MD Comptroller 505X 2015 free printable template

Get, Create, Make and Sign MD Comptroller 505X

How to edit MD Comptroller 505X online

Uncompromising security for your PDF editing and eSignature needs

MD Comptroller 505X Form Versions

How to fill out MD Comptroller 505X

How to fill out MD Comptroller 505X

Who needs MD Comptroller 505X?

Instructions and Help about MD Comptroller 505X

The Comptroller presents real taxpayers of genius today we salute you Mr frustrated taxpayer yeah tired of wasting all of your time filing taxes be an old-fashioned way lot the paper cut makes me so angry we have a solution for you, he found that return get your refund fast yum everybody well done Tyler well done so when you pull out those w2s tax season remember the Eve and you won't be frustrated it's me hi I'm Marilyn state comptroller Peter Franc hot when you file your taxes is season be sure to use e-file it's the fastest and easiest way to file your taxes log on to our website at Maryland taxes calm

People Also Ask about

How long does it take after your amended return is processed?

Can Maryland Form 502X be filed electronically?

Can you file an amended return after 3 years?

How do I file an amended MD tax return?

How long does it take to process a Maryland amended tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my MD Comptroller 505X in Gmail?

How do I fill out MD Comptroller 505X using my mobile device?

How can I fill out MD Comptroller 505X on an iOS device?

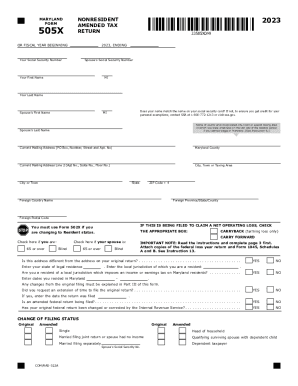

What is MD Comptroller 505X?

Who is required to file MD Comptroller 505X?

How to fill out MD Comptroller 505X?

What is the purpose of MD Comptroller 505X?

What information must be reported on MD Comptroller 505X?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.