Get the free 722 vi 2016 form

Show details

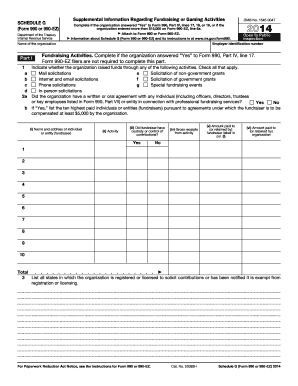

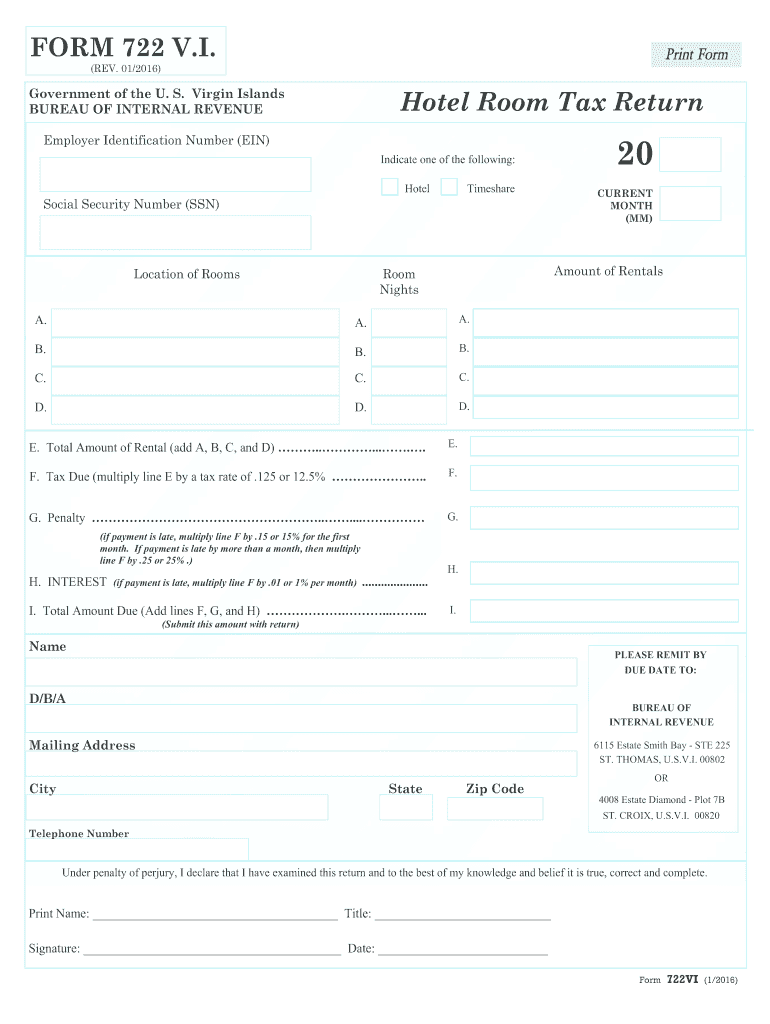

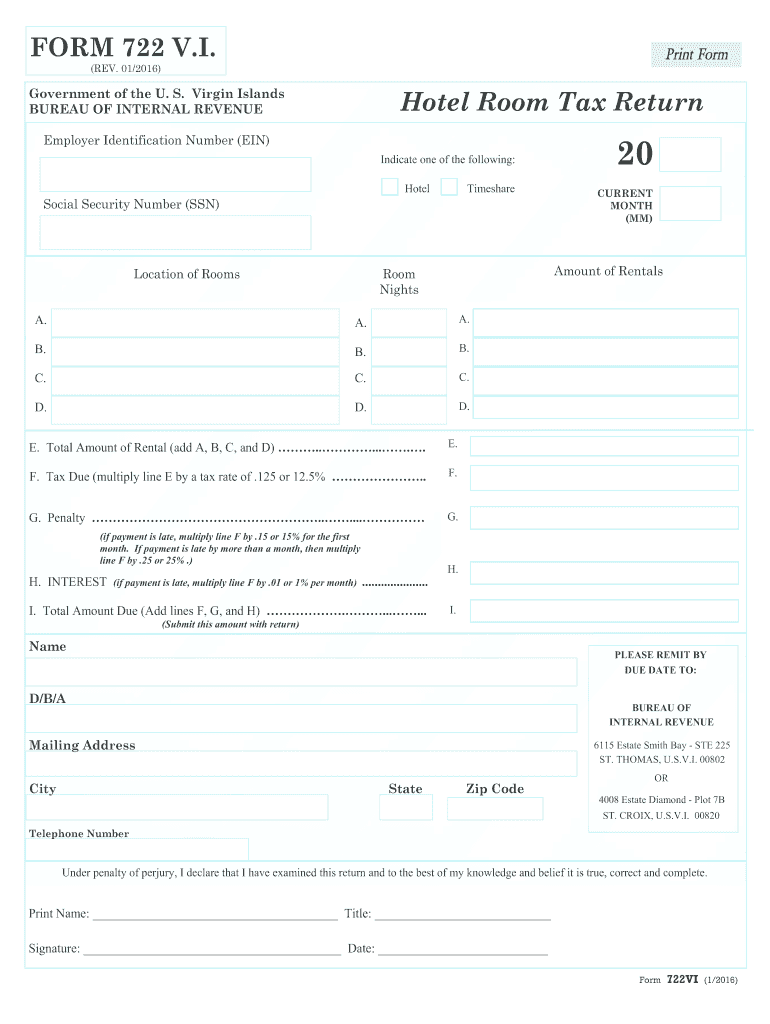

Print Name Title Signature Date Form 722VI 1/2016 INSTRUCTIONS TO TAXPAYERS-FORM 722 VI 1. A guest of a hotel includes an individual who has registered in a hotel as well as one who rents or leases an apartment condominium or residence for a day week or month provided that the rental or lease is for less than 90 days. FORM 722 V. I. Print Form REV. 01/2016 Government of the U* S* Virgin Islands BUREAU OF INTERNAL REVENUE Hotel Room Tax Return Employer Identification Number EIN Indicate one of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 722 vi 2016 form

Edit your 722 vi 2016 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 722 vi 2016 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 722 vi 2016 form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 722 vi 2016 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 722 vi 2016 form

How to fill out VI BIR 722

01

Obtain a copy of the VI BIR 722 form from the Virgin Islands Bureau of Internal Revenue website or office.

02

Fill in the taxpayer's details, including name, address, and taxpayer identification number.

03

Indicate the type of return being filed (e.g., individual, partnership, corporation).

04

Report the total income earned during the tax year in the appropriate section.

05

Deduct any allowable expenses and exemptions as outlined in the form instructions.

06

Calculate the total tax due or the refund owed based on the information provided.

07

Sign and date the form, certifying that the information provided is accurate.

08

Submit the completed form to the Virgin Islands Bureau of Internal Revenue by the specified deadline.

Who needs VI BIR 722?

01

Individuals and entities residing or operating in the Virgin Islands who are required to report their income and pay taxes.

02

Businesses registered in the Virgin Islands that need to report their earnings and calculate tax liabilities.

03

Any taxpayer seeking to claim deductions or credits available under Virgin Islands tax law.

Fill

form

: Try Risk Free

People Also Ask about

Who is not required to file income tax return in USA?

If your income is less than your standard deduction, you generally don't need to file a return (provided you don't have a type of income that requires you to file a return for other reasons, such as self-employment income).

Who must file Form 8689?

A U.S. citizen or resident alien (other than a bona fide resident of the U.S. Virgin Islands (USVI)) with income from sources in the USVI or income effectively connected with the conduct of a trade or business in the USVI uses this form to figure the amount of U.S. tax allocable to the USVI.

