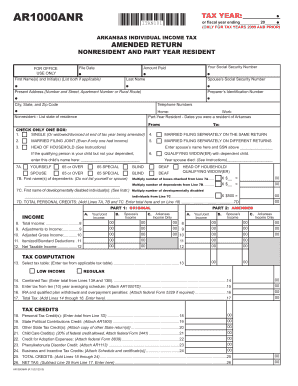

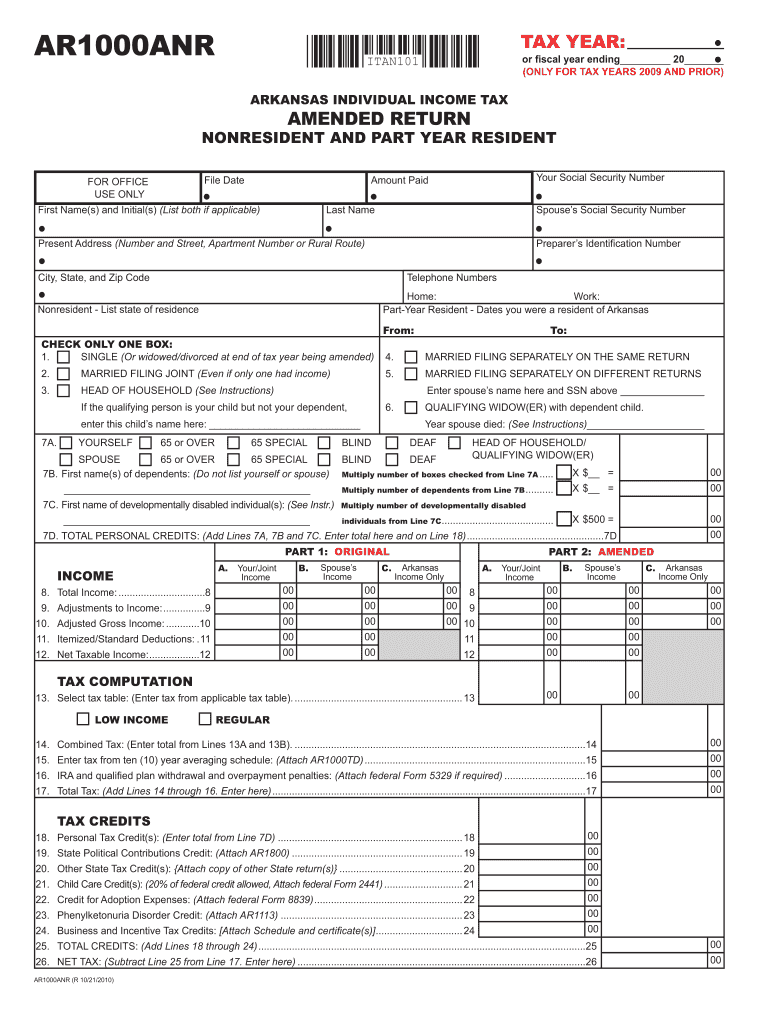

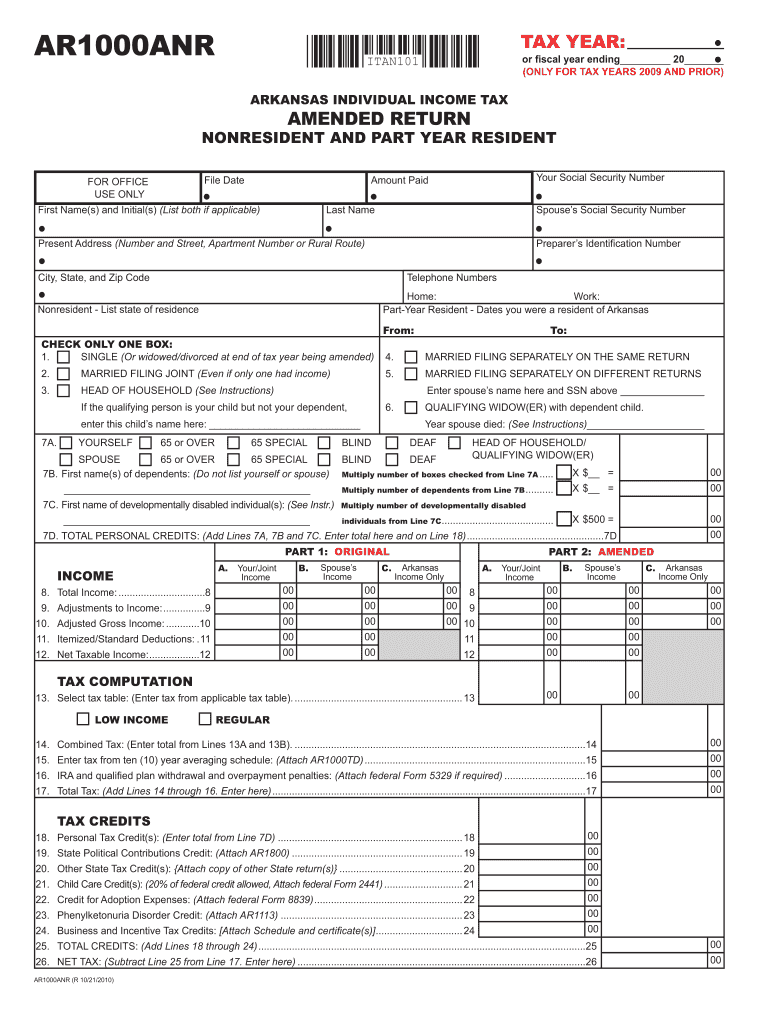

AR DFA AR1000ANR 2009 free printable template

Show details

Your Signature Occupation Date Spouse s Signature Paid Preparer s Signature ID Number/SSN Firm Name Or yours if self employed Telephone Address May the Arkansas Revenue Agency discuss this return with the preparer shown to the left Yes No Mail to Amended Tax Group P. O. Box 3628 Little Rock AR 72203 EXPLANATION OF CHANGES TO INCOME DEDUCTIONS AND CREDITS REQUIRED Attach supporting forms and schedules for items changed and give explanations for each change. If you do not attach the required...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR DFA AR1000ANR

Edit your AR DFA AR1000ANR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR DFA AR1000ANR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR DFA AR1000ANR online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AR DFA AR1000ANR. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR DFA AR1000ANR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR DFA AR1000ANR

How to fill out AR DFA AR1000ANR

01

Gather the necessary information: Ensure you have all required documents and data at hand, such as your financial statements and income details.

02

Start with personal information: Fill out your name, address, and identifying number at the beginning of the form.

03

Report your income: Input all sources of income in the designated sections, making sure to include any relevant details.

04

Complete the expense section: Document any deductible expenses that apply to your financial situation.

05

Double-check calculations: Review the math on the form to ensure accuracy in total figures.

06

Sign and date the form: Ensure that you sign and date the AR DFA AR1000ANR before submission.

07

Submit the form: Follow state guidelines for submitting the completed form, whether electronically or through mail.

Who needs AR DFA AR1000ANR?

01

Individuals or businesses that have taxable income in Arkansas and need to report their financial information.

02

Taxpayers seeking to claim deductions, credits, or adjustments on their income tax liabilities.

03

Those who have received income during the tax year and are required to file tax returns in Arkansas.

Instructions and Help about AR DFA AR1000ANR

Fill

form

: Try Risk Free

People Also Ask about

Do I have to file Arkansas state income tax?

Any PY resident who received any taxable income while an Arkansas resident must file a return, regardless of filing status or gross income amount.

What is AR1000TC?

