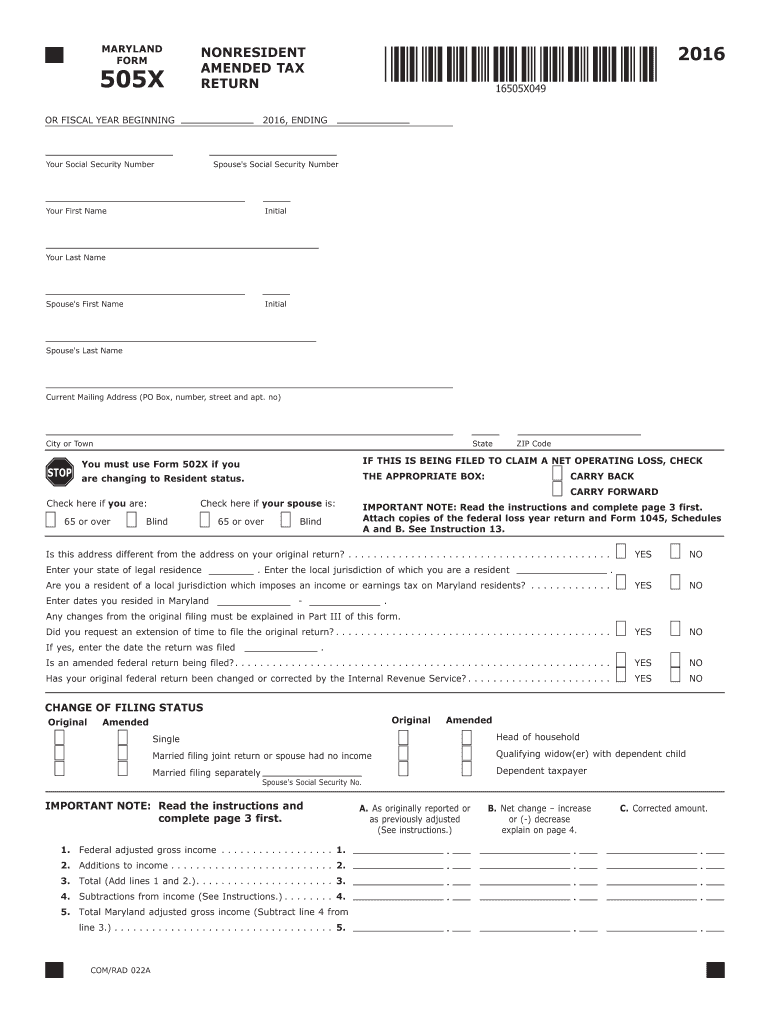

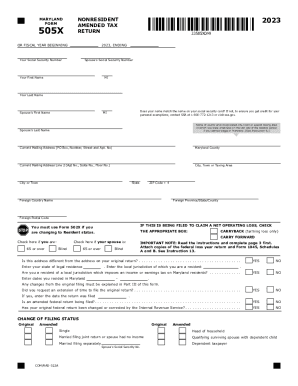

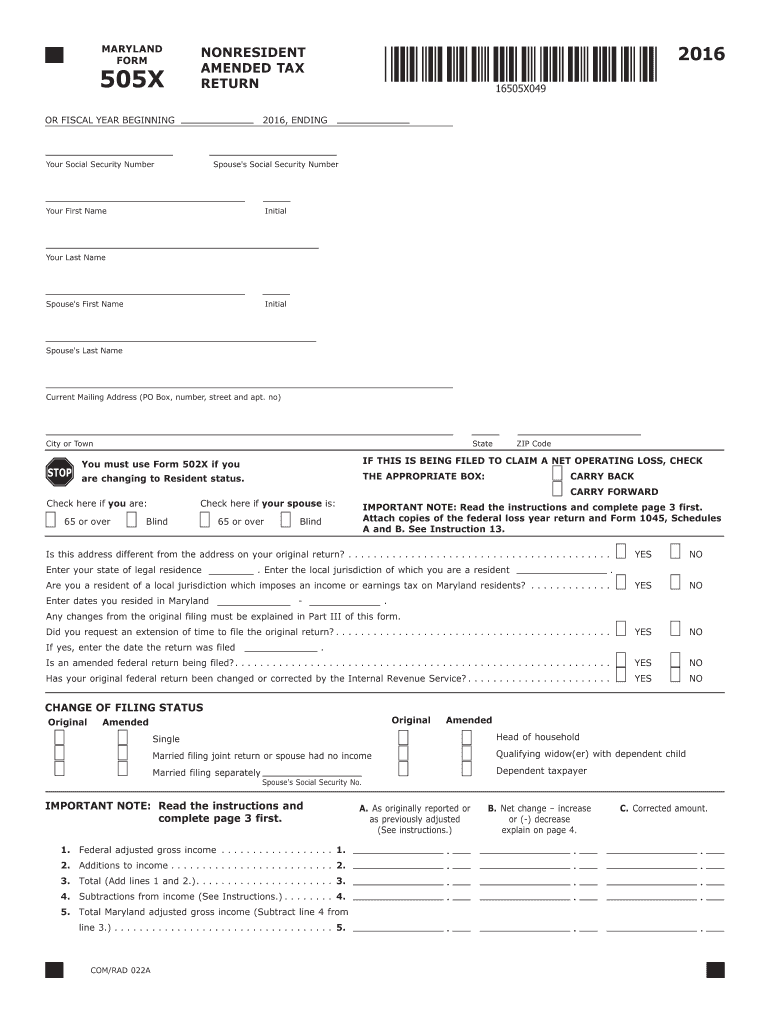

MD Comptroller 505X 2016 free printable template

Get, Create, Make and Sign form 505x 2016

Editing form 505x 2016 online

Uncompromising security for your PDF editing and eSignature needs

MD Comptroller 505X Form Versions

How to fill out form 505x 2016

How to fill out MD Comptroller 505X

Who needs MD Comptroller 505X?

Instructions and Help about form 505x 2016

The Comptroller presents real taxpayers of genius today we salute you Mr frustrated taxpayer yeah tired of wasting all of your time filing taxes be an old-fashioned way lot the paper cut makes me so angry we have a solution for you, he found that return get your refund fast yum everybody well done Tyler well done so when you pull out those w2s tax season remember the Eve and you won't be frustrated it's me hi I'm Marilyn state comptroller Peter Franc hot when you file your taxes is season be sure to use e-file it's the fastest and easiest way to file your taxes log on to our website at Maryland taxes calm

People Also Ask about

How to calculate tax?

Is Maryland tax friendly?

What is Maryland tax rate 2022?

Are Maryland taxes too high?

How do you calculate Maryland sales tax?

What are Maryland taxes on $30000?

How much federal tax do I pay on $33000?

How much do I pay in taxes for $30000?

What are the taxes like in Maryland?

What is the most tax friendly state?

How much is tax in Maryland?

What is the state income tax for Maryland?

What is Maryland State tax 2022?

What is the Maryland state tax rate for 2022?

What will the 2022 tax rates be?

How much tax is on a dollar in Maryland?

What percentage does Maryland take out for taxes?

What is the Maryland standard deduction for 2022?

Is Maryland a good tax state?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 505x 2016 in Gmail?

How do I edit form 505x 2016 on an iOS device?

How do I fill out form 505x 2016 on an Android device?

What is MD Comptroller 505X?

Who is required to file MD Comptroller 505X?

How to fill out MD Comptroller 505X?

What is the purpose of MD Comptroller 505X?

What information must be reported on MD Comptroller 505X?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.