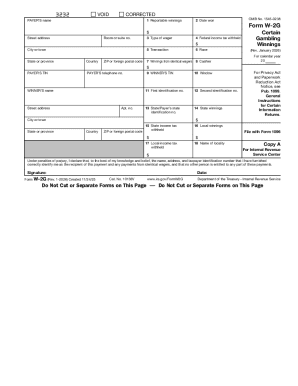

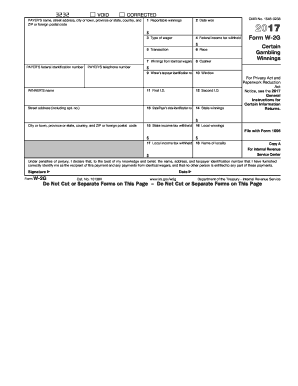

IRS W-2G 2016 free printable template

Instructions and Help about IRS W-2G

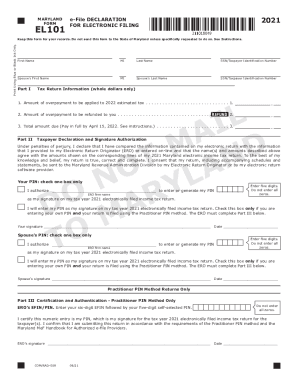

How to edit IRS W-2G

How to fill out IRS W-2G

About IRS W-2G 2016 previous version

What is IRS W-2G?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-2G

How do I fill out the [SKS] form on my smartphone?

Use the pdfFiller mobile app to fill out and sign [SKS]. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit [SKS] on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share [SKS] from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out [SKS] on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your [SKS], upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

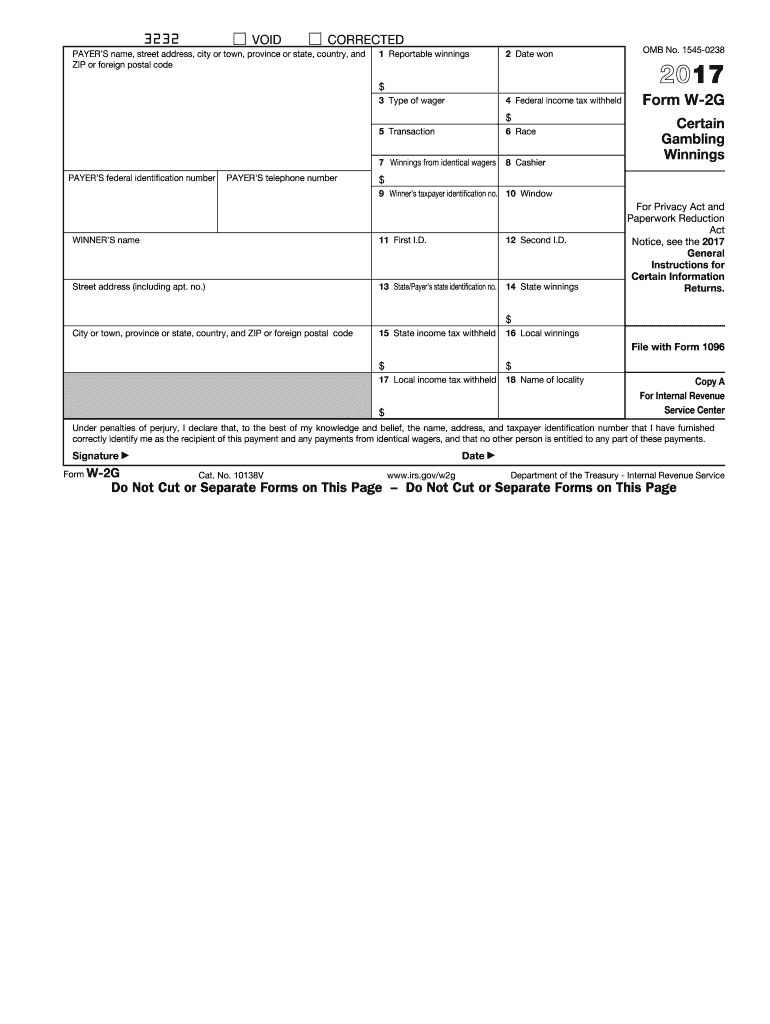

What is IRS W-2G?

IRS W-2G is a tax form used to report gambling winnings and any federal income tax withheld on those winnings.

Who is required to file IRS W-2G?

The payer of gambling winnings, typically casinos or other gambling establishments, is required to file IRS W-2G when a player wins above certain threshold amounts.

How to fill out IRS W-2G?

To fill out IRS W-2G, include the payer's name, address, and TIN, the winner's name, address, and TIN, the date won, the amount won, and any federal income tax withheld.

What is the purpose of IRS W-2G?

The purpose of IRS W-2G is to report specific gambling winnings to the IRS for tax purposes, ensuring that taxpayers report all gambling income.

What information must be reported on IRS W-2G?

The information reported on IRS W-2G includes the winner's name, address, taxpayer identification number, the amount of winnings, date won, the type of betting, and federal income tax withheld.

See what our users say