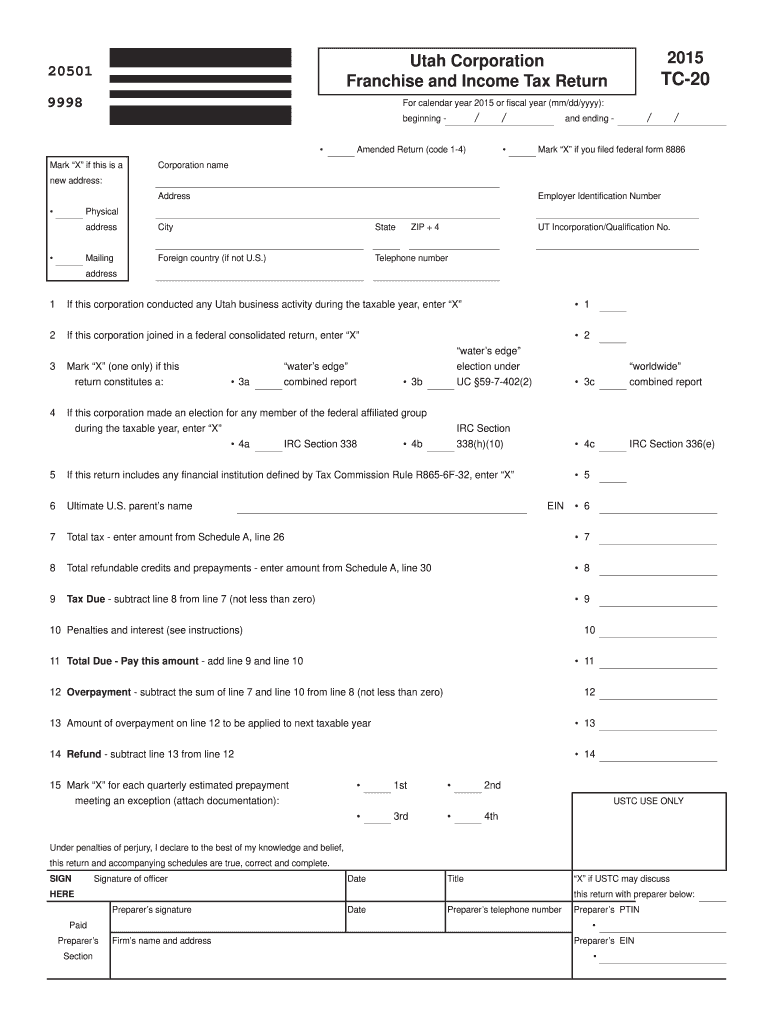

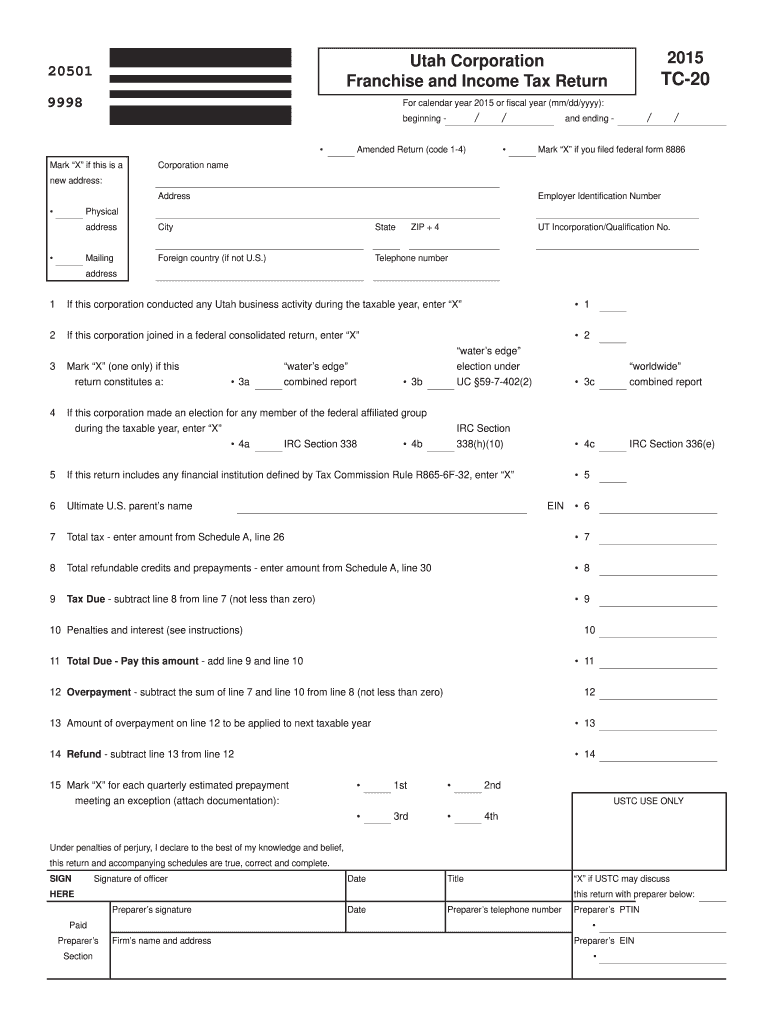

UT USTC TC-20 2015 free printable template

Get, Create, Make and Sign UT USTC TC-20

Editing UT USTC TC-20 online

Uncompromising security for your PDF editing and eSignature needs

UT USTC TC-20 Form Versions

How to fill out UT USTC TC-20

How to fill out UT USTC TC-20

Who needs UT USTC TC-20?

Instructions and Help about UT USTC TC-20

It was going on YouTube I just want to make a video dispelling some rumors and some myths about the bow flex tread climber just put this thing together just a few hours ago there's all the boxes as proof this is the TC 20 this is one of their well this is their highest end model that they sell right now, but I'm sure all them are just as good quality really sturdy construction I will say there's actually not too much to put these things together really, really thick sturdy supports and everything like that hydraulic cylinders are actually really nice I mean they're you know really smooth cylinders there's a nice gift to them but no slack take-up or anything like that so really nice and really smooth not very noisy at all here's your Curie handle down here this allows you to basically lift the Machine up and then now you can move it back and forth, or you know it around in the room no four feet it actually has leveling pads that you can unscrew you know basically if your floor is not completely level you can level this thing out, so that's really nice feature too moving on up to the deck area here you got some step off decks these are actually like a soft rubber if you will, but they're still pretty sturdy so when you go to step off you know it feels like you're stepping on something solid it's actually really soft on your feet, and now you know that's just going to work like a safety on a treadmill or something when you can't keep up what you want to stop you can just step off the treadles and stand on these things to get going you got multiple areas for hand supports they'll give you these nice sidebars here as well as these this whole shape bar in the front I mean if you're really power walking or leaning into for a long period of time you know you could