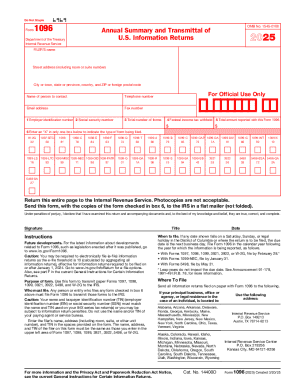

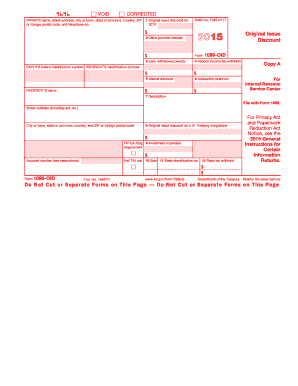

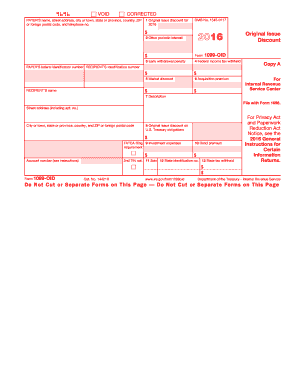

IRS 1096 2015 free printable template

Instructions and Help about IRS 1096

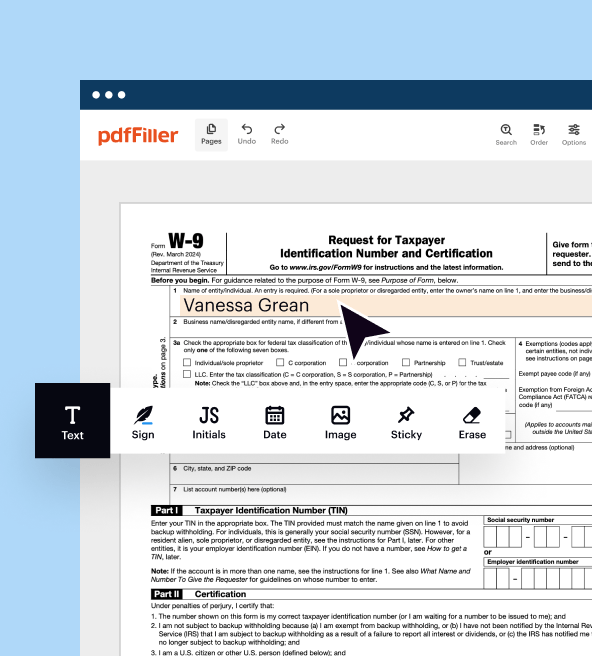

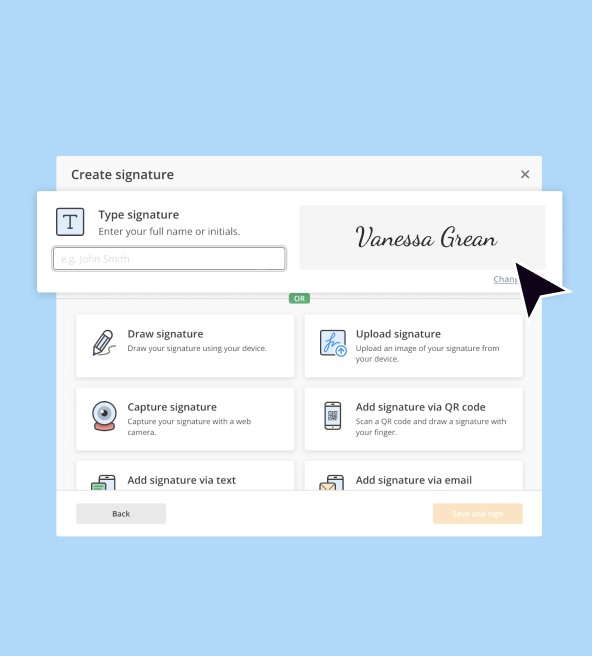

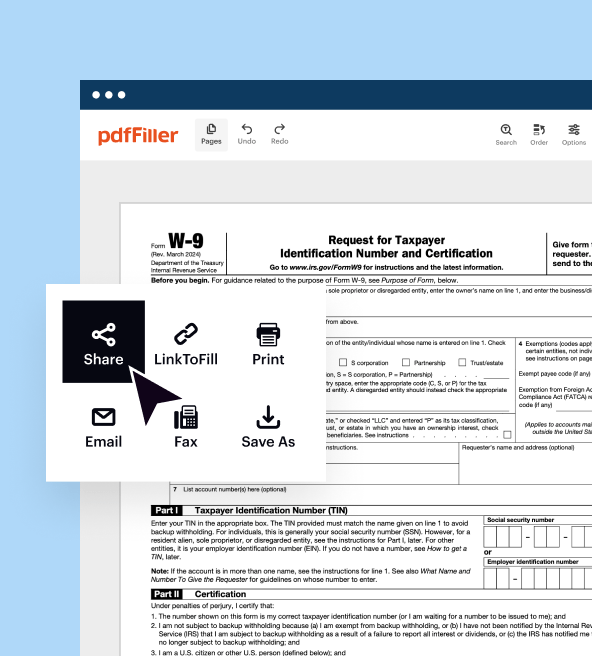

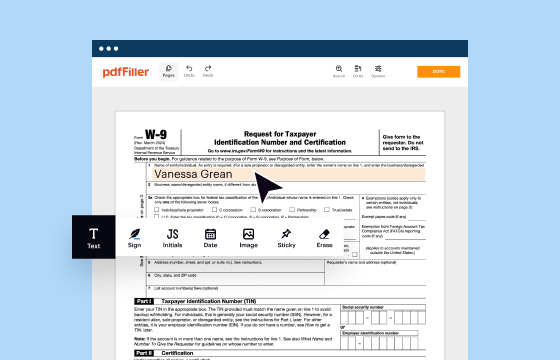

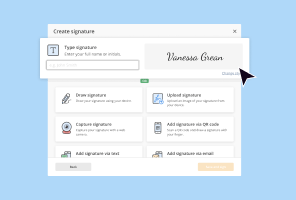

How to edit IRS 1096

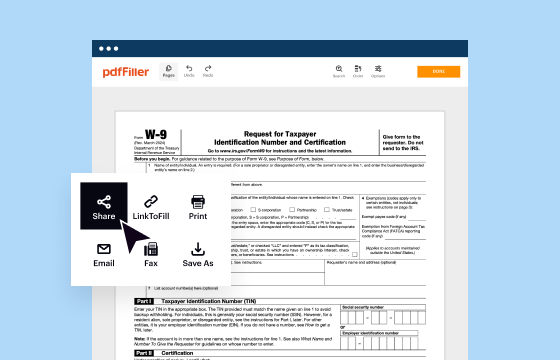

How to fill out IRS 1096

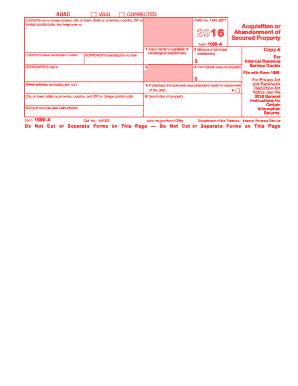

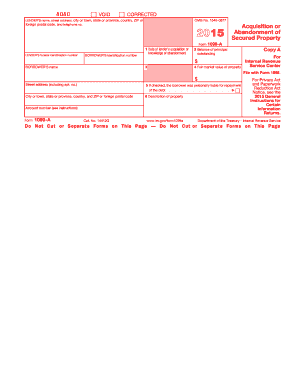

About IRS previous version

What is IRS 1096?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1096

What should I do if I realize I made a mistake after filing the 2015 1096 form?

If you discover an error after submitting the 2015 1096 form, you can file a corrected form. Make sure to indicate that it is a correction on the new form, and clearly outline the mistakes that were made to avoid confusion. Additionally, retain both the original and corrected forms for your records.

How can I verify if my e-filed 2015 1096 form was received and processed?

To verify the status of your e-filed 2015 1096 form, you can check with the IRS through the e-filing platform or contact their support directly. If your submission was rejected, they typically provide a rejection code, which can help you identify and address any issues immediately.

What are common errors to avoid when submitting the 2015 1096 form?

Common errors to avoid when filing the 2015 1096 form include incorrect payee identification numbers, mismatches between reported payments and forms submitted, and omitting required fields. Double-checking the information before submission can significantly reduce the chance of mistakes.

Are there any specific requirements for filing the 2015 1096 form for nonresident payees?

When filing the 2015 1096 form for nonresident payees, ensure that you correctly report their income type and comply with any applicable tax treaty regulations. It's crucial to have accurate withholding information and to consult relevant IRS guidelines for specifics on your situation.

See what our users say