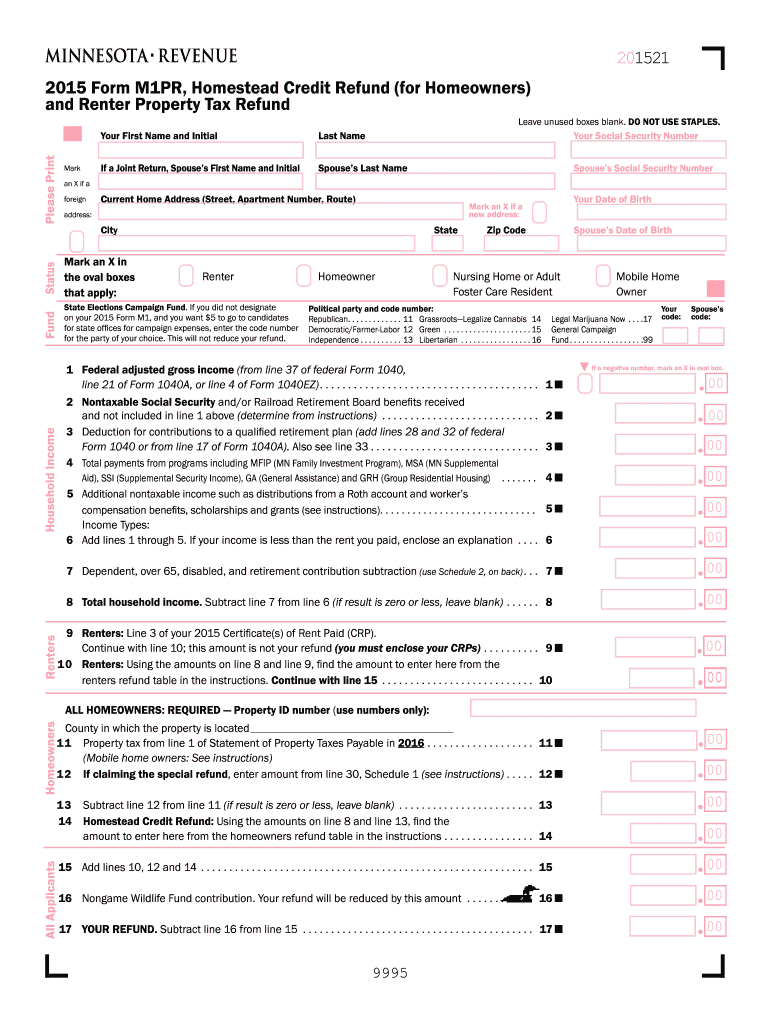

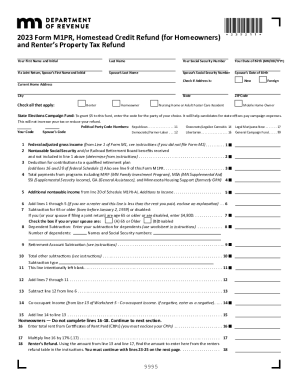

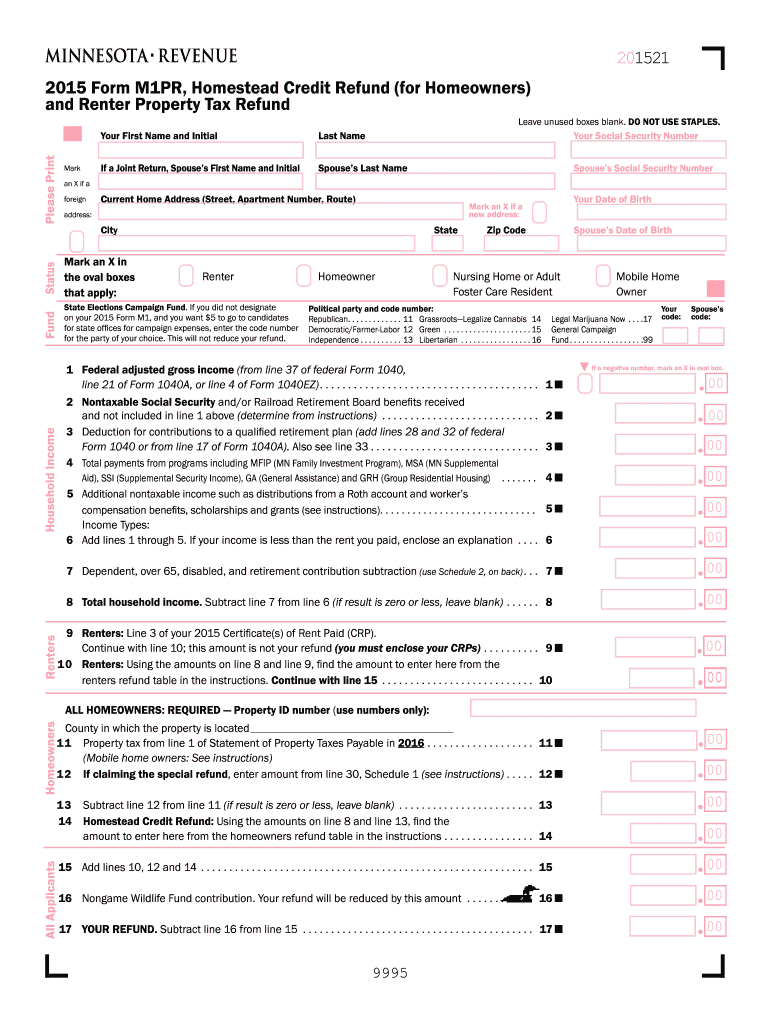

MN DoR M1PR 2015 free printable template

Get, Create, Make and Sign

Editing m1pr 2015 form online

MN DoR M1PR Form Versions

How to fill out m1pr 2015 form

How to fill out m1pr 2015 form:

Who needs m1pr 2015 form:

Instructions and Help about m1pr 2015 form

Okay so I'm going to try and show you how to do the shoulder increases and what I've here is a small swatch and I started a ribbing garter stitch, and then I put my markers where my shoulder seams are, so I have four stitches for the shoulder here and four over here and in between I started out with eight and the back four in the front and four on the other front, so it's a miniature version of what we're trying to do, and you can see here I already did to increase rows one on the right side and one on the purl side and both of those increases look exactly the same on the front, so you have this strand of yarn that goes up below and then back down underneath the front and the same thing happens for that purl increase and these are make one rights so make one purl right here and make one right on the knit side, so we go crossed our shoulder stitches, and then we have the same thing over here and these are make one left and here the Strand of yarn is going up down and underneath and then the same thing happens here up down and underneath the front, so those are leaning to the left both of them so what we would do is we would the pattern says knit your front stitches, so we're going to do that pretend like we're knitting our whatever eight front stitches, but I only had four here to begin with to the marker, and then we're going to make one right and with a make one right you take your left needle and lift the Strand of yarn between two stitches from the back to the front, and then you knit through the front of that stick there's a make one right and there you can see my how that strand is twisted around, and it's the same as the one below it and then one below it, so you want that strand of yarn to twist exactly the same way all the way down the row so slip the marker knit the shoulder stitches slip the marker, and now we're going to make one leaning towards the left, so we're going to pick up that strand of yarn from the front to the back and then knit through the back of that loop and then knit our back stitches to the other shoulder so here's a make one right I usually use my right hand and I don't want to confuse anyone, so I'll try and use my left make one right so from the back to the front and knit through the front shoulder stitches slip marker and then make one that's left-leaning sorry about that so from the front to the back and then knit through the back, so I get to the end and turn snow pearl the front stitches and the first one we're going to do is a make one purl left when what that means is on the purl side of course we want it leaning towards the right, but we're referring to the right side of the fabric when we say left, so I know that's very confusing, and I hope that that's the right name for it make one purl left, but the technique goes like this, so you're going to go from the front of the work to the back now I'm sorry from the back to now I'm confused from the front to the back, and then you're going to purl through that...

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your m1pr 2015 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.