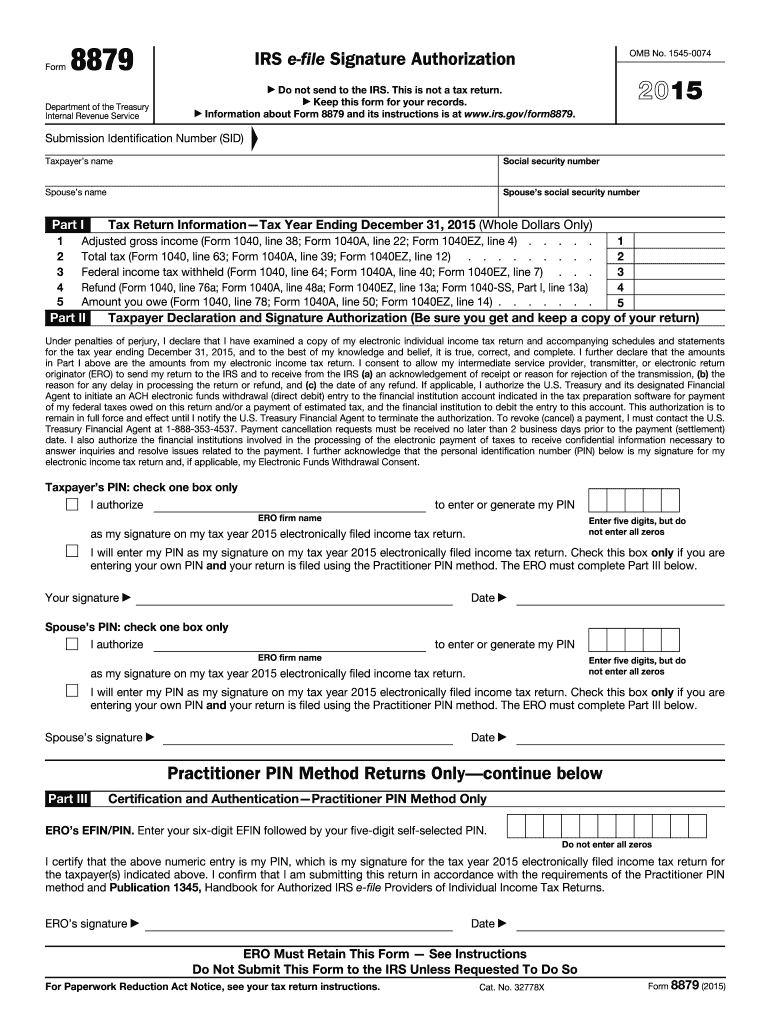

Get the free 2015 8879 form - irs

Instructions and Help about IRS 8879

How to edit IRS 8879

How to fill out IRS 8879

About IRS 8 previous version

What is IRS 8879?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about 2015 8879 form

How can I correct a mistake on my 2015 8879 form after filing?

If you discover an error on your 2015 8879 form after submission, you’ll need to submit a corrected version. Depending on your tax situation, this may require filing an amended return with the IRS. Ensure you clearly indicate the changes made and keep a copy of both the original and the corrected submissions for your records.

What should I do if I receive a notice about my 2015 8879 form?

Receiving a notice regarding your 2015 8879 form requires prompt attention. Carefully read the notice to understand its implications. You may need to provide additional documentation or clarify your submission. It’s also advisable to keep records of any communications with the IRS or related parties about this matter.

How can I track the status of my 2015 8879 form after I’ve submitted it?

You can track the status of your 2015 8879 form by checking the IRS's online tools or contacting them directly. It’s important to keep your submission confirmation and any identifying information at hand for accurate tracking. If you encounter rejection codes during e-filing, refer to the IRS guidelines for resolution.

Are there any specific privacy concerns to keep in mind when filing the 2015 8879 form?

When filing your 2015 8879 form, privacy should be a priority. Ensure that any electronic submissions are made through secure channels and that sensitive information is adequately protected. Retain records of your submission securely to mitigate risks of identity theft or unauthorized access.

Is an electronic signature acceptable on the 2015 8879 form, and what should I consider?

An electronic signature is generally acceptable for the 2015 8879 form when e-filing. Ensure that you comply with IRS requirements for e-signatures. Double-check that your e-filed documents meet all criteria to avoid potential rejections or delays in processing.