and whether it is including a payment with its form. Consult the IRS instructions for specific addresses to ensure timely and accurate submission.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Very useful and very intuitive to use. Well worth the annual fee.

WORKS GREAT

Great interface

Great interface, easy to use.

it is very good service for those using…

it is very good service for those using PDF frequently. it is good help for those using different operating systems such as Ubuntu.thanks.

no complaints

no complaints. does the job.

Love PDFFiller!

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.