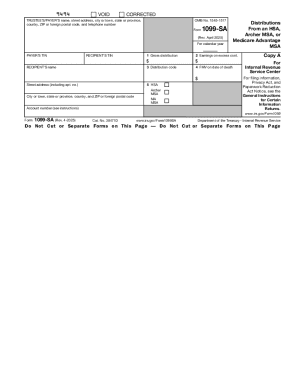

IRS 1099-SA 2015 free printable template

Instructions and Help about IRS 1099-SA

How to edit IRS 1099-SA

How to fill out IRS 1099-SA

About IRS 1099-SA 2015 previous version

What is IRS 1099-SA?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-SA

What should I do if I realize there is a mistake on my 2015 1099 SA form after submission?

If you discover a mistake after submitting your 2015 1099 SA form, you will need to file a corrected version of the form. Ensure you clearly indicate it's a corrected form and provide the correct information. It’s important to submit this correction as soon as possible to prevent any tax implications.

How can I track the status of my filed 2015 1099 SA form?

To track the status of your 2015 1099 SA form, it is advisable to use services that provide confirmation of receipt, especially if e-filing. Keep an eye out for any notification from the IRS regarding acceptance or rejection, and note common rejection codes that may appear during electronic submissions. This enables prompt action to resolve any issues.

Are there specific privacy and data security measures I should consider when filing the 2015 1099 SA form?

Yes, when filing the 2015 1099 SA form, it's crucial to ensure that you are transmitting sensitive information securely. Use encrypted methods for e-filing and maintain physical copies of all documents in secure locations. Adopting secure practices protects your personal information and helps prevent identity theft.

What should I do if I receive an audit notice related to my 2015 1099 SA form?

If you receive an audit notice concerning your 2015 1099 SA form, it's important to respond promptly and thoroughly. Review the notice to understand the audit's basis, gather all required documentation, and consider consulting a tax professional for guidance. Ensure you maintain an organized record of your transactions and filings to provide accurate information.