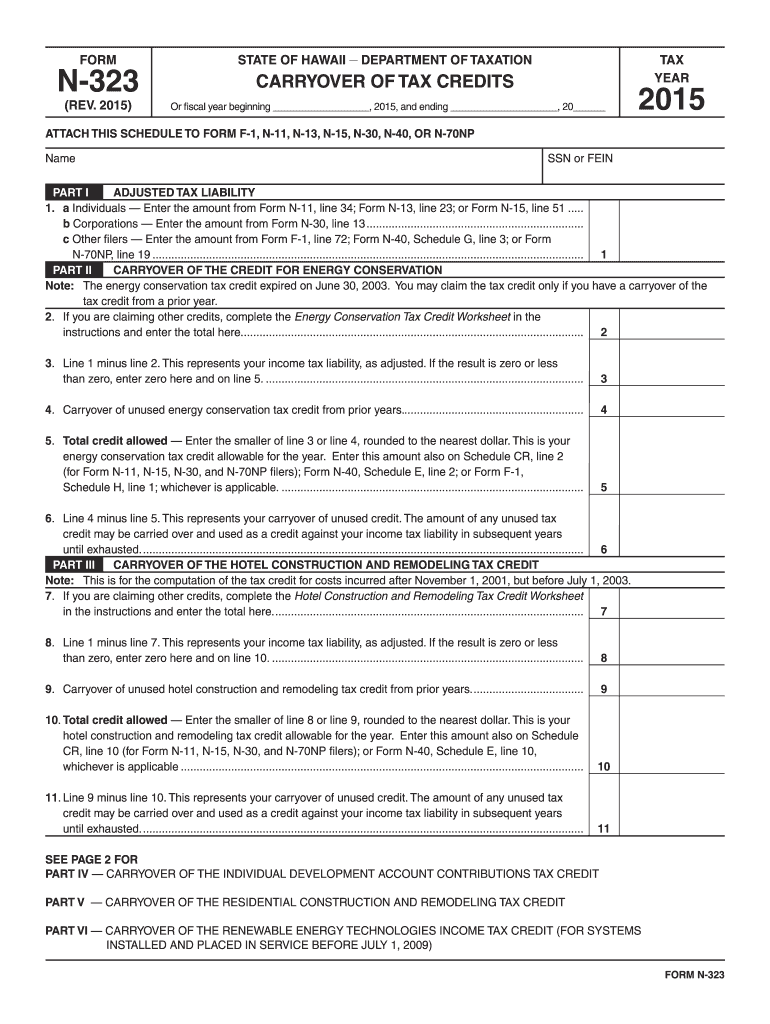

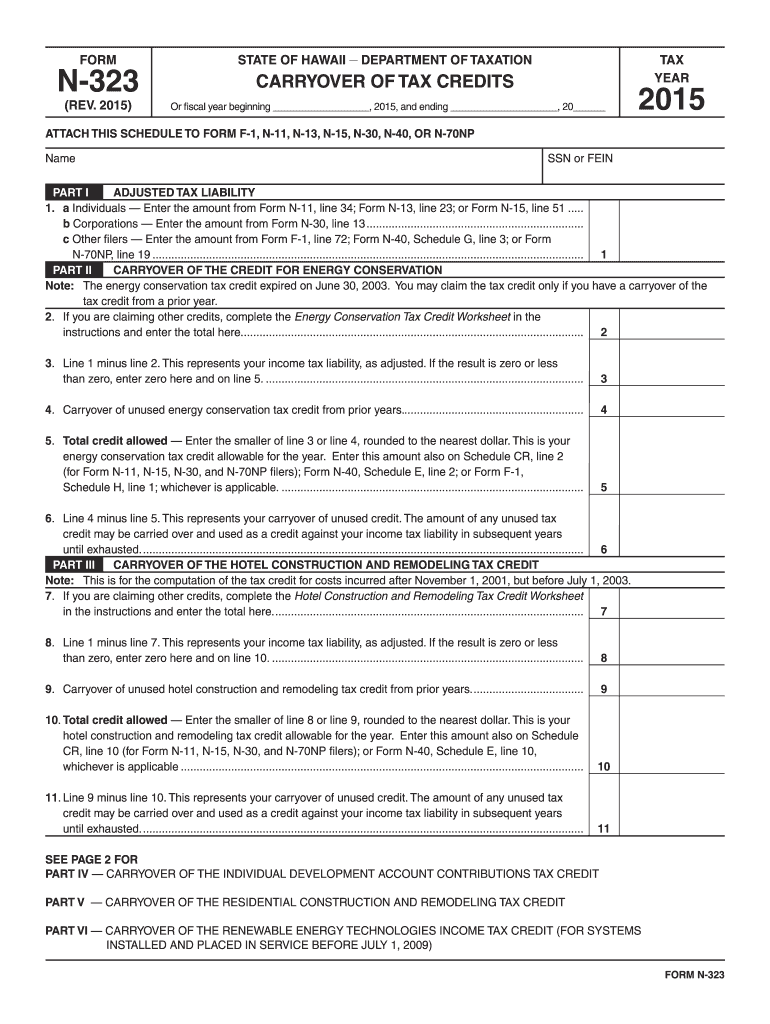

HI DoT N-323 2015 free printable template

Get, Create, Make and Sign HI DoT N-323

Editing HI DoT N-323 online

Uncompromising security for your PDF editing and eSignature needs

HI DoT N-323 Form Versions

How to fill out HI DoT N-323

How to fill out HI DoT N-323

Who needs HI DoT N-323?

Instructions and Help about HI DoT N-323

Good afternoon everyone Hawaii summits under another blizzard warning heavy snow falling up to 10 inches across the Big Island northwest Pakistan 46 avalanches cutting off access in the chiral area for 12,000 people unable to receive food or medical supplies stunning lightning over the Amazon basin and a Beat on what the massive floods and Snowbelt runoff of 7th century lunar calendar graveyard has been unearthed by the flood waters and while you're watching the video please remember to subscribe to adapt 2030 and join me on iTunes and stitches radio for my podcast mini ice age conversations [Music] following a record-breaking snow on Mount okay amount Aloha December 3, 2016, another blizzard warning dropping 10 inches of snow in March on the Big Island summits 65 mile per hour winds and heavy rains across the entire island chain a glimpse here of the East Asian observatory cam the snow that fell overnight another wide out here for you of the observatory another water channel headline rare severe thunderstorms across the islands, but they go out of their way to say in fact that snow isn't unusual that it even snow to top two summits in late July 2015 that's rare in itself, and then we come into 2016 record snows and now again blizzard in March 2017 the forecast is for it intensifying grand solar minimum specifically in these last three years it's been unusual snow fault, and somehow they're trying to just dismiss this images from the December snow falls off social media it was actually feet that fella up to five feet drifting and a fun fact here the mountain peaks on the Big island of Hawaii have had