OK OTC 512E 2015 free printable template

Show details

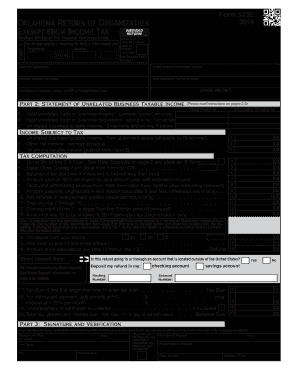

Form 512E Oklahoma Return of Organization Exempt from Income Tax Part 1 Section 501 c of the Internal Revenue Code AMENDED RETURN For the year January 1 - December 31 2015 or other taxable year If this is an Amended Return beginning ending place an X here Name of Organization Federal Employer Identification Number Address number and street Date Qualified for Tax Exempt Status OFFICE USE ONLY City State or Province Country and ZIP or Foreign Postal Code Part 2 Statement of Unrelated Business...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK OTC 512E

Edit your OK OTC 512E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK OTC 512E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK OTC 512E online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit OK OTC 512E. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 512E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK OTC 512E

How to fill out OK OTC 512E

01

Obtain a copy of the OK OTC 512E form.

02

Fill in the applicant's name and contact information in the designated fields.

03

Provide a detailed description of the transaction or item being reported.

04

Indicate the date of the transaction.

05

Sign and date the form to verify the information provided.

06

Submit the form to the appropriate agency or organization as specified in the instructions.

Who needs OK OTC 512E?

01

Individuals or businesses involved in transactions subject to Oklahoma’s tax regulations.

02

Tax professionals preparing documentation for clients related to Oklahoma tax matters.

03

Anyone needing to report specific financial activities to comply with state requirements.

Fill

form

: Try Risk Free

People Also Ask about

Do LLC pay franchise tax in Oklahoma?

Since LLCs aren't subject to Oklahoma's Franchise Tax, they are required to submit the Oklahoma Annual Certificate. Like an annual report, the annual certificate ensures that the state has up-to-date contact and ownership information for your LLC. LLCs submit a report each year to Oklahoma's Secretary of State.

How do I file a final sales tax return in Oklahoma?

You have three options for filing and paying your Oklahoma sales tax: File online – File online at OK Tap. You can remit your payment through their online system. File by mail – You can use form STS-20002 to file on paper and by mail. AutoFile – Let TaxJar file your sales tax for you.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

Do I have to file Oklahoma State Income Tax?

Every resident individual whose gross income from both within and outside of Oklahoma exceeds the standard deduction plus personal exemption is required to file an Oklahoma income tax return. Every part-year resident, during the period of residency, has the same filing requirements as a resident.

Who Must File Oklahoma partnership tax return?

If federal and Oklahoma distributive net incomes are the same, you may complete Part Three, Columns A and B, line 15; then complete Part Five. A copy of your Federal Form 1065 and K-1s must be provided with your Oklahoma return. An Oklahoma return must be filed by all partnerships having Oklahoma source income.

Who is responsible for paying franchise tax?

A corporation or other business entity always has to pay the franchise tax in its home state. It may also have pay franchise taxes in other states in which it does business or owns property. Many corporations and other business entities have to pay franchise taxes in multiple states.

What is exempt from sales tax in Oklahoma?

Sales Tax Exemptions in Oklahoma Some examples of items which the state exempts from tax charges are certain medical prescriptions, some items used in the agricultural industry, cable television services, meals or foodstuff used in furnishing meals for school children, and newsprint paper.

Can I file my Oklahoma state taxes for free?

E-File your Federal and State Return for FREE, if: Adjusted Gross Income is $73,000 or less. Active Duty Military Adjusted Gross Income is $73,000 or less.

What does OTC suspension mean in Oklahoma?

If a corporation fails to pay the required franchise tax, the Oklahoma Tax Commission enters an order suspending the corporation's charter and then send the order to the Oklahoma Secretary of State directing that the corporation be suspended.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute OK OTC 512E online?

Completing and signing OK OTC 512E online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for signing my OK OTC 512E in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your OK OTC 512E and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit OK OTC 512E on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute OK OTC 512E from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is OK OTC 512E?

OK OTC 512E is a form used in Oklahoma for reporting certain tax-related information to the state. It is typically related to the tax obligations of businesses operating in the state.

Who is required to file OK OTC 512E?

Businesses in Oklahoma that are engaged in certain operations that trigger specific tax obligations are required to file OK OTC 512E.

How to fill out OK OTC 512E?

To fill out OK OTC 512E, one must provide the required business information, including tax identification number, and complete sections regarding income and applicable taxes as instructed in the guidelines provided with the form.

What is the purpose of OK OTC 512E?

The purpose of OK OTC 512E is to ensure compliance with state tax regulations by properly reporting financial and operational details of businesses, which in turn helps the state assess and collect taxes.

What information must be reported on OK OTC 512E?

The information that must be reported on OK OTC 512E includes business identification details, income earned, taxes owed, and any deductions applicable as per Oklahoma tax laws.

Fill out your OK OTC 512E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK OTC 512e is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.