use those forward risers they're how you do have two upholders they're actually really large flat areas down at the bottom here, so they're making it, so you can accommodate all different sizes and shapes of things there's also you know very large area on the side places for your phones and anything else you may want to keep in there it's more than large enough as far as display goes you know leaves a little to be desired you basically got a building, and you got the other restaurant there on the skyscraper thing so there you go you just hit start, and you're kind of off I will say you need this magnetic key and that is magnetizing it snap into place you clip this to your body basically this way if you get thrown off the treadmill without tread climber will actually electronically break the motors not break as in like break but stop the motors from running this way if you're on there the motors and the treadles aren't going to burn you or anything like that because basically a moving belt create friction it will actually burn you if you're resting up against and stuff like that so to demonstrate see the troubles moving to pull the cord you know he breaks out the motors and everything stops and...

People Also Ask about

Does Utah have tax reciprocity?

Does Utah tax non residents?

Does Utah have a franchise tax?

Does Utah require a state tax form?

Is there a Utah state tax form?

What is the due date for filing the Utah annual withholding reconciliation?

Where do I mail my Utah TC 20S?

What income is taxable in Utah?

Where do I send Utah state tax return?

Do I need to send a copy of my federal return with my Utah state return?

Where do I send my Utah TC 20S?

Do I need to send a 1099 to the state of Utah?

Do I need a Utah state tax ID number?

Does Utah allow NOL carryback?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute UT USTC TC-20 online?

How do I edit UT USTC TC-20 online?

How can I edit UT USTC TC-20 on a smartphone?

What is UT USTC TC-20?

Who is required to file UT USTC TC-20?

How to fill out UT USTC TC-20?

What is the purpose of UT USTC TC-20?

What information must be reported on UT USTC TC-20?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.