more snow in this one day then Denver has received so far in all of 2017 over to Pakistan in the arc re valley 46 avalanches and different points across the region have blocked over 12,000 people locked them into their villages the running out of food and medicine it's an isolated area up in the T trial Northwest Frontier Province area those of you who are familiar trekking Hindu Kush and Karakorum region diverse vegetation and ecosystems up there lush Valley floors steep mountains and the rivers have ocean colors to them looking at the higher peaks across the Karakorum looks like something right out of the Alps on a personal story when I was trekking in lay in northern India I kept hearing these magical stories people saying how amazingly friendly to pee we're up in the Karakorum Hindu Kush area and that you need to get there right now this was in the late 90s and I should have taken their advice over to eat on along with the heavy flooding and now the snow falls melting filling the river basins the floods have actually scoured away parts of the riverbank unearthing a 7th century lunar calendar cemetery why not here for you of what's been unearthed so far now the archaeologists are waiting for the flood waters to recede, and then they're going to get in there for a full study of what this actually is they're quite unsure right now one day it's a...

People Also Ask about

What form do I use for Hawaii estimated taxes?

Who is required to file a Hawaii tax return?

What is form N 163 in Hawaii?

Who must file Hawaii partnership return?

How do I get my Hawaii state tax form?

What is Hawaii tax form N 15?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete HI DoT N-323 online?

How do I fill out the HI DoT N-323 form on my smartphone?

How do I edit HI DoT N-323 on an iOS device?

What is HI DoT N-323?

Who is required to file HI DoT N-323?

How to fill out HI DoT N-323?

What is the purpose of HI DoT N-323?

What information must be reported on HI DoT N-323?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.