AR1000TC (R 08/16/2022) ARKANSAS INDIVIDUAL INCOME TAX. TAX CREDITS.

Which people are legally required to file a tax return?

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

Who has to pay Arkansas state income tax?

Just like the federal government, if you earn an income, you must pay income taxes in Arkansas. As a traditional W-2 employee, your Arkansas taxes will be drawn on each payroll automatically. You will see this on your paycheck stub, near or next to the federal taxes.

What is the retirement income exclusion in Arkansas?

If you are retired and receiving retirement benefits from an employer- sponsored pension plan, you are eligible for a $6,000 retirement income exclusion.

Who is required to file Arkansas state tax return?

All non-residents must file a state tax return if they receive any in- come from an Arkansas source. Part-year residents must file a return if they re- ceive any income from any source while a resident of Arkansas.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AR DFA AR1000ANR directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your AR DFA AR1000ANR as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I fill out the AR DFA AR1000ANR form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign AR DFA AR1000ANR. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete AR DFA AR1000ANR on an Android device?

On Android, use the pdfFiller mobile app to finish your AR DFA AR1000ANR. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is AR DFA AR1000ANR?

AR DFA AR1000ANR is a tax form used in Arkansas for reporting various income and tax-related information to the state revenue office.

Who is required to file AR DFA AR1000ANR?

Individuals and entities that earn income in Arkansas and meet specific filing requirements are required to file the AR DFA AR1000ANR.

How to fill out AR DFA AR1000ANR?

To fill out AR DFA AR1000ANR, gather all necessary income and tax information, complete the form according to the instructions provided, and ensure all sections are filled out accurately.

What is the purpose of AR DFA AR1000ANR?

The purpose of AR DFA AR1000ANR is to report income, claim deductions, and calculate the amount of tax owed or refund due for individuals and businesses in Arkansas.

What information must be reported on AR DFA AR1000ANR?

The information that must be reported on AR DFA AR1000ANR includes income details, deductions, exemptions, and other pertinent tax information relevant to the taxpayer's financial situation.

Fill out your AR DFA AR1000ANR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR DFA ar1000anr is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.