ME MRS 700-SOV 2016 free printable template

Show details

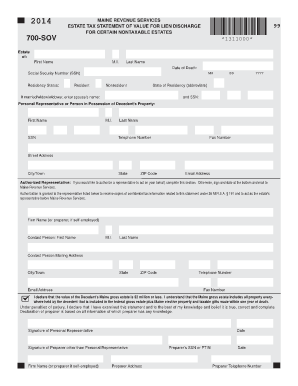

2016 MAINE REVENUE SERVICES ESTATE TAX STATEMENT OF VALUE FOR LIEN DISCHARGE FOR CERTAIN NONTAXABLE ESTATES 99 700-SOV *1311000* Estate of: First Name M.I. Last Name Social Security Number (SSN) Date

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ME MRS 700-SOV

Edit your ME MRS 700-SOV form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ME MRS 700-SOV form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ME MRS 700-SOV online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ME MRS 700-SOV. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME MRS 700-SOV Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ME MRS 700-SOV

How to fill out ME MRS 700-SOV

01

Begin by gathering necessary information such as project details and contractor information.

02

Start with the header section, clearly indicating the project's name, location, and date.

03

Fill in the contractor's name, address, and license number in the designated space.

04

Carefully list each item of work to be performed, along with the corresponding item numbers.

05

Provide unit prices for each item based on the contract agreement.

06

Specify the quantity of each item that will be installed or completed.

07

Calculate the total cost for each item by multiplying the unit price by the quantity.

08

Ensure that all calculations are accurate and that there are no discrepancies.

09

Review the form to confirm that all fields are filled out correctly.

10

Sign and date the completed form before submission.

Who needs ME MRS 700-SOV?

01

The ME MRS 700-SOV is typically required by contractors, subcontractors, and suppliers involved in construction projects.

02

It is also needed by project owners and managers for tracking project expenditure and budget management.

03

Additionally, regulatory authorities may require it for compliance and auditing purposes.

Fill

form

: Try Risk Free

People Also Ask about

Are services subject to sales tax in Maine?

Services are generally exempt from sales and use tax in Maine unless specifically taxable. Some services are subject to Maine's service provider tax. The service provider tax is imposed at the rate of 6%.

Who is exempt from paying income tax?

Under age 65. Single. Don't have any special circumstances that require you to file (like self-employment income) Earn less than $12,950 (which is the 2022 standard deduction for a single taxpayer)

Do I have to pay Maine income tax?

Anyone who is a resident of Maine for any part of the tax year, and has taxable Maine-source income, must file a Maine return. Anyone who is not a resident of Maine, but performs personal services in Maine for more than 12 days and earns more than $3,000 of income from all Maine sources, must file a Maine return.

How much can you inherit without paying taxes in 2022?

For 2022, the federal estate exemption is $12.06 million, and it will increase to $12.92 million in 2023. Estates smaller than this amount are not subject to federal taxes, though individual states have their own rules. Internal Revenue Service.

What does a letter from Department of Revenue mean?

Typically, it's about a specific issue with a taxpayer's federal tax return or tax account. A notice may tell them about changes to their account or ask for more information. It could also tell them they need to make a payment.

Why would the Department of Revenue send me a letter?

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

How do I get my sales tax registration certificate online?

Procedure of Registration The person shall use their Iris Portal credentials to login into Iris Portal. Once logged in, the person shall select Form 14(1) (Form of Registration filed voluntarily through Simplified) (Sales Tax) from the Registration drop down menu.

Why would Maine Revenue Services send me a letter?

If tax is due, and you have no remaining appeal rights, you will receive a letter from MRS informing you that you have 10 days to pay the full amount to avoid enforced collection. The letter will also explain your rights during the enforced collection process.

How much is inheritance tax in the state of Maine?

If Maine taxable estate is: More thanBut not more thanMultiply result by$0$5,600,0000%$5,600,000$8,600,0008%$8,600,000$11,600,00010%$11,600,00012%

Do I need to charge sales tax in Maine?

Sales Tax. 1. Every seller of tangible personal property or taxable services, whether at wholesale or at retail, who maintains any kind of business location in Maine.

At what age do you stop paying property taxes in Maine?

The State Property Tax Deferral Program is a lifeline loan program that can cover the annual property tax bills of Maine people who are ages 65 and older or are permanently disabled and who cannot afford to pay them on their own.

What is the 2022 federal estate tax?

Estates whose value exceeds the exemption amount are taxed at the federal estate tax rate of 40% in 2022. The total value of an estate is found by taking the fair market value of the decedent's assets at the time of death (not when they were purchased).

How do I get a resale certificate in Maine?

To qualify for a resale certificate, a retailer must apply for or have an active account and report $3,000 or more of gross sales per year. Maine Revenue Services annually reviews all active sales tax accounts and reissues expiring resale certificates to those retailers that qualify.

Are photography services taxable in Maine?

Photographers and photofinishers are producers and retailers of tangible personal property. They may also be engaged in the sale of fabrication services. Sales of tangible personal property are subject to sales tax.

What is the estate tax exemption for 2022 in Maine?

Maine Estate Tax Exemption The estate tax threshold for Maine is $5.870 million in 2021 and $6.01 million in 2022. If your estate is worth less than that, Maine won't charge estate tax on it. If it is worth more than that, you'll owe a percentage of the estate to the government based on a series of progressive rates.

Are goods and services taxable?

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor services and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new tangible personal property.

What happens if you don't pay property taxes in Maine?

Is Maine a Tax Lien or a Tax Deed State? Again, if you don't pay your property taxes, past-due amount becomes a lien on your home. Each state has a different tax sale process to collect delinquent taxes. Maine is considered a tax deed state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ME MRS 700-SOV directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ME MRS 700-SOV and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify ME MRS 700-SOV without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including ME MRS 700-SOV, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get ME MRS 700-SOV?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the ME MRS 700-SOV in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

What is ME MRS 700-SOV?

ME MRS 700-SOV is a specific form used in Maine for reporting sales and use taxes related to the sale of tangible personal property and certain services.

Who is required to file ME MRS 700-SOV?

Businesses and individuals who sell tangible personal property or taxable services in Maine and are required to collect sales tax must file ME MRS 700-SOV.

How to fill out ME MRS 700-SOV?

To fill out ME MRS 700-SOV, gather all required sales data for the reporting period, enter total sales amounts, detail taxable and nontaxable sales, and report total collected sales tax.

What is the purpose of ME MRS 700-SOV?

The purpose of ME MRS 700-SOV is to ensure that businesses report their sales accurately and pay the correct amount of sales tax to the state of Maine.

What information must be reported on ME MRS 700-SOV?

Information that must be reported on ME MRS 700-SOV includes total sales, taxable sales, exempt sales, total sales tax collected, and any adjustments for prior periods.

Fill out your ME MRS 700-SOV online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ME MRS 700-SOV is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.