MN LG240B 2015 free printable template

Show details

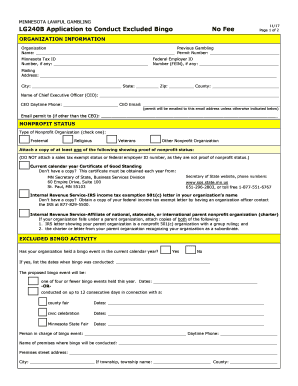

MINNESOTA LAWFUL GAMBLING LG240B Application to Conduct Excluded Bingo No Fee 6/15 Page 1 of 2 ORGANIZATION INFORMATION Organization Previous Gambling Name Permit Number Minnesota Tax ID Number if any Federal Employer ID Number FEIN if any Mailing Address City State Zip County Name of Chief Executive Officer CEO Daytime Phone Email NONPROFIT STATUS Type of Nonprofit Organization check one Fraternal Religious Veterans Other Nonprofit Organization Attach a copy of at least one of the following...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN LG240B

Edit your MN LG240B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN LG240B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MN LG240B online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MN LG240B. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN LG240B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN LG240B

How to fill out MN LG240B

01

Gather all necessary personal and business information.

02

Start with the form's header section, entering your name and address.

03

Fill in the 'Business Information' section, including the business name and type.

04

Complete the 'Funding Information' section, detailing the purpose of the funding.

05

Specify the amount of funding requested in the appropriate field.

06

Provide a detailed project description, including the expected outcomes.

07

Include all required signatures and dates in the designated sections.

08

Review the completed form for accuracy and completeness.

09

Submit the form by the specified deadline through the correct channel.

Who needs MN LG240B?

01

Organizations or groups seeking funding for local government projects.

02

Nonprofits applying for grants related to community services.

03

Individuals or teams involved in projects that require state or local funding.

04

Anyone fulfilling the application criteria set by the Minnesota Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

How much does a gambling license cost in Minnesota?

The annual license fee is $100. Training.

Are there laws around raffles?

Currently, raffles are legal with various restrictions in 47 of the 50 states. The states that prohibit raffles altogether are Alabama, Hawaii, and Utah. To find out what you need to do to run a legal raffle, you need to check the raffle laws for your state.

Do you need a license to run a raffle?

If you are running a raffle where tickets are not sold before the event, it falls under the terms of an incidental lottery. As such, you will not require a licence or any specific permissions.

Can you play bingo without gambling?

For the most part, playing bingo for real money in California is prohibited, but you can still legally play bingo online for real money through non-Californian gambling sites. If you're interested, check out Smart Bingo Guide's article on the most trusted bingo sites in and outside of the US.

Do I need a raffle license in Minnesota?

An Exempt permit is required when for the calendar year: the total value of ALL prizes donated and purchased is less than $50,000, and is. limited to five days of gambling activity.

Can anyone run a raffle?

Fundraising, raffles, and lotteries are all forms of gambling and you must follow the rules for the type of lottery you plan to run, otherwise you may be breaking the law. You can run a lottery or raffle to raise money for charity.

Are online raffles legal in Minnesota?

No. You may not sell tickets through your website, but you are allowed to advertise the raffle on the website. Raffle tickets may not be sold online. 7) Are there any age restrictions for raffles?

What's the difference between a raffle and a drawing?

People usually buy raffle tickets. Drawings, on the other hand, are entry-based: you could have a limit of one entry per person or have rewards of entries based on a variety of things (how many times you attend a meeting, how much money you raised in a fundraiser, etc.).

Does a raffle count as gambling?

A raffle is a gambling competition in which people obtain numbered tickets, each of which has the chance of winning a prize.

Do you need a gambling license for bingo in MN?

No license is required for bingo conducted at fairs for up to 12 days a year and bingo conducted elsewhere for up to four days a year.

Do you need a licence to play bingo for money?

Yes, playing bingo in dedicated halls or playing online bingo is gambling. However, non commercial bingo nights are considered 'gaming' by the Gambling Commission, alongside nights and race nights.

Do you need a licence for prize bingo?

You do not need a gambling licence to run a fundraising event or a private bingo night, but that doesn't mean you have free reign to run the event how you want.

Do you need a license for a raffle in MN?

An Exempt permit is required when for the calendar year: the total value of ALL prizes donated and purchased is less than $50,000, and is. limited to five days of gambling activity.

Do I need a licence to run a raffle?

If you are running a raffle where tickets are not sold before the event, it falls under the terms of an incidental lottery. As such, you will not require a licence or any specific permissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MN LG240B without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including MN LG240B. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get MN LG240B?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the MN LG240B in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete MN LG240B online?

Easy online MN LG240B completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is MN LG240B?

MN LG240B is a form used in Minnesota for reporting local government financial information, specifically related to expenditures for property tax levies.

Who is required to file MN LG240B?

Local government entities in Minnesota, such as cities, counties, and townships, that levy property taxes are required to file MN LG240B.

How to fill out MN LG240B?

To fill out MN LG240B, local government entities must provide detailed information on their proposed property tax levies, including expenditure categories, amounts, and purpose for each levy being reported.

What is the purpose of MN LG240B?

The purpose of MN LG240B is to ensure transparency and accountability in local government financial practices by reporting how property tax revenues will be utilized.

What information must be reported on MN LG240B?

The information that must be reported on MN LG240B includes the specific amounts of property tax levies, the categories of expenses, the intended use of the levies, and any relevant financial details pertaining to the budget.

Fill out your MN LG240B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN lg240b is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.