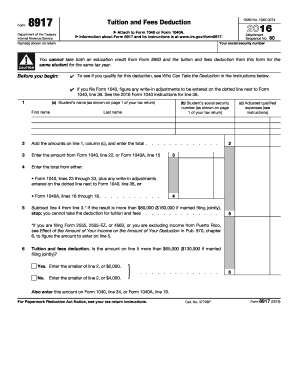

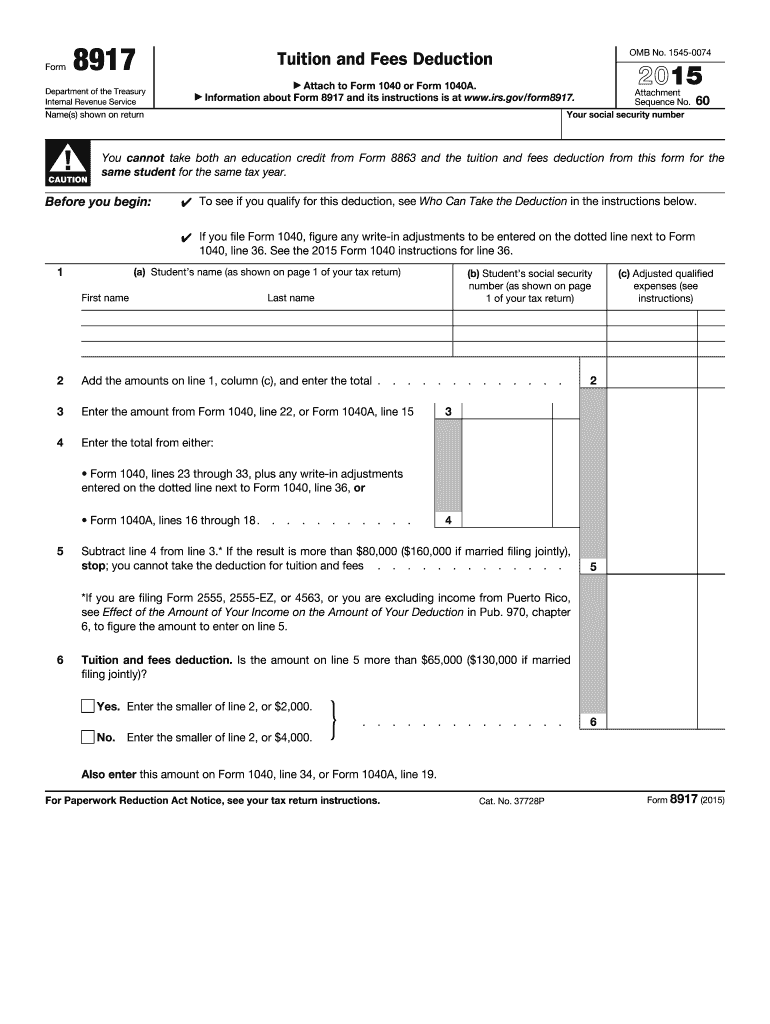

IRS 8917 2015 free printable template

Instructions and Help about IRS 8917

How to edit IRS 8917

How to fill out IRS 8917

About IRS 8 previous version

What is IRS 8917?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

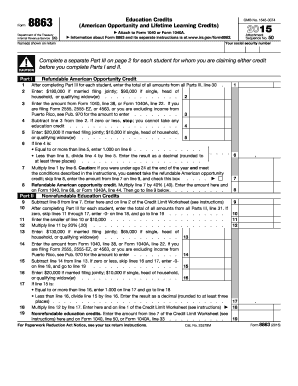

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8917

How can I correct mistakes after filing the 2015 IRS Form 8917?

If you need to correct mistakes on your 2015 IRS Form 8917, you'll need to file an amended return using Form 1040-X. Ensure you include the corrected information as well as an explanation of the changes made. It's essential to provide any relevant documentation to support your claims and keep a copy of the amended form for your records.

How can I verify the status of my 2015 IRS Form 8917 submission?

To check the status of your 2015 IRS Form 8917 submission, you can use the IRS 'Where's My Refund?' tool if you are expecting a refund. If you e-filed, you may also receive an acknowledgment email that indicates whether your form was accepted or rejected. Be sure to note any rejection codes provided to identify issues that need resolution.

What should I consider regarding e-signature acceptability for the 2015 IRS Form 8917?

When filing the 2015 IRS Form 8917 electronically, e-signatures are generally accepted if you use approved tax software. Ensure that your software complies with IRS guidelines for e-signatures. This adds a layer of security and confirms your intention to file. Always keep documentation of your submission in a secure location.

What common errors should I avoid when submitting the 2015 IRS Form 8917?

Common errors while filing the 2015 IRS Form 8917 include incorrect mathematical calculations and missing signatures. Additionally, ensure that you are not entering incorrect identification numbers or mismatching tax years when reporting. Double-checking your entries can help prevent unnecessary processing delays or rejections.

What steps should I take if I receive an audit notice after filing my 2015 IRS Form 8917?

If you receive an audit notice regarding your 2015 IRS Form 8917, respond promptly and carefully review the notice for details about what documentation is required. Prepare the necessary documents, such as receipts or transcripts, to support your claims effectively. Consider consulting with a tax professional for guidance on how to proceed with the audit process.