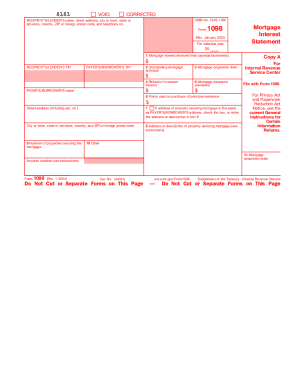

IRS 1098 2015 free printable template

Show details

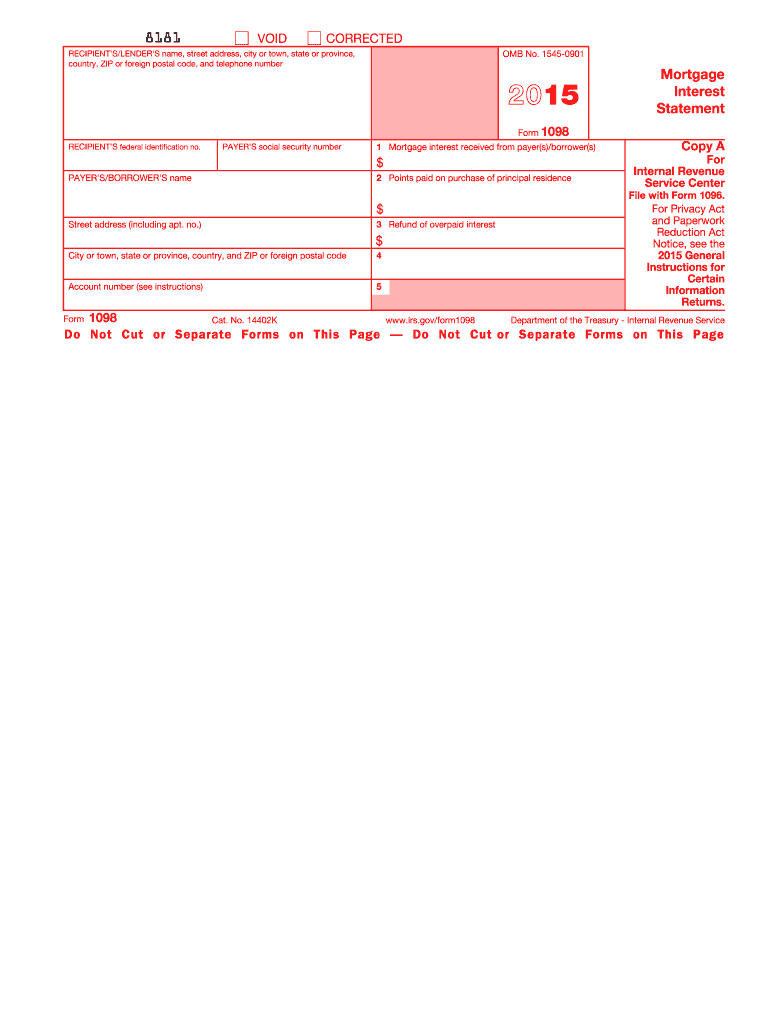

Copy C Recipient/Lender To complete Form 1098 use Returns and the 2015 Instructions for Form 1098. VOID CORRECTED OMB No. 1545-0901 RECIPIENT S/LENDER S name street address city or town state or province country ZIP or foreign postal code and telephone number Form 1098 RECIPIENT S federal identification no. PAYER S social security number 1 Mortgage interest received from payer s /borrower s PAYER S/BORROWER S name 2 Points paid on purchase of principal residence Mortgage Interest Statement Copy...A For Internal Revenue Service Center File with Form 1096. Street address including apt. no. 3 Refund of overpaid interest City or town state or province country and ZIP or foreign postal code Account number see instructions For Privacy Act and Paperwork Reduction Act Notice see the 2015 General Instructions for Certain Information Returns. If you itemized deductions in the year s you paid the interest you may have to include part or all of the box 3 amount on the Other income line of your 2015...Form 1040. No adjustment to your prior year s tax return s is necessary. For more information see Pub. 936 and Itemized Deduction Recoveries in Pub. Box 3. Do not deduct this amount. It is a refund or credit for overpayment s of interest you made in a prior year or years. If you itemized deductions in the year s you paid the interest you may have to include part or all of the box 3 amount on the Other income line of your 2015 Form 1040. However you cannot deduct the prepaid amount in 2015 even...though it may be included in box 1. If you hold a mortgage credit certificate and can claim the mortgage interest credit see Form 8396. If the interest was paid on a mortgage home equity line of credit or credit card loan secured by your personal residence you may be subject to a deduction limitation. Box 2. PAYER S social security number 1 Mortgage interest received from payer s /borrower s PAYER S/BORROWER S name 2 Points paid on purchase of principal residence Mortgage Interest Statement Copy...A For Internal Revenue Service Center File with Form 1096. Street address including apt. no. 3 Refund of overpaid interest City or town state or province country and ZIP or foreign postal code Account number see instructions For Privacy Act and Paperwork Reduction Act Notice see the 2015 General Instructions for Certain Information Returns. Cat. No. 14402K www.irs.gov/form1098 Department of the Treasury - Internal Revenue Service Do Not Cut or Separate Forms on This Page Do Not Cut or Separate...Forms on This Page CORRECTED if checked Caution The amount shown may not be fully deductible by you. Box 1. Shows the mortgage interest received by the recipient/lender during the year. This amount includes interest on any obligation secured by real property including a home equity line of credit or credit card loan. This amount does not include points government subsidy payments or seller payments on a buydown mortgage. Such amounts are deductible by you only in certain circumstances. Caution...If you prepaid interest in 2015 that accrued in full by January 15 2016 this prepaid interest may be included in box 1. However you cannot deduct the prepaid amount in 2015 even though it may be included in box 1. If you hold a mortgage credit certificate and can claim the mortgage interest credit see Form 8396.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1098

