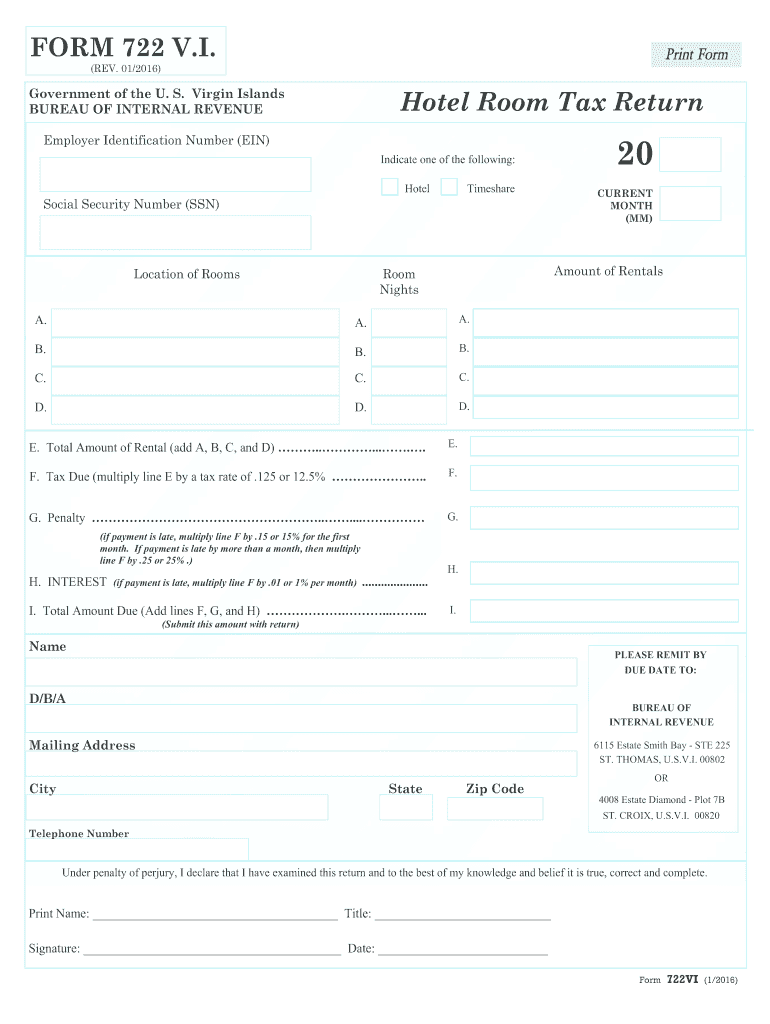

VI BIR 722 2016 free printable template

Get, Create, Make and Sign 722 vi 2016 form

Editing 722 vi 2016 form online

Uncompromising security for your PDF editing and eSignature needs

VI BIR 722 Form Versions

How to fill out 722 vi 2016 form

How to fill out VI BIR 722

Who needs VI BIR 722?

Instructions and Help about 722 vi 2016 form

The moderation forms the way of the rancor in the time of Paul Patton's chancellorship form six is the current standard in Jedi lightsaber training this form balances the emphases of other forms with overall moderation in keeping with the Jedi quest to achieve true harmony and justice without resorting to the rule of power it is considered the diplomats form because it is less intensive in its demands than the other disciplines allowing Jedi to spend more time developing their skills in perception political strategy and negotiations in practice form six is a combination of forms one three four and five young Jedi spend their first few years studying form one and then a year or two with each additional form before completing their training by comparison a form six master will spend at least ten years studying only that form after completing basic form one training form six well suits the modern Jedi's role in the galaxy in which a knight overly trained in martial combat might be at a loss to resolve a complex political conflict between star systems however full masters of other forms sometimes consider form six to be insufficiently demanding the history of nigh man's development is one of the most convoluted the original description of form six in the fight Sabre article describes it as a combination of forms one three four and five specifically the Jedi path throwing in form two for good measure however the article dark forces part four of the crudest matter describes nine men as simply being a lightsaber adapted version of the ancient Marque high form developed by the option swordsman and then the Jedi path confuses things further by stating that nine man's pure root is Sri SU however none of these ideas are mutually exclusive due to the fact that Newman is a hybrid martial art intended to consolidate various disciplines under one roof the baseline single blade technique is the mixture of the previous five forms the dual saber element is taken entirely from classical Zhao CAI and Sri SU is likely the source for nine manses core discipline and mindset beyond being a hybrid martial art there is comparatively little information on the physical technique of Newman it basically boils down to being a balanced mixture of techniques intended to be easily adapted for any situation as the form was intended for academics rather than combat specialists it was designed to be easily learned so that librarians didn't have to take time away from studying to practice however mastering Newman took upwards of a decade unsurprising given how comprehensive and multifaceted the technique was if the examples set by its masters are anything to go by Newman is effectively a blank slate that practitioners can configure into whatever they need it to be the stances and maneuvers of Newman are detailed in various sources mysteries of the Jedi gave us the opening stance blade extended off to one side in a one-handed grip off hand held across the chest The Revenge of the...

