TX RRC W-3X 2011 free printable template

Show details

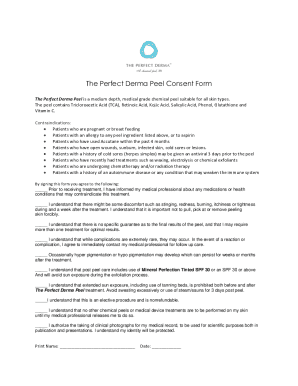

RAILROAD COMMISSION OF TEXAS Oil and Gas / Admin. Compliance PO Box 12967 Austin TX 78711-2967 READ INSTRUCTIONS ON BACK APPLICATION FOR AN EXTENSION OF DEADLINE FOR PLUGGING AN INACTIVE WELL Form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX RRC W-3X

Edit your TX RRC W-3X form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX RRC W-3X form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX RRC W-3X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX RRC W-3X

How to fill out TX RRC W-3X

01

Obtain the TX RRC W-3X form from the Texas Railroad Commission website or relevant office.

02

Fill out the identification section with your name, address, and Texas Railroad Commission (RRC) account number.

03

Enter the reporting period for which you are submitting the form.

04

Complete the production data section, providing accurate figures for oil and gas production during the reporting period.

05

Include any additional data as required by the specific instructions on the form.

06

Review all the information for accuracy and completeness.

07

Submit the form by the designated deadline, either electronically or via mail as per RRC guidelines.

Who needs TX RRC W-3X?

01

Operators of oil and gas wells in Texas who are required to report production data.

02

Companies and entities looking to stay compliant with Texas Railroad Commission regulations.

03

Individuals or businesses seeking to claim certain tax exemptions related to oil and gas production.

Fill

form

: Try Risk Free

People Also Ask about

What is P5 form?

Form P5. Description. Application to the Board to Amend the Conditions of, or Terminate the Appointment of a Representative under Subsection 27(7) or (8) of the Personal Health Information Protection Act.

What happened to the Texas Railroad Commission?

The Railroad Commission of Texas remains unified and focused on its mission to protect the public, environment and economy of Texas.

What is a P5 form?

Form P5. Description. Application to the Board to Amend the Conditions of, or Terminate the Appointment of a Representative under Subsection 27(7) or (8) of the Personal Health Information Protection Act.

What is Rule 32 Texas Railroad Commission?

Statewide Rule 32 allows an operator to flare gas while drilling a well and for up to 10 days after a well's completion to conduct potential well testing. Statewide Rule 32 also allows an operator to request an exception to flare gas in certain circumstances.

What is a P5 with Railroad Commission?

The P-5 bond is a license & permit bond required by the Railroad Commission of Texas. P-5 surety bonds are required to ensure different aspects of operating and abandoning oil or gas wells are managed and/or completed in ance with Texas laws and regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TX RRC W-3X?

TX RRC W-3X is a report used by the Texas Railroad Commission to request the redistribution of funds related to production or royalty payments within the oil and gas industry.

Who is required to file TX RRC W-3X?

Producers, operators, or payors of oil and gas royalties who seek to redistribute funds or correct discrepancies in their payments are required to file TX RRC W-3X.

How to fill out TX RRC W-3X?

To fill out TX RRC W-3X, complete all required fields, including the producer's name, company details, royalty owner information, and specific details about the amounts being redistributed or corrected.

What is the purpose of TX RRC W-3X?

The purpose of TX RRC W-3X is to facilitate accurate distribution of funds among royalty owners and to ensure compliance with Texas Railroad Commission regulations.

What information must be reported on TX RRC W-3X?

The report must include the producer's information, royalty owner details, the amounts involved in the redistribution, and any relevant corrections or adjustments related to past payments.

Fill out your TX RRC W-3X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX RRC W-3x is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.