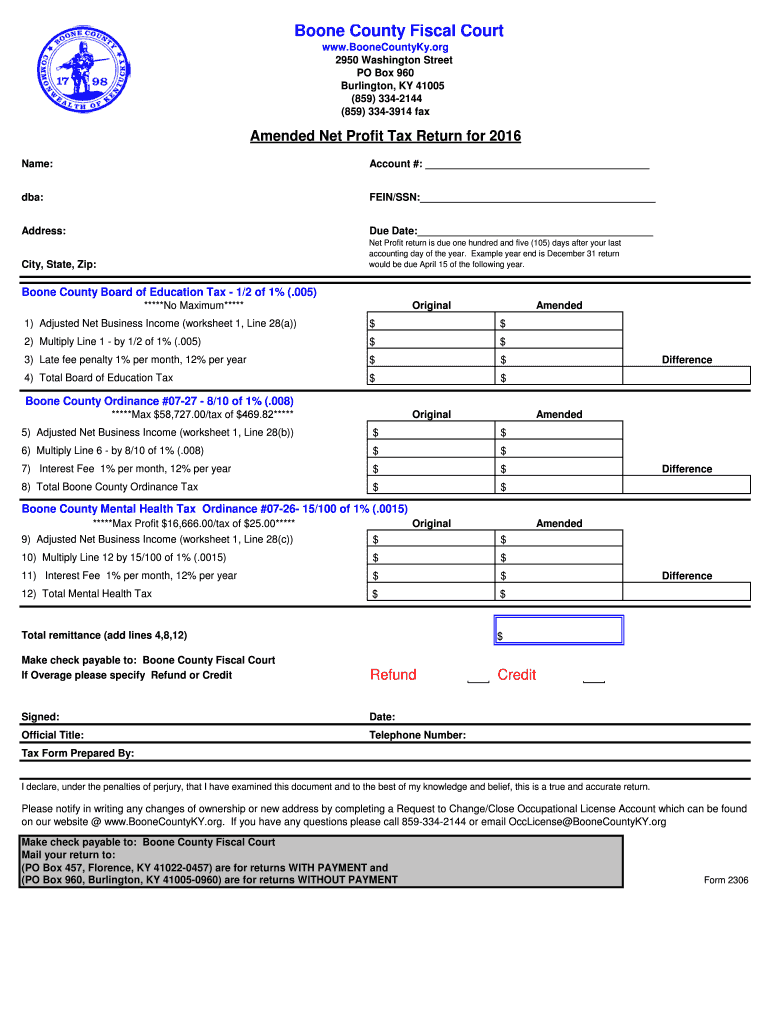

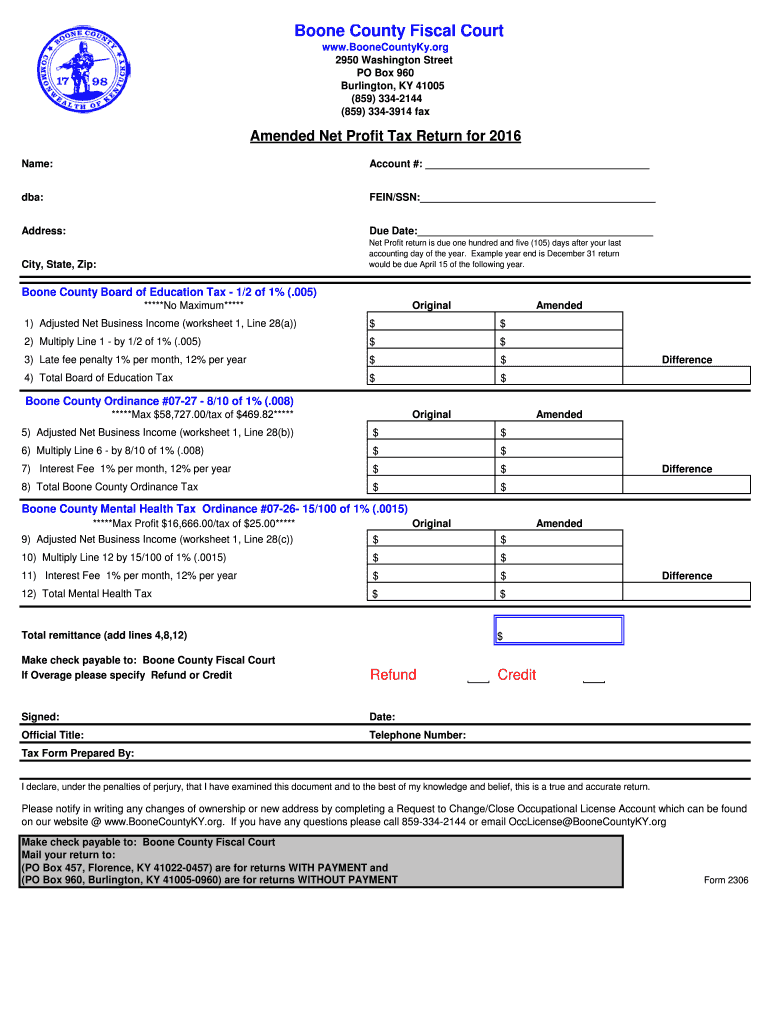

KY 2306 - Boone County 2016 free printable template

Get, Create, Make and Sign KY 2306 - Boone County

How to edit KY 2306 - Boone County online

Uncompromising security for your PDF editing and eSignature needs

KY 2306 - Boone County Form Versions

How to fill out KY 2306 - Boone County

How to fill out KY 2306 - Boone County

Who needs KY 2306 - Boone County?

Instructions and Help about KY 2306 - Boone County

Law.com legal forms guide form 6 11 X amended Alaska corporate net income tax return Alaska corporations should use a form 611 X if they need to amend an initially filed net income tax return this document is found on the website of the Alaska Department of Revenue step 1 enter your federal employer identification number your business name and complete address your phone and fax number and a contact person's name title phone number and email address step 2 if you had a different name or a federal employer identification number on your original return enter it give the tax year for which you are filing step 3 if you're being audited by the Alaska Department of Revenue indicate this with a check mark where indicated step 4 lines 1 through 15 provide instructions for the calculation of your net Alaska income tax due on these lines three columns must be completed Colo me requires you to enter the numbers filed on your initial or last amended return column B requires you to detail the net change between the original and amended figures column C requires you to enter the correct amounts Step five lines one through six provide instructions for detailing your Alaska income step 6 lines 7 through 12 provide instructions for calculating the Alaska tax owed step seven lines 12 through 15 provide instructions for calculating your adjusted Alaska tax owed after credits have been applied step eight lines 16 through 18 adjust your text do based on payments already made step 9 you must attach an explanation of all changes reported if you have filed an amended federal return a copy must be attached step 10 an officer of the company should sign and date the form and provide their title step 11 the file containing this form includes a form 611 n if you wish to apply for a tentative refund based on overpayment to watch more videos please make sure to visit laws calm

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit KY 2306 - Boone County online?

Can I sign the KY 2306 - Boone County electronically in Chrome?

How do I complete KY 2306 - Boone County on an Android device?

What is KY 2306 - Boone County?

Who is required to file KY 2306 - Boone County?

How to fill out KY 2306 - Boone County?

What is the purpose of KY 2306 - Boone County?

What information must be reported on KY 2306 - Boone County?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.