NY NYS-45 2015-2026 free printable template

Show details

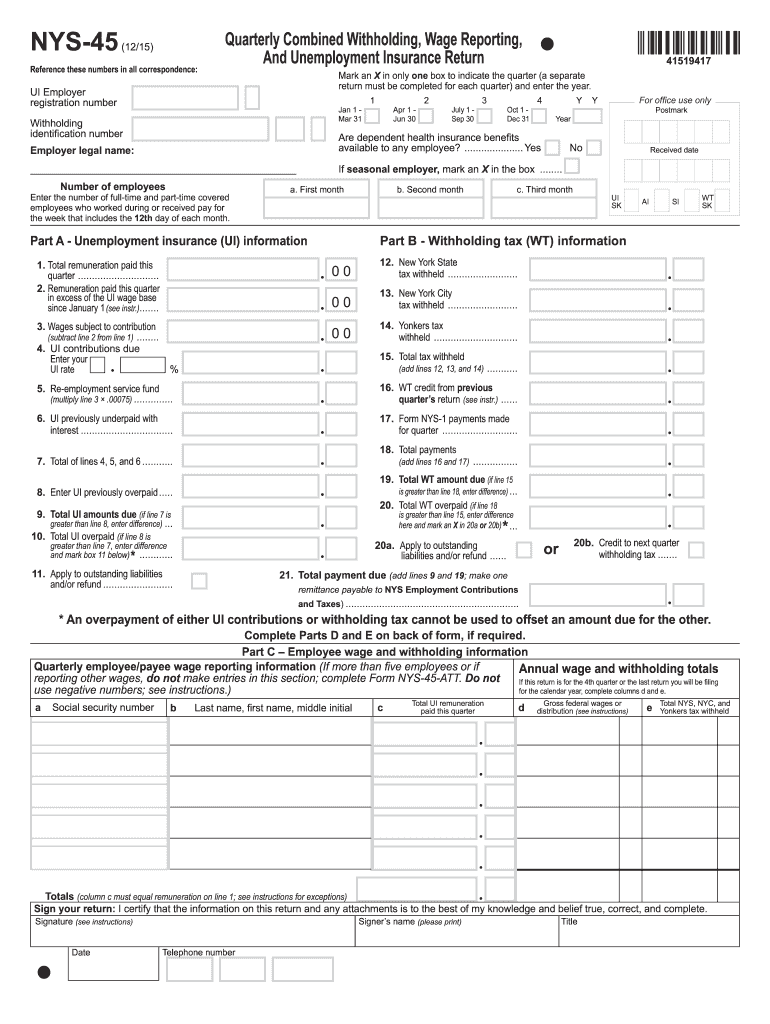

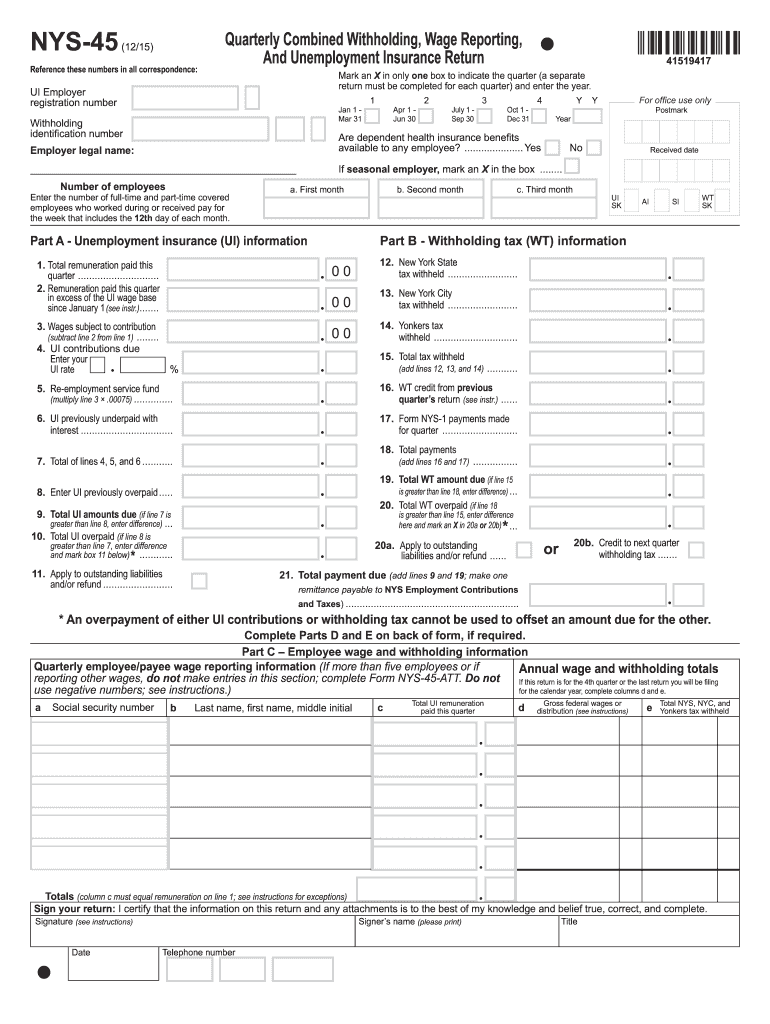

NYS-45 (12/15) Reference these numbers in all correspondence: Quarterly Combined Withholding, Wage Reporting, And Unemployment Insurance Return 41519417 Mark an X in only one box to indicate the quarter

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 6964575 form

Edit your NY NYS-45 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY NYS-45 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY NYS-45 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY NYS-45. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out NY NYS-45

How to fill out NY NYS-45

01

Obtain the NYS-45 form from the New York State Department of Taxation and Finance website or through your payroll service provider.

02

Fill out the employer information section, including your business name, address, and identification number.

03

Enter the reporting period for which you are filing the form.

04

Complete the employee information section, including each employee’s name, Social Security number, and total wages paid during the reporting period.

05

Calculate the total amount of New York State unemployment insurance contributions due based on the wages paid.

06

Report any adjustments for the quarter, if necessary.

07

Review all entered information for accuracy before submitting the form.

08

Submit the form electronically or via mail by the due date.

Who needs NY NYS-45?

01

Employers in New York State who have employees and are required to report wages and unemployment insurance contributions must file the NYS-45 form.

Fill

form

: Try Risk Free

People Also Ask about

What is a IT-201 form?

Form IT-201-V, Payment Voucher for Income Tax Returns, to make a payment by check or money order. Form IT-225, New York State Modifications, to report New York State addition or subtraction modifications to federal AGI other than those specifically listed on Form IT-201.

What is an it-203 form?

IT-203 (Fill-in) IT-203-I (Instructions) Nonresident and Part-Year Resident Income Tax Return; Description of Form IT-203. This is the only return for taxpayers who are nonresidents or part-year residents of New York State, whether they are itemizing their deductions or claiming the standard deduction.

Is it 201 different from 1040?

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

What is an IT-203 form?

