TX AP-178 2015 free printable template

Show details

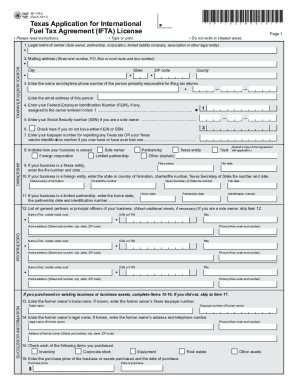

PRINT FORM CLEAR FIELDS AP17820W051516 Instructions in English AP-178-2 Rev.5-15/16 A P W Please read instructions. Use P. O. Box or rural route number. If more than one location attach a separate sheet. AP-178-1 Rev.5-15/16 Item 23 - Do not complete this application if you have a written lease agreement in your files that clearly states the lessor is responsible for filing your Texas IFTA reports. Texas Application for International Fuel Tax Agreement License Glenn HeGar Texas CompTroller...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX AP-178

Edit your TX AP-178 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX AP-178 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX AP-178 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX AP-178. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX AP-178 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX AP-178

How to fill out TX AP-178

01

Obtain the TX AP-178 form from the Texas Comptroller's website or local tax office.

02

Provide the requested general information, including your name, address, and contact details.

03

Indicate the reporting period for which the application is being completed.

04

Fill out the specific tax information sections accurately according to your business activities.

05

Attach any required documentation, such as proof of exemption eligibility if applicable.

06

Review the completed form for accuracy and completeness.

07

Submit the form by the deadline via mail, fax, or electronic submission, as specified by the Comptroller's instructions.

Who needs TX AP-178?

01

Businesses operating in Texas that are seeking a sales tax exemption or refund.

02

Individuals or entities that qualify for specific tax exemptions and need to report their eligibility.

Fill

form

: Try Risk Free

People Also Ask about

How to apply for IFTA in Louisiana?

New Louisiana IFTA Fuel Tax Accounts You will need to submit a Louisiana application online or in person. There is a $35 application fee and $2 per set of decals fee. You will need one set of decals per qualified vehicle. Decals should be received within 7-10 business days.

How do I get my IFTA sticker in Texas?

How to Apply for an IFTA License. Motor carriers are encouraged to apply for an IFTA license through the Comptroller's Webfile system. With Webfile it's easy to submit the application electronically from the convenience of a home or office without the delays associated with mailing paper applications.

How to apply for IFTA stickers in Alabama?

You will need to complete an Alabama IFTA application form and submit it to the MCS office. Incomplete applications will be returned, which will delay processing. There is a $17 fee for each set of decals per each qualified vehicle. Once the application is approved, credentials will be mailed within 30 days.

How to apply for Texas IFTA license?

How to Apply for an IFTA License. Motor carriers are encouraged to apply for an IFTA license through the Comptroller's Webfile system. With Webfile it's easy to submit the application electronically from the convenience of a home or office without the delays associated with mailing paper applications.

How do I renew my IFTA in Texas?

Renewing your IFTA license in Texas Your IFTA Texas license is valid for one year and expires on December 31st. Make sure you are compliant with the IFTA taxes as mentioned above and submit your IFTA sticker renewal application before November 30th. You may file for an extension if needed.

Is IFTA required in Louisiana?

You are required to obtain an IFTA license if your vehicle is designed for the transport of persons or products and has: Two axles and a GVW or registered GVW exceeding 26,000 pounds. Three or more axles regardless of weight. A combination GVW over 26,000 pounds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my TX AP-178 in Gmail?

TX AP-178 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify TX AP-178 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your TX AP-178 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete TX AP-178 online?

Completing and signing TX AP-178 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

What is TX AP-178?

TX AP-178 is a Texas state form used for reporting and remitting the state's franchise tax, specifically for entities that owe no tax or are not liable for tax due to having no activity or a change in their tax status.

Who is required to file TX AP-178?

Entities that are not liable for franchise tax or those that meet specific criteria, such as having no revenue or assets, are required to file TX AP-178.

How to fill out TX AP-178?

To fill out TX AP-178, provide the required identifying information for your entity, indicate your reason for filing the report, and submit it through the Texas Comptroller's office either electronically or by mail.

What is the purpose of TX AP-178?

The purpose of TX AP-178 is to formally notify the Texas Comptroller's office that an entity is not liable for franchise tax, ensuring compliance with state tax regulations regardless of tax status.

What information must be reported on TX AP-178?

On TX AP-178, you must report your entity's name, address, Federal Employer Identification Number (FEIN), and the reason for filing the report, along with any other pertinent details as specified by the form.

Fill out your TX AP-178 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX AP-178 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.