How to edit IRS 1098

How to fill out IRS 1098

Instructions and Help about IRS 1098

How to edit IRS 1098

To edit IRS Form 1098, utilize pdfFiller's functionality that allows users to modify the tax form directly. Begin by uploading your existing form into pdfFiller. Then, utilize the editing tools to adjust any necessary fields, including borrower information or interest amounts. Save your updates to maintain an accurate record before finalizing the document.

How to fill out IRS 1098

Filling out IRS Form 1098 requires accurate reporting of mortgage interest and other related information. Start by entering the borrower’s name, address, and Social Security number. Next, specify the lender's information and the total amount of interest received during the tax year. Be sure to review each section for correct figures to avoid discrepancies.

About IRS previous version

What is IRS 1098?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS previous version

What is IRS 1098?

IRS 1098 is the Mortgage Interest Statement form used by lenders to report mortgage interest received from individuals in a calendar year. This form is essential for taxpayers who have paid mortgage interest, as they can use it to claim deductions on their individual income tax returns. Complete and accurate data on the form helps ensure proper tax filing.

What is the purpose of this form?

The purpose of IRS Form 1098 is to provide the Internal Revenue Service (IRS) and taxpayers with a record of mortgage interest payments made during the tax year. This form aids in the verification of tax deductions, ensuring that taxpayers can appropriately report their financial obligations and interest paid, which may be deductible under IRS rules.

Who needs the form?

Individuals who have taken out a mortgage for their home and have paid at least $600 in interest during the tax year will need IRS Form 1098. Lenders are required to issue this form to borrowers to assist in the accurate reporting of interest deductions on tax returns. Additionally, other entities that receive mortgage interest payments may also be involved in issuing this form.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out IRS Form 1098 if they did not pay any mortgage interest during the tax year or if the interest paid is below the $600 threshold. Additionally, those who have paid interest only as part of a lease or rental agreement rather than an actual mortgage would also not be required to submit this form.

Components of the form

IRS Form 1098 includes several key components, such as the borrower's and lender's identification details, the total interest received, and any related expenses. Specifically, it highlights the mortgage interest paid, points paid on the purchase of the home, and any property taxes collected by the lender. Each section is vital for accurate deductions and tax compliance.

What are the penalties for not issuing the form?

Lenders who fail to issue IRS Form 1098 may face penalties from the IRS. The penalties can range from $50 to $260 per form, depending on the lateness of the filing and whether there was intentional disregard. It is essential for lenders to comply with IRS guidelines to avoid financial penalties and ensure their clients are properly informed.

What information do you need when you file the form?

When filing IRS Form 1098, gather the necessary information, including details of the borrower such as full name, address, and Social Security number. Also, compile the lender’s information and the total mortgage interest received during the year. Having accurate data ensures the correct reporting and helps avoid any discrepancies with the IRS.

Is the form accompanied by other forms?

IRS Form 1098 may be accompanied by other forms, particularly if there are associated deductions or tax credits being claimed. For example, if points paid on the mortgage are being deducted, a taxpayer may also need to include IRS Form 1098-E for educational loan interests. It is essential to check IRS guidelines for comprehensive filing.

Where do I send the form?

IRS Form 1098 must be sent directly to the Internal Revenue Service, alongside the taxpayer's income tax return. Ensure that the form is submitted with the appropriate tax return package to avoid delays or potential issues with tax processing. For electronic filers, the form may be submitted through their chosen tax preparation software.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

very simple and useful but I would include some more functions

Great, easy and User friendly to the max.....thanks

See what our users say