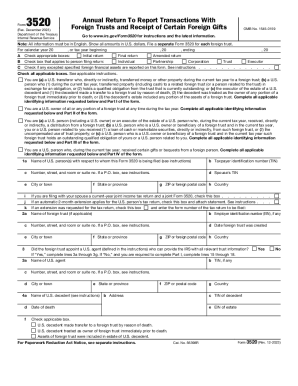

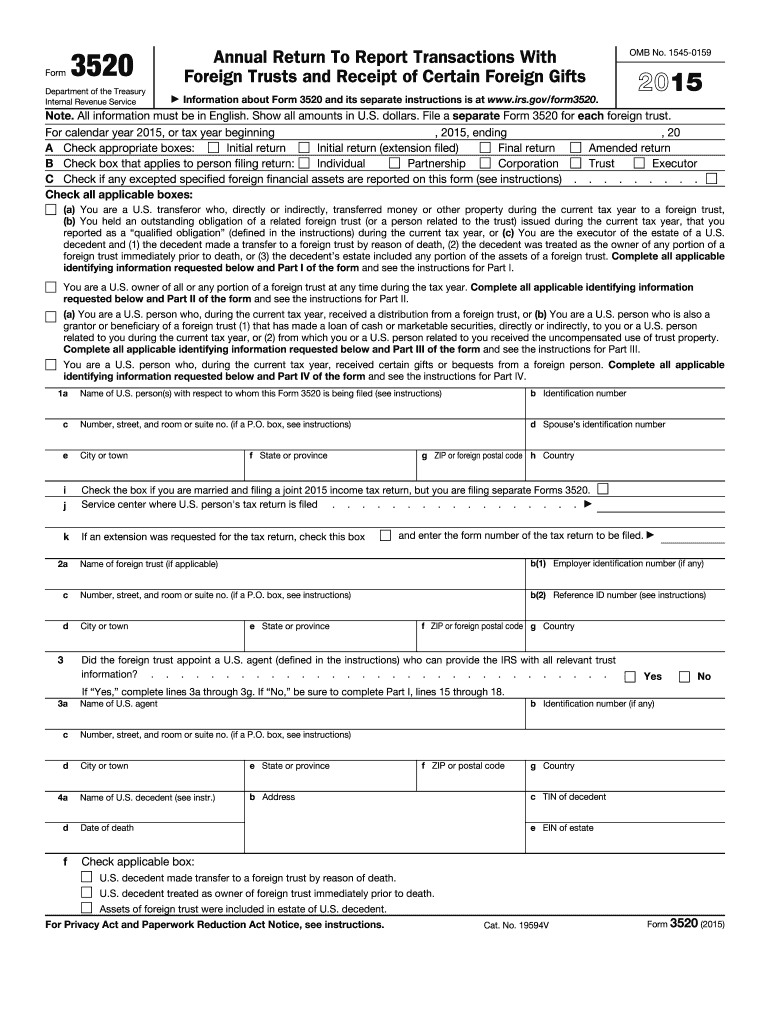

IRS 3520 2015 free printable template

Instructions and Help about IRS 3520

How to edit IRS 3520

How to fill out IRS 3520

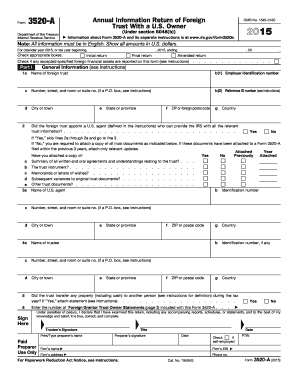

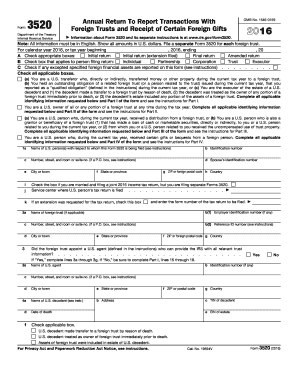

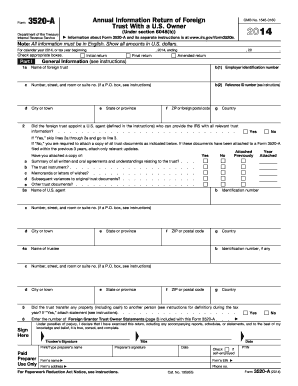

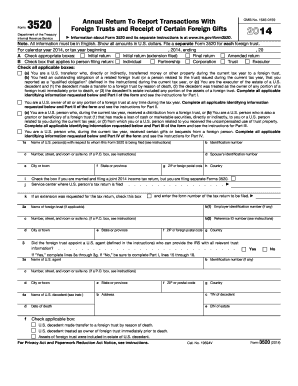

About IRS 3 previous version

What is IRS 3520?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about form 3520 2015

Can I create an electronic signature for the [SKS] in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your [SKS] in minutes.

Can I edit [SKS] on an iOS device?

Create, edit, and share [SKS] from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete [SKS] on an Android device?

On Android, use the pdfFiller mobile app to finish your [SKS]. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is IRS 3520?

IRS Form 3520 is a tax form used to report certain transactions with foreign trusts, as well as the receipt of certain foreign gifts.

Who is required to file IRS 3520?

U.S. persons who receive gifts from foreign persons over a certain threshold or who engage in certain transactions with foreign trusts are required to file IRS Form 3520.

How to fill out IRS 3520?

To fill out IRS Form 3520, follow the instructions provided in the form, including reporting details about the foreign trust or gift, your identification information, and any applicable financial details.

What is the purpose of IRS 3520?

The purpose of IRS Form 3520 is to provide the IRS with information about foreign trusts and large foreign gifts to ensure compliance with U.S. tax laws.

What information must be reported on IRS 3520?

Information that must be reported on IRS Form 3520 includes the name and address of the foreign trust, the identity of the grantor, the terms of the trust, and details regarding any gifts received from foreign individuals over the specified thresholds.