How do I file my USVI tax return?

The Virgin Islands Bureau of Internal Revenue and the IRS are not the same entity although the same tax rates and laws apply. If you are a US resident with income allocable to the Virgin Islands, file Form 8689 with your regular 1040 tax return.

Who files form 8689?

Key Takeaways. U.S. Taxpayers who are not bona fide residents of the U.S. Virgin Islands but earned income there must file Form 8689. Form 8689 determines how much income tax should be allocated to the U.S. Virgin Islands.

Do residents of the U.S. Virgin Islands pay federal income tax?

Generally, instead of filing returns and paying taxes to the IRS, residents of the USVI, and corporations[3] formed in the USVI, file returns and pay income taxes directly the Virgin Islands Bureau of Internal Revenue[13].

What is the occupancy tax in St Thomas?

(1) Every guest of a hotel as defined above shall pay to the Government of the United States Virgin Islands a tax to be collected and remitted to the Government by the hotelkeeper or innkeeper at the rate of 12.5 percent of the gross room rate or rental.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 722 vi 2016 form online?

With pdfFiller, it's easy to make changes. Open your 722 vi 2016 form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I edit 722 vi 2016 form on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 722 vi 2016 form.

How do I complete 722 vi 2016 form on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 722 vi 2016 form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is VI BIR 722?

VI BIR 722 is a tax form used in the United States Virgin Islands for reporting the annual income and income tax calculated for individuals.

Who is required to file VI BIR 722?

Individuals who have earned income in the United States Virgin Islands and are subject to taxation must file VI BIR 722.

How to fill out VI BIR 722?

To fill out VI BIR 722, taxpayers must complete the form by entering personal information, income details, deductions, and calculating the tax owed before submitting it to the Virgin Islands Bureau of Internal Revenue.

What is the purpose of VI BIR 722?

The purpose of VI BIR 722 is to report individual income for tax purposes and to determine the amount of tax owed to the Virgin Islands government.

What information must be reported on VI BIR 722?

VI BIR 722 requires reporting of personal identification information, income sources, total income, applicable deductions, tax credits, and the final tax liability.

Fill out your 722 vi 2016 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

722 Vi 2016 Form is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.