IT-203 (Fill-in) IT-203-I (Instructions) Nonresident and Part-Year Resident Income Tax Return; Description of Form IT-203. This is the only return for taxpayers who are nonresidents or part-year residents of New York State, whether they are itemizing their deductions or claiming the standard deduction.

How do I get a NY state tax form?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

What are the New York fiscal quarters?

The reporting periods covered by quarterly returns are March 1 through May 31, June 1 through August 31, September 1 through November 30, and December 1 through February 28/29. Quarterly returns are due no later than 20 days after the end of the quarter to which they relate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NY NYS-45 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your NY NYS-45 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send NY NYS-45 for eSignature?

When your NY NYS-45 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit NY NYS-45 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign NY NYS-45 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is NY NYS-45?

NY NYS-45 is a form used by employers in New York State to report wages, tips, and other compensation paid to employees, as well as to report withholdings for state income tax and other payroll-related information.

Who is required to file NY NYS-45?

Any employer in New York State who pays wages to employees is required to file NY NYS-45. This includes both full-time and part-time employees.

How to fill out NY NYS-45?

To fill out NY NYS-45, employers must provide detailed information about their business, employee wages, tax withholdings, and the periods being reported. Specific instructions and a completed sample form can be found on the New York State Department of Taxation and Finance website.

What is the purpose of NY NYS-45?

The purpose of NY NYS-45 is to facilitate the reporting of employee wages and withholdings to the New York State Department of Taxation and Finance. This information is used for state tax collection and compliance.

What information must be reported on NY NYS-45?

NY NYS-45 requires reporting of the employer's identification details, employee information, total wages paid to each employee, total taxes withheld, and any adjustments for overpayments or underpayments regarding state taxes.

Fill out your NY NYS-45 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY NYS-45 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.