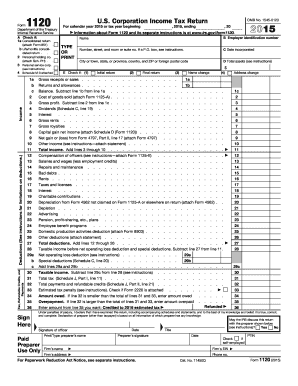

Who needs a form K-120?

Any ?corporation fully or partially operating under federal and state tax law in Kansas. This includes all business entities created “for profit” with incoming revenue and taxed separately from its owners.

What is form K-120 for?

IRS K-120 Form is used to document and report income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. It is requested by Kansas Department of Revenue.

Is it accompanied by other forms?

You can use the form K-120AS, Corporation Apportionment Schedule, to add information. Fill it out inside this form, you’ll find it on page 5.

When is form K-120 due?

Corporate tax returns are always due on the April, 15th of the year following the reported period. If the due date falls on a Saturday, Sunday, or legal holiday, the corporation can file on the next business day.

How do I fill out a form K-120?

You can edit, save, share, and sign your corporation’s K-120 form usinfillerer. To fill in the form you will need the corporation’s Haman addressees the Employer Identification Number (EIN), and the corporation’s total assets, income, deductions, and refundable credits.

Where do I send it?

Once you have filled your IRS 1120 Form, you can send it to the following address: ? Kansas Corporate Tax, Kansas Department of Revenue, 915 SW Harrison Street, Topeka, KS 66612-1588. For more information on how to fill out the form and where to send it, you can consult the Kansas Department of Revenue webpage.