People Also Ask about

Who is not required to file income tax return in USA?

Who must file Form 8689?

How do I file my USVI tax return?

Who files form 8689?

Do residents of the U.S. Virgin Islands pay federal income tax?

What is the occupancy tax in St Thomas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 722 vi 2016 form online?

How can I edit 722 vi 2016 form on a smartphone?

How do I complete 722 vi 2016 form on an iOS device?

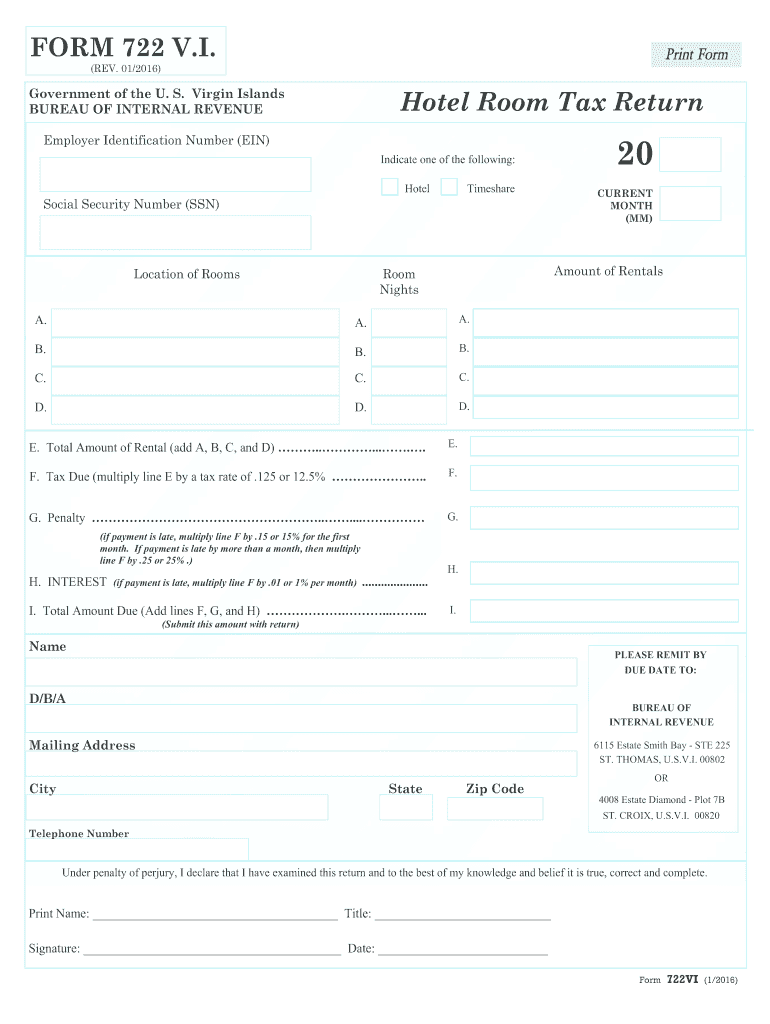

What is VI BIR 722?

Who is required to file VI BIR 722?

How to fill out VI BIR 722?

What is the purpose of VI BIR 722?

What information must be reported on VI BIR 722?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.