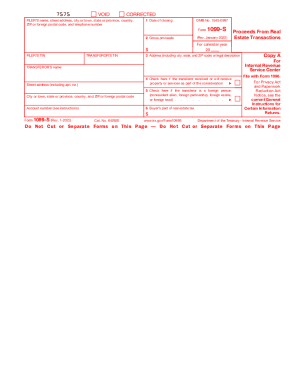

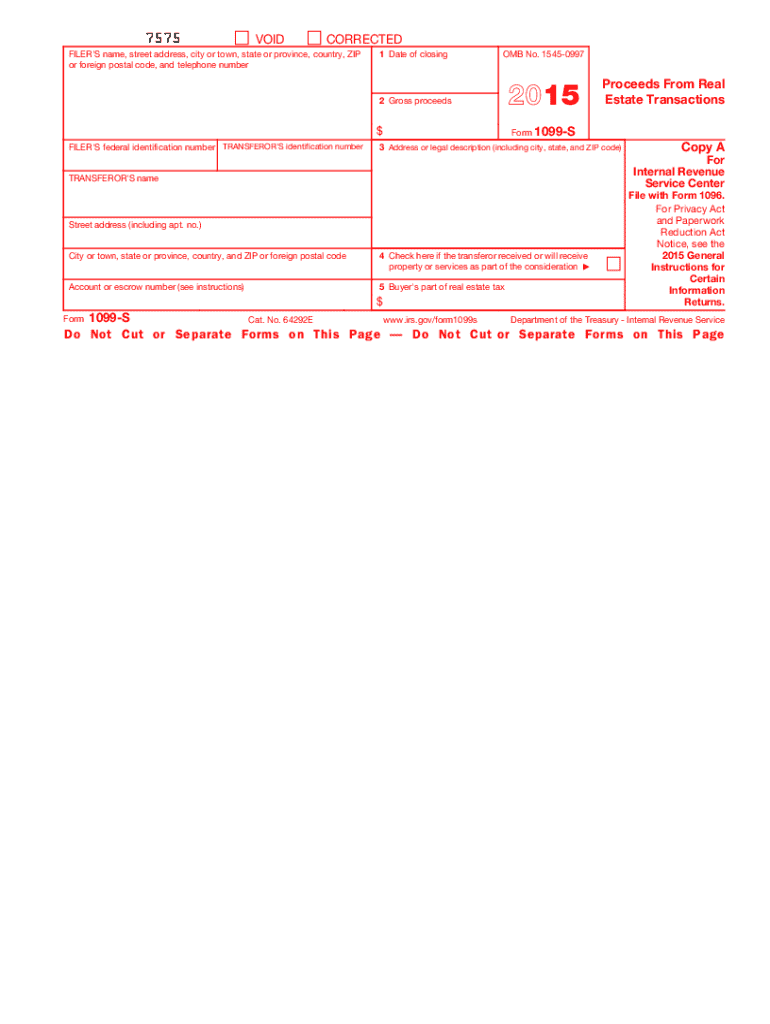

IRS 1099-S 2015 free printable template

Instructions and Help about IRS 1099-S

How to edit IRS 1099-S

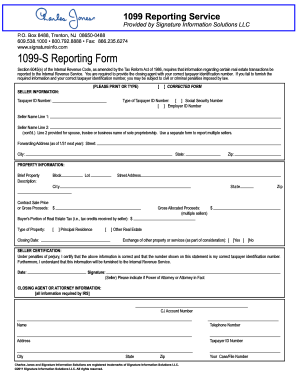

How to fill out IRS 1099-S

About IRS 1099-S 2015 previous version

What is IRS 1099-S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-S

What should I do if I realize I made an error on my IRS 1099-S after filing?

If you discover an error on your IRS 1099-S after filing, you should submit a corrected form as soon as possible. This may involve completing a new 1099-S form with the correct information and indicating it's a corrected form. Make sure to keep records of both the original and corrected submissions for your records.

How can I track the status of my filed IRS 1099-S?

To verify the receipt and processing of your filed IRS 1099-S, you can check with the IRS e-filing system or contact their customer service. It's essential to monitor for any rejection codes that may indicate issues with your submission. Keep your confirmation email or document handy, as it will help facilitate the tracking process.

Are e-signatures accepted for submitting IRS 1099-S electronically?

Yes, e-signatures are generally accepted for filing IRS 1099-S electronically. However, it's important to ensure that your method of obtaining the e-signature complies with IRS guidelines. This will enhance the validity of your submission and ensure it meets the necessary security standards.

What should I do if I receive a notice from the IRS regarding my submitted 1099-S?

If you receive a notice from the IRS concerning your submitted IRS 1099-S, carefully read the communication to understand the issue raised. Prepare any required documentation and respond promptly, addressing the specifics mentioned in the notice to avoid further complications.

See what our users say